-

The state that imposes the most on residents has an individual income tax burden of 4.72%.

January 9 -

The retirement legislation has several new provisions that tackle student loan debt, emergency savings and retirement benefits for small businesses.

January 9 -

Asking the right questions early on can help a planner identify gaps in an emerging estate plan and uncover opportunities for clients down the road.

January 9 LJW Wealth Management of Raymond James

LJW Wealth Management of Raymond James -

Winning multi-millionaire clients looks different today for advisors — here's what's changed, a Cerulli study reports.

January 9 -

At least one industry consultant thinks the large fintech provider has lost its "innovative spirit" since Bill Crager took over from his fellow founder in 2019.

January 8 -

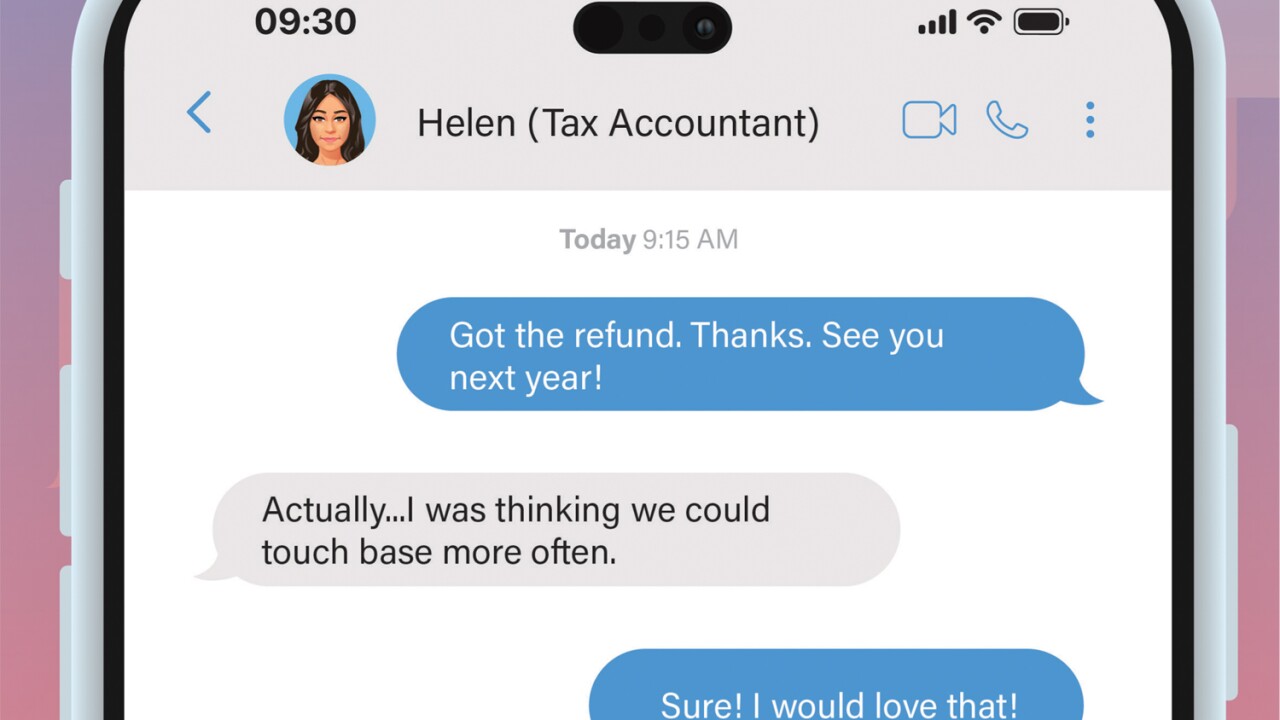

Practitioners have always shared advice as part of tax prep, but the future of the field is in proactive, intentional tax advisory services.

January 8 -

Financial advisors, tax professionals and their customers can recoup 30% of the cost through credits for qualified upgrades to their residences.

January 8 -

In 2023, Financial Planning's op-ed section featured nearly 100 original columns penned by experts across wealth management, from tax pros to tech founders and seemingly everything in between.

January 8 -

Crypto insiders expect the SEC to announce several key decisions on Jan. 10, which could determine the future of the proposed spot-backed ETF.

January 8 -

Donald Trump plans to make permanent the 2017 individual tax cuts that he enacted as president while keeping corporate tax levels unchanged in an appeal to working and middle class voters should he retake the White House.

January 8