Michael Cohn, editor-in-chief of AccountingToday.com, has been covering business and technology for a variety of publications since 1985. Prior to joining Accounting Today and WebCPA, he worked for Red Herring, Internet World, Beyond Computing, Accounting Technology and PC Magazine, and freelanced for a variety of other business publications. A graduate of the University of Pennsylvania with a BA in English, he studied accounting at the Wharton School of Business, and currently lives in New York City.

-

Relief comes as a result of the short notice firms were originally given to comply with the Secure Act, the agency says.

By Michael CohnJanuary 30 -

To help individuals and businesses prepare for filing season, Grant Thornton has released a collection of year-end tax tips.

By Michael CohnDecember 17 -

The agency processed more of every major type of form during FY 2018 than during the prior year, with the exception of estate tax returns.

By Michael CohnMay 22 -

The IBD's advisors can expect new technology and product offerings, says David Knoch.

By Michael CohnApril 4 -

The Treasury and IRS are lowering the withholding underpayment threshold to 80%.

By Michael CohnMarch 26 -

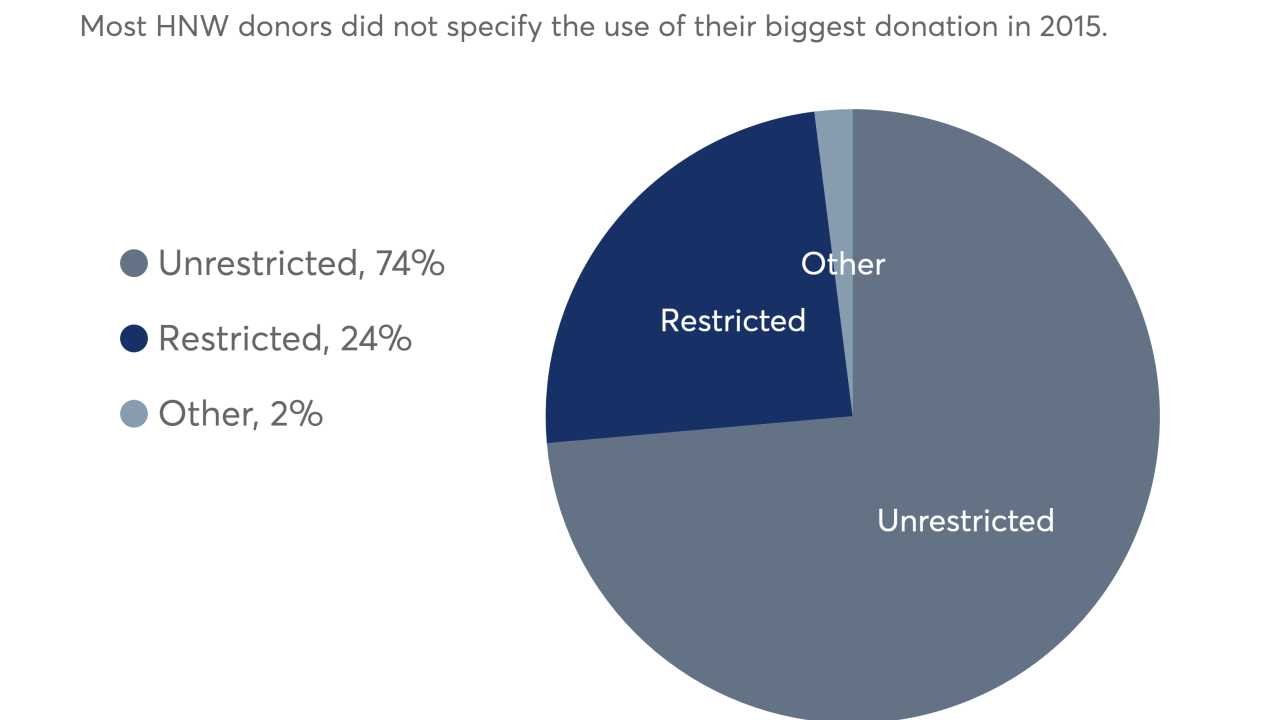

Advisors take note: DAFs remain the fastest-growing charitable giving vehicle.

By Michael CohnNovember 16 - The doubling of the standard deduction will provide less incentive to itemize deductions.Sponsored by Nationwide Advisory Solutions

- Using this technology, a tax professional can look at clients' effective tax rate for income along with long-term capital gains.Sponsored by Nationwide Advisory Solutions

-

The program will give CPAs a new way to gain the institute's PFS credential — as well as provide other educational opportunities for non-CPAs.

By Michael CohnJune 13 -

There are three top specialties that survey takers said they want when choosing a new financial planner, with one clear winner.

By Michael CohnMay 17 -

CPAs and enrolled agents who added planning services generated an average of $1.7 million in incremental revenue over five years, a survey shows.

By Michael CohnMay 4 -

LifeYield makes it proprietary Taxficient Score available to individual advisors.

By Michael CohnApril 2 -

The agency has reprogrammed its systems to process three benefits most likely to be claimed on returns this season.

By Michael CohnFebruary 27 -

The 110-year-old wealth management firm intends to expand its tax-planning services through more acquisitions.

By Michael CohnFebruary 23 -

What some clients tried to claim on their tax returns shows they often don't know much about accounting.

By Michael CohnFebruary 5 -

Contributions and grants have recently reached record highs.

By Michael CohnNovember 30 -

Taxpayers face a penalty known as an individual shared responsibility payment if they do not comply, IRS says.

By Michael CohnOctober 30 -

The Internal Revenue Service granted additional relief to victims of Hurricane Harvey on Wednesday by making it easier for 401(k)s and other employer-sponsored retirement plans to give loans and hardship distributions to aid victims.

By Michael CohnAugust 30 -

It is a sensitive topic, especially for partners who have earned their appellation on the letterhead.

By Michael CohnMarch 2 -

Eligible taxpayers can now qualify for a waiver of the 60-day time limit and avoid possible taxes and penalties on early distributions, if they meet certain requirements.

By Michael CohnAugust 25