-

The incentive structures for both banks and large, sophisticated depositors have changed because of federal regulators' decision to guarantee the uninsured deposits of Silicon Valley Bank and Signature Bank.

March 21 -

There are key differences between the current banking crisis and the one that brought down the world's economy, but also chilling similarities.

March 21 -

Their search for new opportunities collides with a difficult job market, where major banks are cutting roles, from dealmaking to trading.

March 21 -

Financial advisors are flooded with questions from panicked clients. Here's a field guide to answers.

March 21 -

UBS's website rolled out last fall, before the current banking crisis.

March 20 -

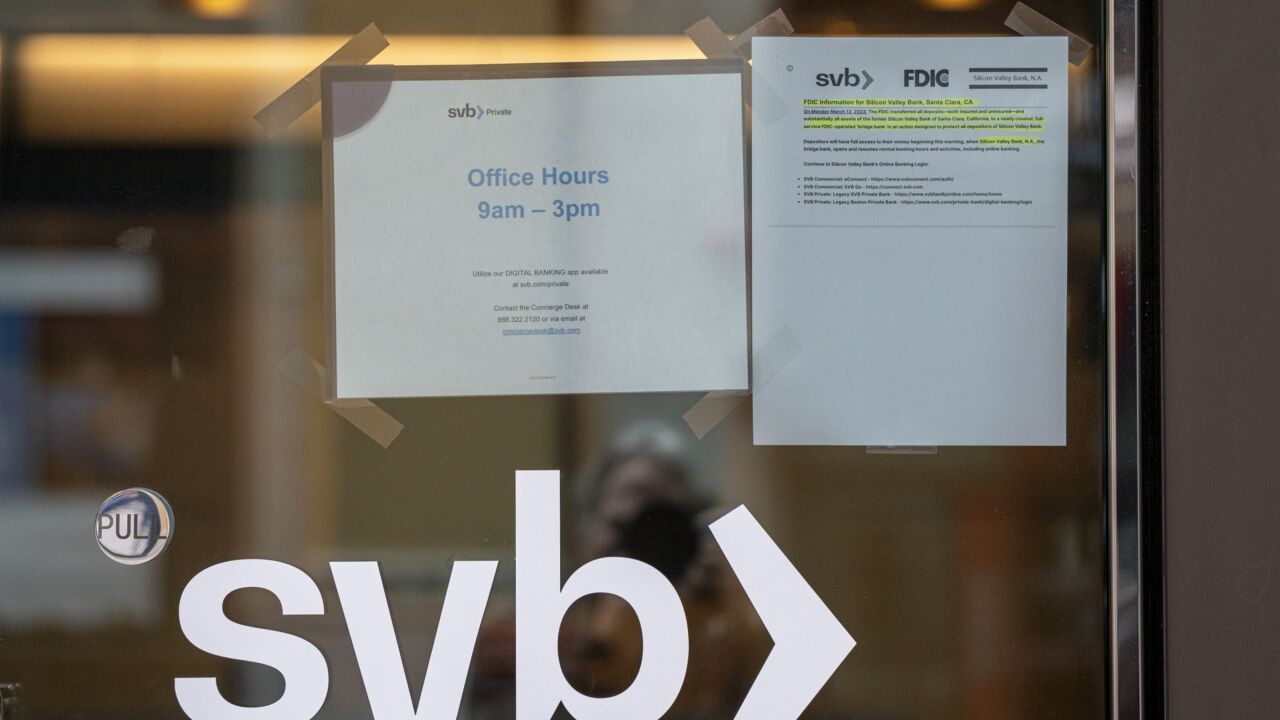

The Federal Deposit Insurance Corp. says it has extended the deadline for bids on Silicon Valley Bank, will break the bank into two parts for sale and will allow nonbanks to bid on asset portfolios.

March 20 -

UBS Group is paying 3 billion francs ($3.3 billion) for its rival in an all-share deal that includes extensive government guarantees and liquidity provisions.

March 19 -

Following the collapse of Silicon Valley Bank and a wider banking-sector panic this month, the smaller banks told regulators that explicitly insuring all deposits would stem the flow of money to the largest banks.

March 18 -

Firms across the industry are scrambling to assuage client fears, while others are taking advantage of the frenzy to attract talent. Meanwhile, some advisors are using the moment to reassess what they want professionally.

March 17 -

Charles Schwab Corp., one of the financial firms whose shares have been roiled by the current banking crisis, says it has added a net $16.5 billion in five days.

March 17 -

Is the banking sector in crisis? What happened, and what can bankers learn from this turmoil? Two of American Banker's reporters discuss the fallout and what comes next with the magazine's editor-in-chief.

-

Employees of the collapsed bank are using LinkedIn, and old-school means, to find new jobs.

March 16 -

After three banks collapsed, a New York teacher wonders if the wreckage could reach her nest egg. Should she be worried?

March 16 -

After the collapse of three banks, many Americans are wondering if their long-term nest eggs are safe. Here's what to tell them.

March 15 -

Navigating challenges and what's ahead in banking regulation.

March 15 -

A behind-the-scenes business, cash management services for advisory firms and affluent clients are in the spotlight following the Silicon Valley Bank and Signature Bank implosions.

March 14 -

While depositors will be made whole under an extraordinary move by regulators, a fire sale of the entire bank and advisors fleeing to competitors create new challenges.

March 12 -

The abrupt downfall of Silicon Valley Bank prompted investors to question whether other banks that hold tech-related deposits could also be at risk. But one analyst said there could be opportunities for banks to add deposits from customers of the failed bank.

March 10