-

With AI concerns crimping wealth management firms' stock values, an analysis by Fitch Ratings reveals the companies' underlying dynamics after a strong 2025.

February 24 -

Blue Owl's decision to halt withdrawals from one of its private credit funds raises further questions about the already obscure world of private credit.

February 23 -

Impact investing experts admit that the first year under President Trump has brought changes to the rhetoric around ESG. The realities look far more murky, though.

February 23 -

The 6-3 Supreme Court ruling against one of President Donald Trump's signature economic policies was consequential, but experts say volatility is unlikely to be over.

February 20 -

Retail investors increased their allocations to private equity, private credit by a whopping 36% last year as advisors look for diversification and strong returns.

February 19 -

Betterment is further encroaching on Charles Schwab and Fidelity's turf with a new referral program and portfolio options.

February 18 -

SyntheticFi co-founder Joseph Wang says his firm's investment and trading technology makes an options strategy long embraced by hedge funds more accessible to advisors and their clients.

February 17 -

The "sticker shock" of tax rates and IRS reporting rules may place the recent record highs and falls in a different context for investors, one expert says.

February 11 -

Financial advisors say they are increasing client portfolio allocations to international stocks in the latest Financial Planning survey.

February 10 -

None of the findings in a new working academic paper will likely surprise financial advisors. But they could provide some helpful data for conversations with investors.

February 4 -

With more than $12 trillion in assets, the company led by CEO Salim Ramji is pressing its advantages of scale in a rapidly consolidating, commodified industry.

February 2 -

The accounts give wealthy investors more opportunities to place alternative vehicles in a tax-advantaged retirement nest egg. But mistakes can be costly.

January 28 -

The results of Morningstar's latest study tracking fees and performance finds accelerating consolidation and commodification that makes advice more valuable.

January 22 -

Even as crypto prices slide, a growing share of financial advisors are adding digital assets to client portfolios, with firm policies slowly catching up.

January 21 -

As adoption of the dual-wrapper products accelerates, so will questions about timing, pricing and residual balances.

January 21 Nottingham

Nottingham -

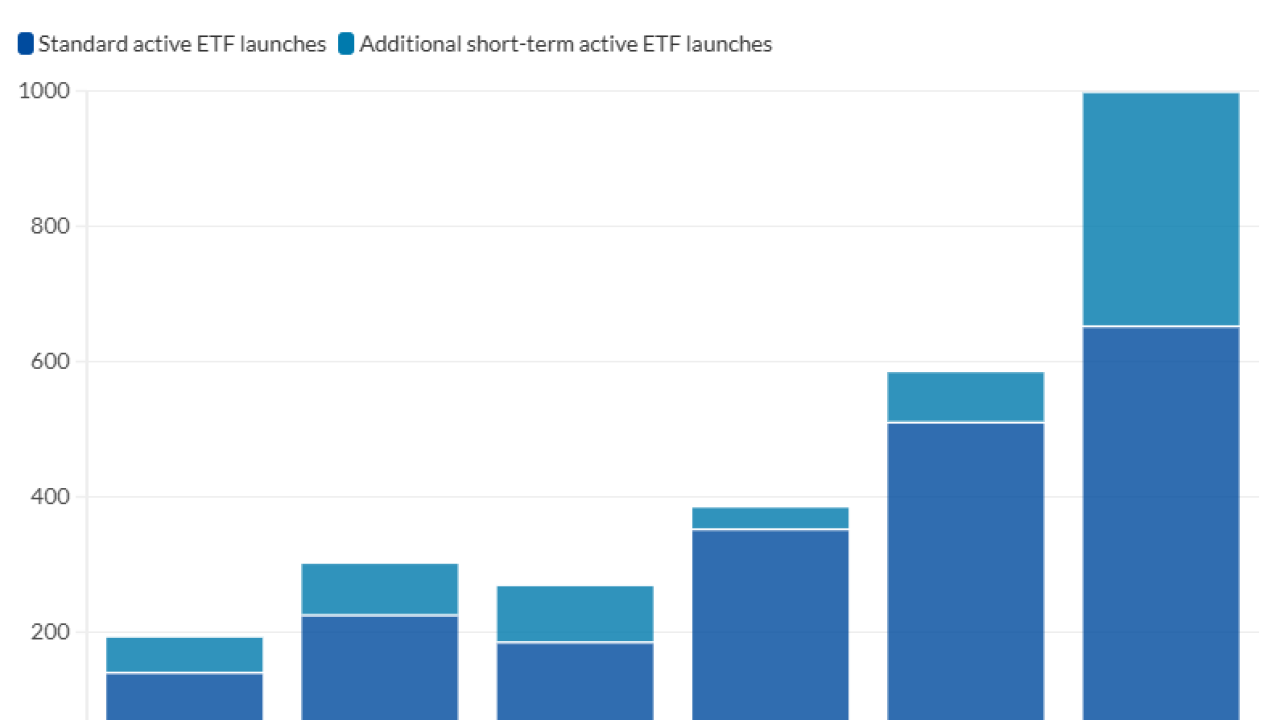

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

Once rare, the same kind of permissive terms that are widespread on leveraged loans are becoming increasingly common in the $1.7 trillion private credit market.

January 15 -

Tax-loss harvesting's overlooked cousin can pay off for clients with low-earning years, concentrated positions or UTMA accounts.

January 14 Natixis Investment Managers Solutions

Natixis Investment Managers Solutions -

A Financial Planning survey found that advisors believe AI will continue to transform wealth management. But experts say human oversight is still essential.

January 12 -

The "in-kind" method allows investors to diversify highly appreciated stock without handing over a chunk of the profit to the IRS.

January 6 Exchangifi

Exchangifi