-

Some firms are hiring more analysts and salesmen in hopes for a windfall from the rules.

August 31 -

A cornerstone of what drives American capitalism, the number of IPOs has plunged even as the stock market, and tech stocks in particular, have been hitting new highs.

August 31 -

In addition to launching new smart beta funds, the firm may look to expand into “a whole host of different asset classes,” according to one executive.

August 30 -

The real concern is not just that actively managed funds could disappear but that the entire market could be left for dead.

August 29 -

The new European Union rules were discussed on 50 earnings calls since BlackRock reported results on July 17, up from 17 mentions in May and June.

August 28 -

Jeffrey Sherman’s bond fund returned 14% on average over the last three years, besting 99% of all large-cap value funds tracked by Bloomberg.

August 25 -

Rates are likely to remain low, which will have a negative effect on retirees and older workers who are adjusting their portfolios in preparation for retirement.

August 24 -

While these funds often combine various asset classes, the firm’s offering will stay close to home — buying its own bond products.

August 24 -

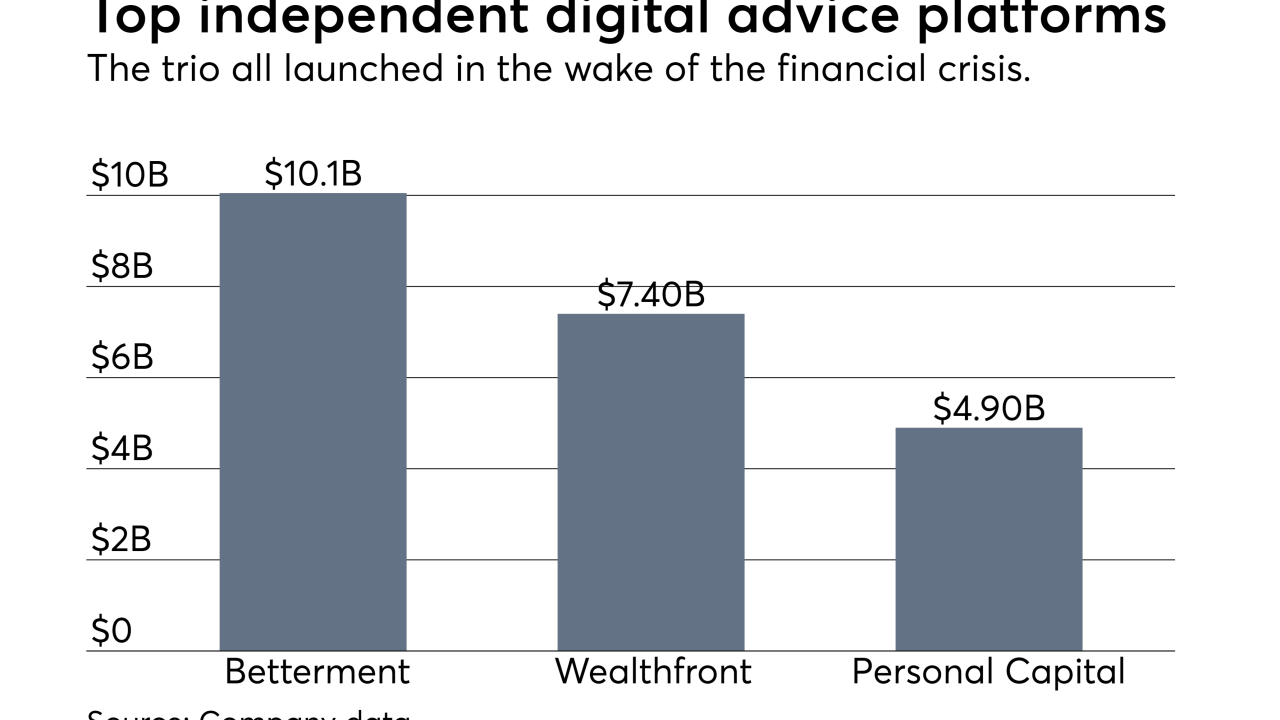

The top independents all state going public is a goal, but there are doubts about broad market support.

August 23 -

Sometimes it’s business. Sometimes it’s sentimental. Whatever the reason, it’s almost always problematic when a client insists on keeping a very large position in a single stock.

August 22