Consumer banking

Consumer banking

-

Complaints lodged against the firm through Dec. 15 dropped 18% from the same period of 2016, federal figures show.

January 5 -

Banks' online advice platforms are just the face of a deeper effort to restructure client data and adapt to a digital era.

December 21 -

With millions of Alexa and Google Home devices now in use, first-mover banks are rapidly developing services to let customers control their finances using only their voice — even if there are still many kinks to work out.

December 4 -

The brokerage firm says reimbursements will be evaluated on a “case-by-case basis.”

December 1 -

Central Valley Community Bank of Fresno, California, will look to Raymond James to help it expand its client investment offerings.

December 1 -

The firm would not comment on the cause.

November 29 -

Wealth managers are fielding calls and emails from clients worried they’re missing out on something big.

November 21 -

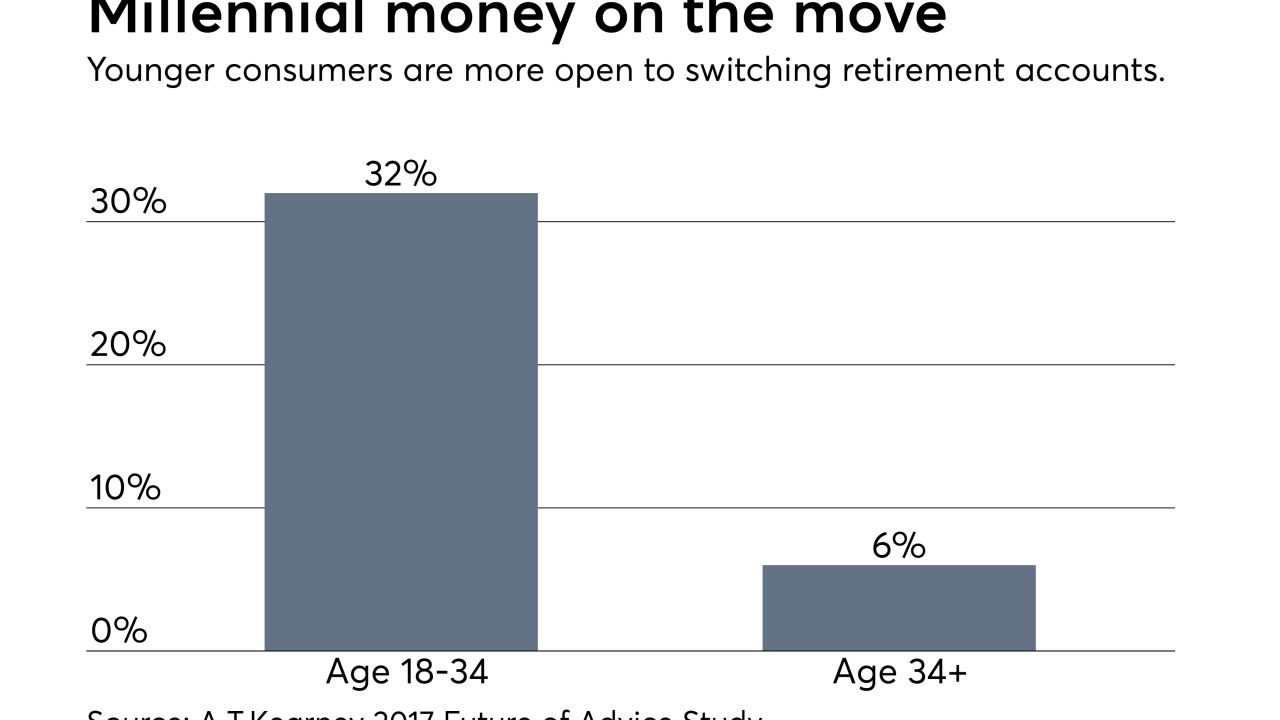

Acquiring a retirement savings tool provider allows the app to broaden its offerings to millennial clients.

November 8 -

The 22 million Gen X and Gen Y clients banking with Wells are a competitive advantage for its digital advice platform, executives say.

November 6 -

Stash is the latest young fintech to pair debit and savings products with financial advice as it competes for clients.

October 30 -

"This bill is a giant wet kiss to Wall Street,” Senator Elizabeth Warren says.

October 25 -

Catering to young clients, Finn by Chase blends instant account access, emojis and PFM tools.

October 24 -

For young advisors, coping with the emotional ups and downs of the business is a big hurdle, says Raymond James Complex Manager Tony Barrett.

October 5 -

AI and predictive analytics have key roles in the bank's plan to add automated advice and savings to mobile banking.

September 27 -

“We’ve been very focused on opening every drawer and turning over every rock in the company,” CEO Tim Sloan said.

September 14 -

An offering that can grow with a client, Ally Invest's president says, will stand out in the digital advice field.

September 6 -

“You can’t serve the public if your employees are shellshocked,” said one top banker, comments echoed by other institutions dealing with the aftermath of Hurricane Harvey.

September 5 -

Fifth Third Bank tweaks microinvesting premise with software that rounds up debit card purchases to help pay back educational loans.

September 5 -

Many financial institutions have activated their emergency centers, closed branches and stocked ATMs in advance of landfall.

August 25 -

Big banks north of the border are rapidly expanding their U.S. wealth divisions, competing with their stateside peers for higher-income clientele.

August 24