Charles Paikert is a senior editor at Financial Planning. Follow him on Twitter at @paikert.

-

Why RIAs are focusing on firm success rather than individual performance.

April 1 -

An NBA veteran opens a nonprofit RIA to help young athletes manage their sudden wealth.

March 31 -

About 63% of industry professionals say they’re interested in working for a new firm.

March 27 -

The RIA will be combined with Sontag Advisory to create an $11 billion wealth management powerhouse.

March 26 -

Strategic buyers have less cash but more flexibility, experts say.

March 21 -

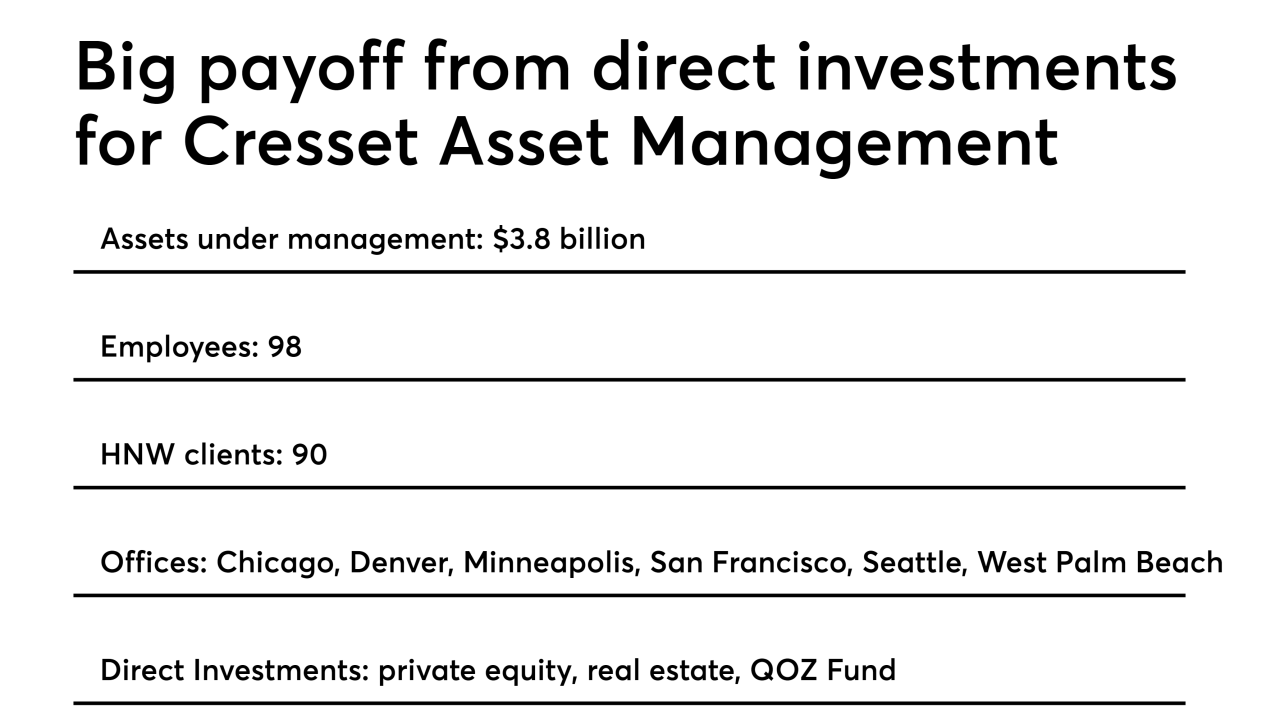

The $3 billion-plus RIA seeking scale via acquisitions.

March 19 -

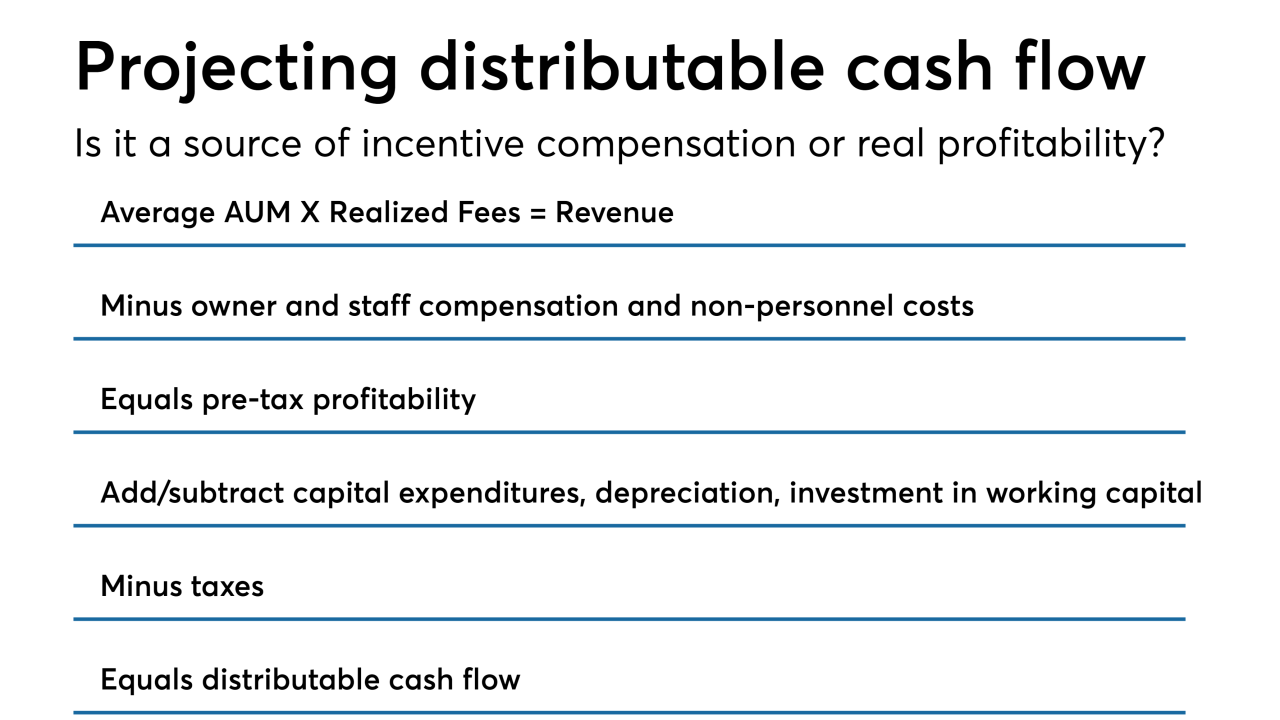

Discounted cash flow valuations have become popular, but untangling the formula can be challenging.

March 15 -

Still, advisors thinking of selling are urged not to procrastinate.

March 12 -

Third-party providers can boost AUM, but due diligence is critical.

February 26 -

The aggregator nears $1 billion in revenue.

February 21 -

The platform provider will keep its New York offices.

February 19 -

Productivity may not come back, but private equity may be the answer for some.

February 14 -

Fintechs are also attracting strong PE interest; robos not so much.

February 12 -

New M&A and lending services bolster the company’s offering but steep challenges remain.

February 11 -

As CEO Joe Duran prepares to meet potential investors, he faces one of the greatest sales pitches of his career.

January 28 -

While the average deal size has climbed above $1.3 billion, solo practices still continue to thrive.

January 24 -

In a surprise move, Liz Nesvold sells investment bank Silver Lane Advisors to Raymond James Financial.

January 23 -

Outside investors are ready to exit, CEO Joe Duran tells Financial Planning.

January 14 -

The frothy seller’s market for advisory firms may be coming to end, says veteran dealmaker Peter Raimondi.

January 3 -

Concerns mount about the aggregator counting tuck-ins as organic growth.

January 2