Vanguard is entering the latest game in ETF, but with a very Vanguard twist.

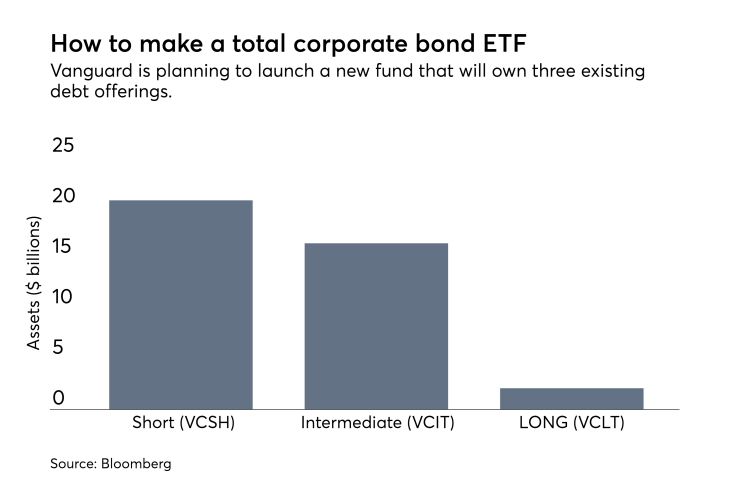

The $4.4 trillion asset manager is seeking approval for a Total Corporate Bond ETF, which would use the “ETF-of-ETFs” structure to buy other debt funds sold by the company, rather than individual bonds, according to regulatory filings. The new ETF, which would be the first from Vanguard to use this construction, would wrap the company’s short-term, intermediate term and longer-dated corporate bond funds into one product, the filings show.

ETFs that invest in other ETFs have been proliferating over the past few years. But while most of these funds combine different asset classes, or rotate between sectors, Vanguard’s new ETF will stay close to home — buying its own bond funds.

“The use of its very, very liquid bond ETFs will help it tap into the corporate bond market very easily,” said Todd Rosenbluth, director of ETF and mutual funds at CFRA Research. “It’s a novel approach that will work well for not only investors, but also for Vanguard in its ability to launch a low-cost product that will trade with tight spreads and build its asset base relatively quickly.”

By owning its own bond ETFs, Vanguard can keep down both the management fees and trading costs of its new fund because ETFs are easier to buy and sell than the underlying bonds. The firm estimates the fund will have an expense ratio of 0.07% and expects to launch it in the fourth quarter, it said in a press release.

-

Bill McNabb declined to speculate how low fees may go at his firm, which has the majority of its assets in passive funds.

June 15 -

Charity Charge, Growfund partner to offer workplaces donor-advised funds, cashback credit cards.

June 14 -

The move is a plus for clients looking to tap into emerging markets stocks and equities in Europe after run-ups the past year.

February 27

“The ETF-of-ETFs approach benefits from $39 billion in scale from the underlying funds,” said Freddy Martino, a spokesman for Malvern, Pennsylvania-based Vanguard. “This would be our first ETF of ETFs in the U.S. but we have many mutual fund funds-of-funds.”

The First Trust Dorsey Wright Focus 5 ETF is currently the largest ETF of ETFs at $2.4 billion, and invests in sector and industry funds deemed likely to outperform. It rebalances periodically.

No performance chasers here; these investors buy on the downside.

“Vanguard hasn’t launched a lot of products, so whenever they do it’s a big deal,” said Eric Balchunas, an analyst at Bloomberg Intelligence. “They’re probably hearing from clients and advisers that they want something that is the easy button.”