The flow of private equity capital into the financial advisory business isn’t about to slow down anytime soon, according to a prominent PE executive.

“I absolutely do see more private equity investment in wealth management,” says Brad Armstrong of Lovell Minnick. “Private equity has seen success in similar industries like insurance brokerage, where you also have recurring revenue, scalable infrastructure, high margins and low capital expenditures.”

PE firms are particularly excited about the “consolidation opportunity” in wealth management, Armstrong told Financial Planning after a presentation at Investments & Wealth Institute’s annual investment conference in New York.

He also expects valuations to remain high —easily into the double digits — as a multiple of EBITDA for firms with a true platform. “Wealth management valuations are as strong as they’ve ever been,” says Armstrong, a partner in Lovell Minnick’s Philadelphia office.

Favorable industry trends, including increasing personal wealth, an aging population cohort needing advice and the increased popularity of independent advice providers are also attracting strong private equity interest in RIAs, IBDs, TAMPs, service providers and fintech firms, according to Armstrong.

Robo advisors are lagging because there’s “not enough proof of concept in the business model,” he says. “Nor is there the presence of — or the near-term prospect of — positive cash flows sufficient to make it a suitable standalone private equity investment.”

By contrast, fintech firms are “breaking out of silos” and garnering more private equity interest, Armstrong says.

PE firms are looking for RIAs with more than $3 billion in AUM, access to capital and brand awareness.

“The common theme seems to be disruption, but that shouldn’t be narrowly confined to a few pockets of the financial services industry,” he explains. “[Fintech] should be viewed more like a horizontal slice across financial services subsectors.”

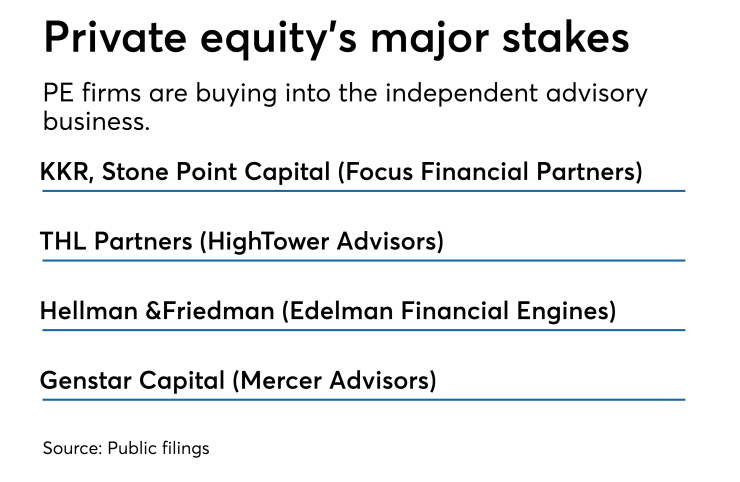

Lovell Minnick’s financial service investments have included stakes in Mercer Advisors, HD Vest, First Allied, AssetMark and Kanaly Trust. Notable private equity investments in the past few years include KKR and Stone Point Capital’s stake in Focus Financial Partners, THL Partners’ shares in HighTower Advisors and Hellman & Friedman taking a majority ownership in Edelman Financial Engines.

What are PE firms looking for in a financial advisory firm?

More than $3 billion in AUM, access to capital or a partner with capital and brand awareness, Armstrong says. PE firms also search for firms with scaled infrastructure, an ability to integrate and a track record of organic growth, acquisitions and being able to recruit high quality advisors.

Key factors for valuating an RIA or IBD include practice compatibility, client concentration and identifying key producers who aren’t owners, according to Armstrong.

-

As CEO Joe Duran prepares to meet potential investors, he faces one of the greatest sales pitches of his career.

January 28 -

The definition of independence for advisors is changing, according to a new report.

June 6 -

Independent firms need capital, but some top executives question private equity's benefits.

October 18

Firm owners who sell should expect restrictive covenants that protect buyers from sellers setting up a competing business, Armstrong says. Because PE firms are buying cash flow, they are paying close attention to replacement costs for an owner who is responsible for bringing in — and retaining — business.

Owners shouldn’t underpay themselves on financial statements to boost a firm’s EBITDA in search of a higher multiple, Armstrong warns.

“It’s all about replacement costs,” he says. “If you’re only paying yourself $100,000 but it costs $600,000 to replace you, that’s $500,000 you have to add back.”