Elijah returned to Financial Planning in 2025 after working as a summer intern with FP in 2023. He earned an undergraduate degree from Berea College in Berea, Kentucky, and a master's degree in data journalism from Northeastern University in Boston. His work has been published in Bloomberg News, The Boston Globe, The Texas Tribune, WCVB, WBUR, The Drive and Autoblog.

-

New OBBBA restrictions mean wealthy donors lose deductions on smaller, routine gifts. Here is how to use DAFs and donation grouping to preserve tax benefits.

January 19 -

A sharp fourth-quarter decline in net new investment assets weighed on Citi's wealth division, tempering full-year growth despite revenue gains.

January 14 -

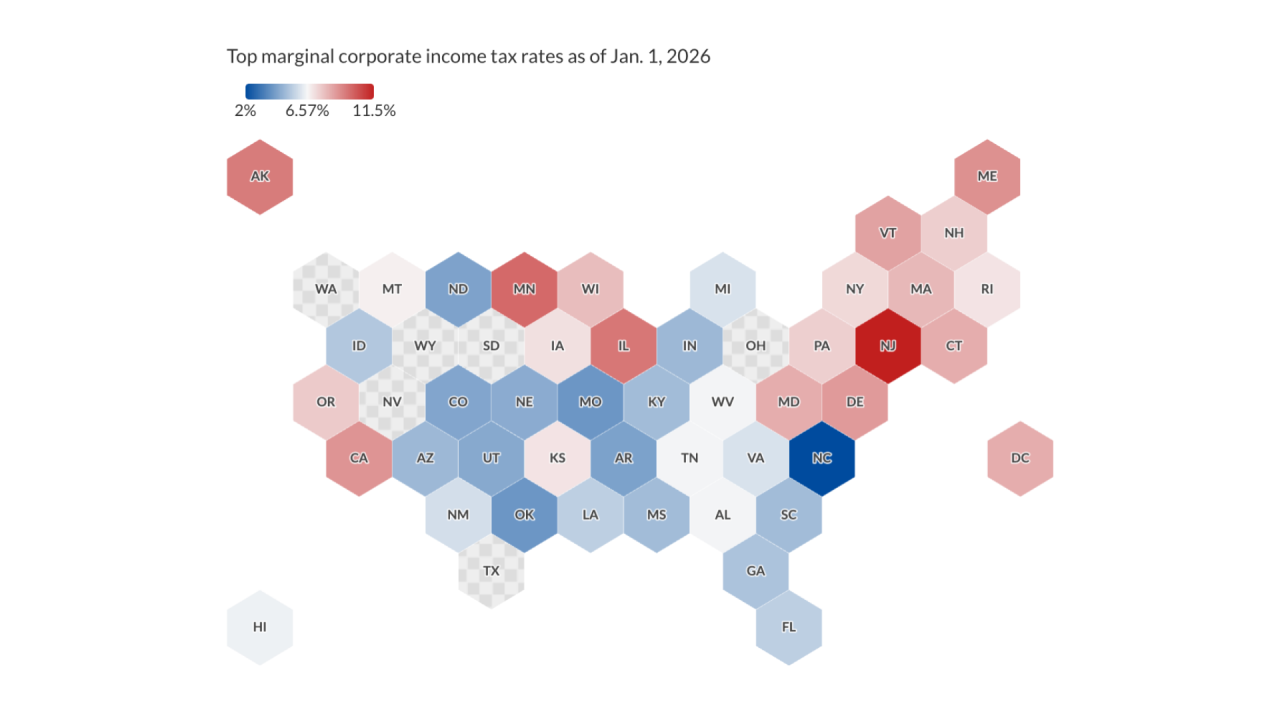

Corporate tax rates vary widely by state, affecting client business decisions around relocation, expansion and growth planning. Here's how the landscape is changing in 2026.

January 13 -

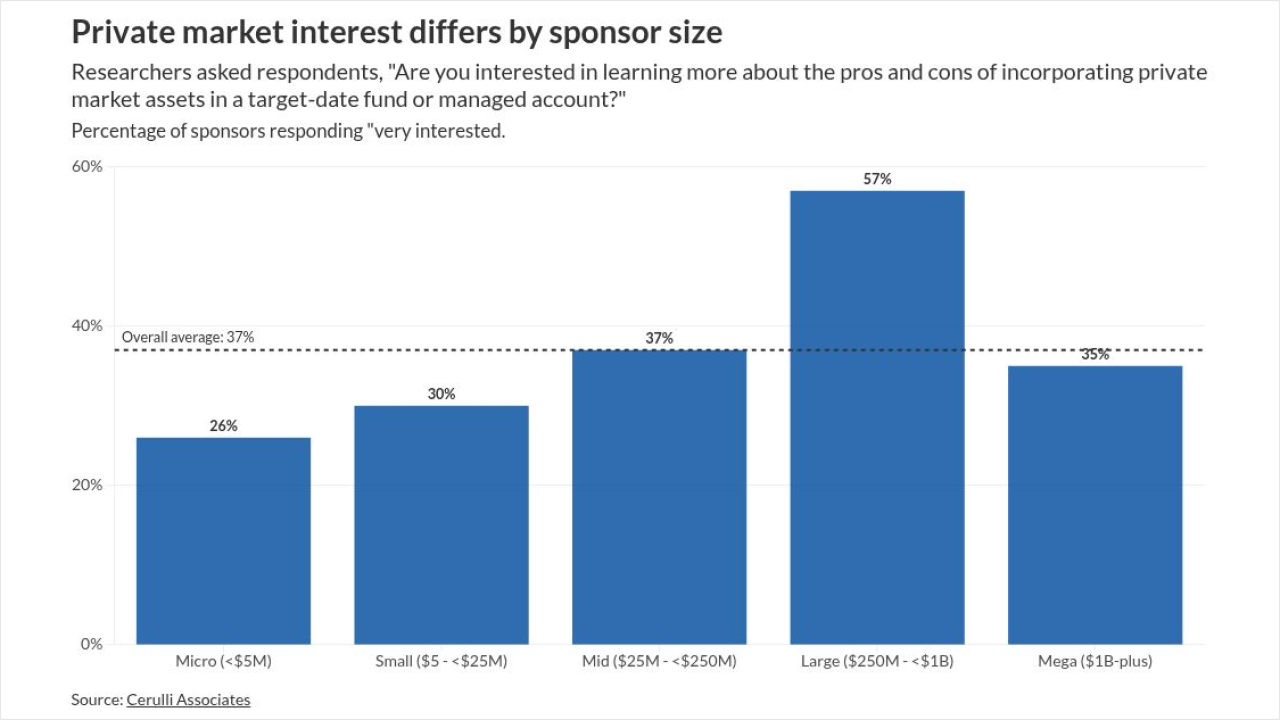

Plan sponsors show growing interest in private market investments for 401(k) plans, but regulatory uncertainty, fees and litigation risk continue to slow adoption, a Cerulli study found.

January 9 -

Spot bitcoin ETFs simplify custody, but they cost clients a major tax advantage. Here is why direct ownership still wins for HNW and UHNW clients.

January 7 -

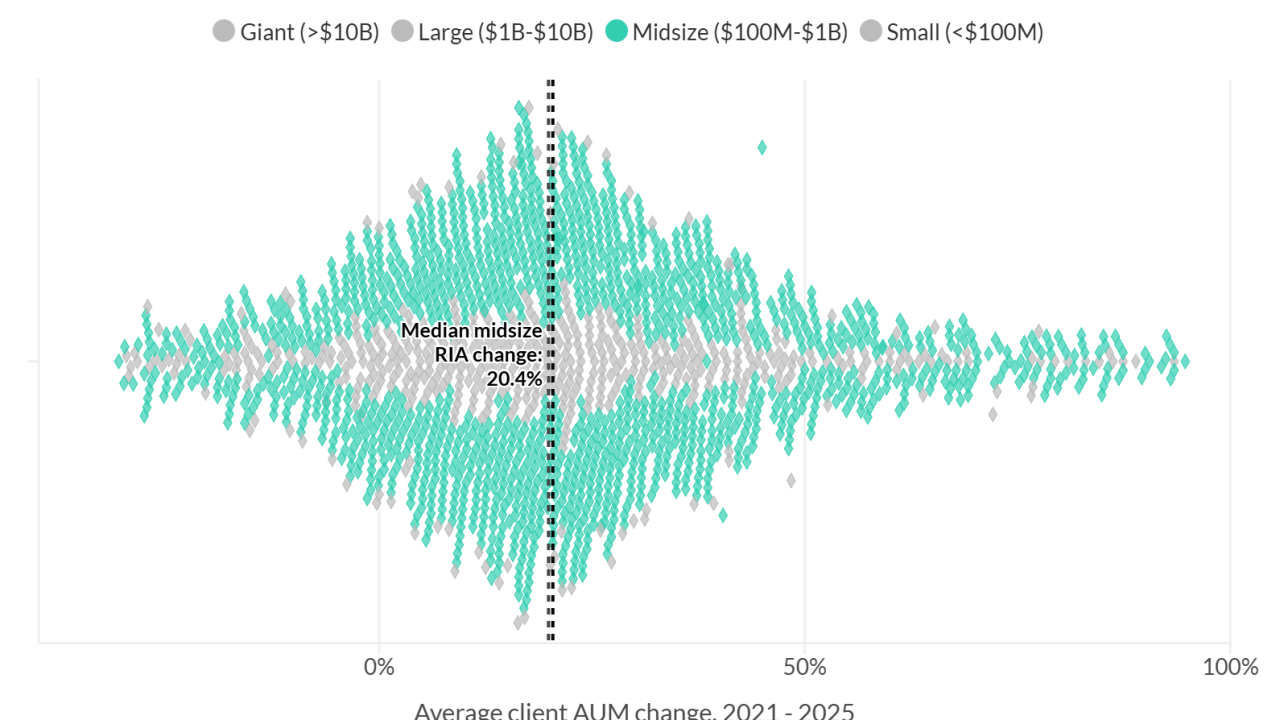

The industry's biggest firms are winning the battle for assets but losing the war for high net worth efficiency. New data reveals how some of the biggest RIAs are growing through volume, not value.

January 7 -

The tax shield on student loan forgiveness has expired. Here is how advisors can help clients lower their burdens.

January 6 -

Financial advisors often urge clients to delay Social Security to maximize benefits, but new research suggests early claiming may be a rational choice for most households.

December 31 -

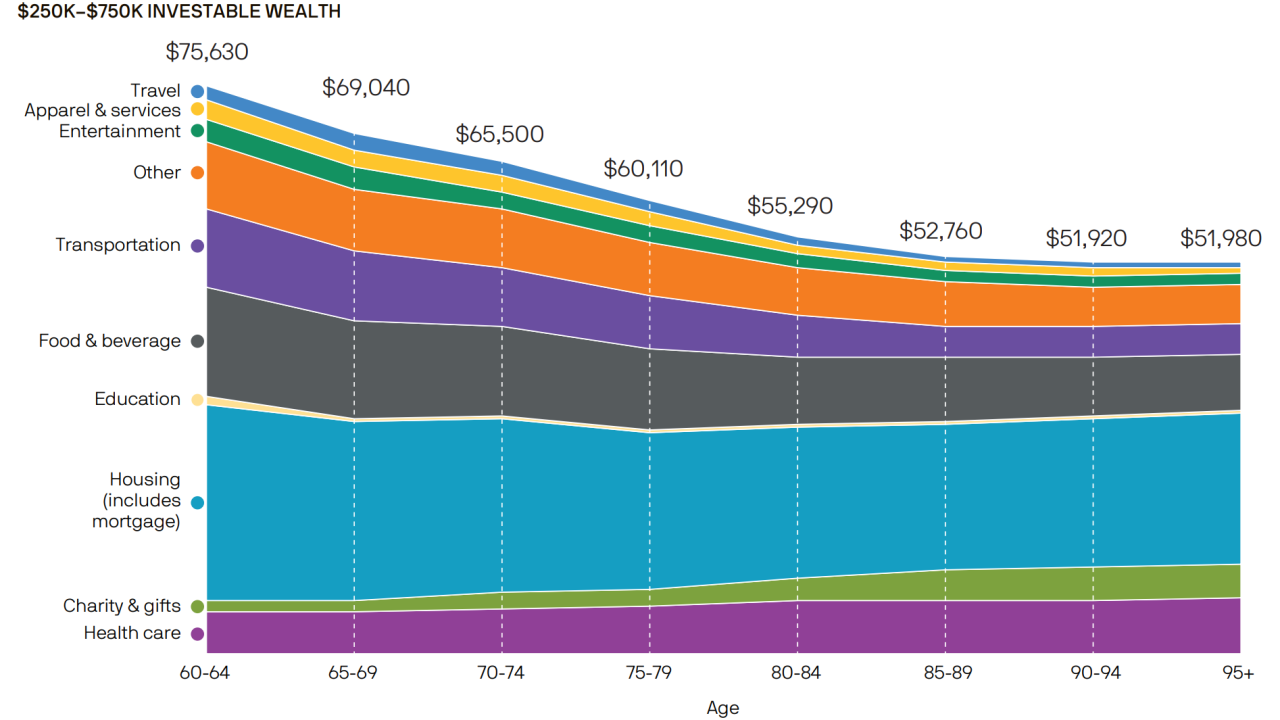

Popular retirement withdrawal strategies like the 4% rule assume a steady rate of spending for retirees. But new research from J.P. Morgan shows that premise is often disconnected from reality.

December 29 -

Treasury Secretary Scott Bessent outlined how Trump accounts could be opened, managed and used for children's savings and future retirement. Here's what advisors should know.

December 26 -

Across the industry, financial advisors are anticipating a busy 2026. From consumer protection cuts to AI regulation, wealth management could look very different a year from now.

December 24 -

Overspending, liability risk and emotional strain. Clients who ignore advice can jeopardize their own finances and create real challenges for advisors. But a few key strategies can help limit the damage.

December 22 -

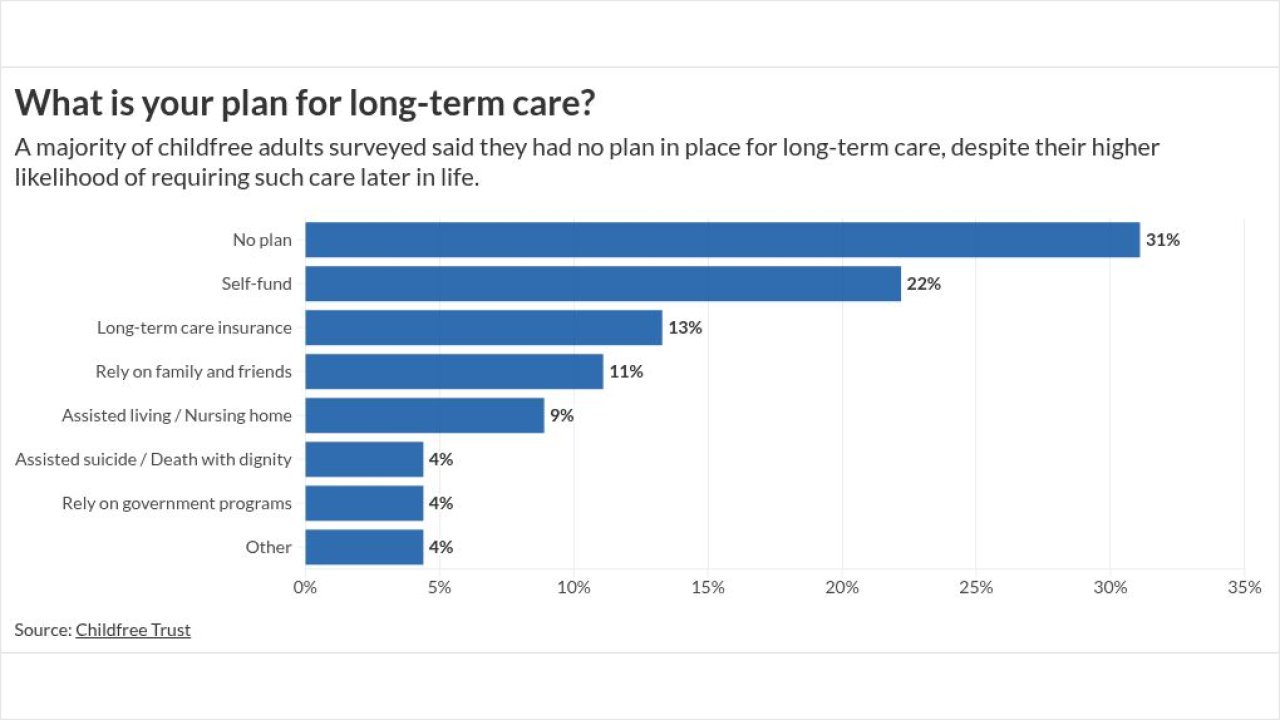

New research highlights a widening planning gap among childfree savers, with lagging estate and long-term care planning exposing unique risks — and opportunities for advisors.

December 19 -

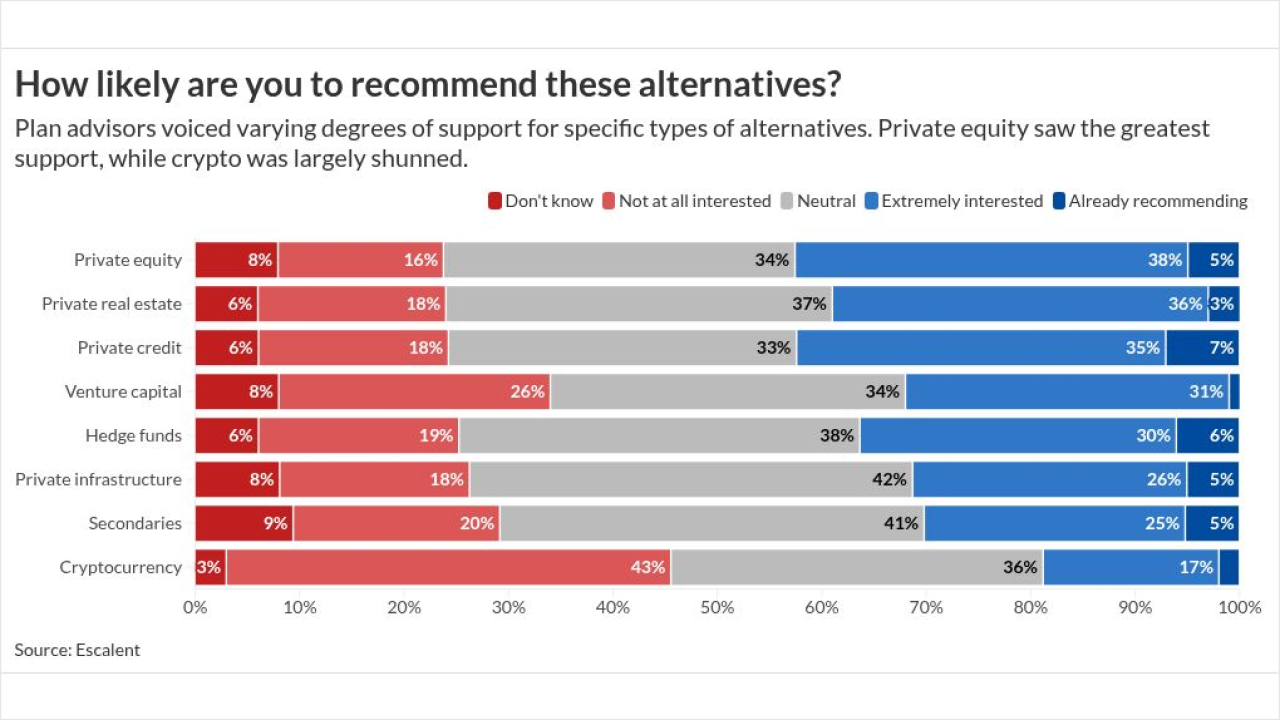

As ERISA rules around alternatives ease, more workplace plan advisors are warming to once-niche investments like private equity and private credit. But advisors remain skeptical of certain asset classes.

December 18 -

Most borrowers use defined contribution plan loans for essential health and housing costs rather than discretionary spending, new EBRI research found. Still, many financial advisors remain skeptical of such loans.

December 16 -

Paid sabbaticals, employee ownership and a philosophy-first culture have helped Bailard top this year's Best RIAs to Work For list.

December 11 -

This year, 60 RIAs made the cut. See the firms that advisors say excel in culture, leadership and the benefits that matter most.

December 11 -

Retirement savers say they want investment choice, but confidence in navigating those decisions remains low, according to new T. Rowe Price research.

December 8 -

Researchers found that potentially traumatic childhood experiences, including physical abuse and parental separation, have lasting financial consequences, shaping workers' savings and retirement security decades later.

December 5 -

When it comes to retirement planning, financial advisors are always looking for an edge. Could these strategies get them there?

December 3