-

When it comes to retirement planning, financial advisors are always looking for an edge. Could these strategies get them there?

December 3 -

When clients die, their children are often left with the uncomfortable job of dealing with what they may see as just junk. That is, unless financial advisors make it a priority to address this topic sooner rather than later.

December 3 -

The initiative from the president's tax law has drawn support from corporate and financial leaders.

December 3 -

Year-end client meetings, Dec. 31 deadlines, oh my. It can be a lot, but it doesn't have to be overwhelming.

December 3 -

JPMorgan again shows it makes a sharp distinction between advisors who build their own books of business and those who amass clientele from bank referrals.

December 2 -

The fund manager, convicted of fraud by a New York federal jury in August 2024 and sentence to seven years, spent less than two weeks in prison before being released.

December 2 -

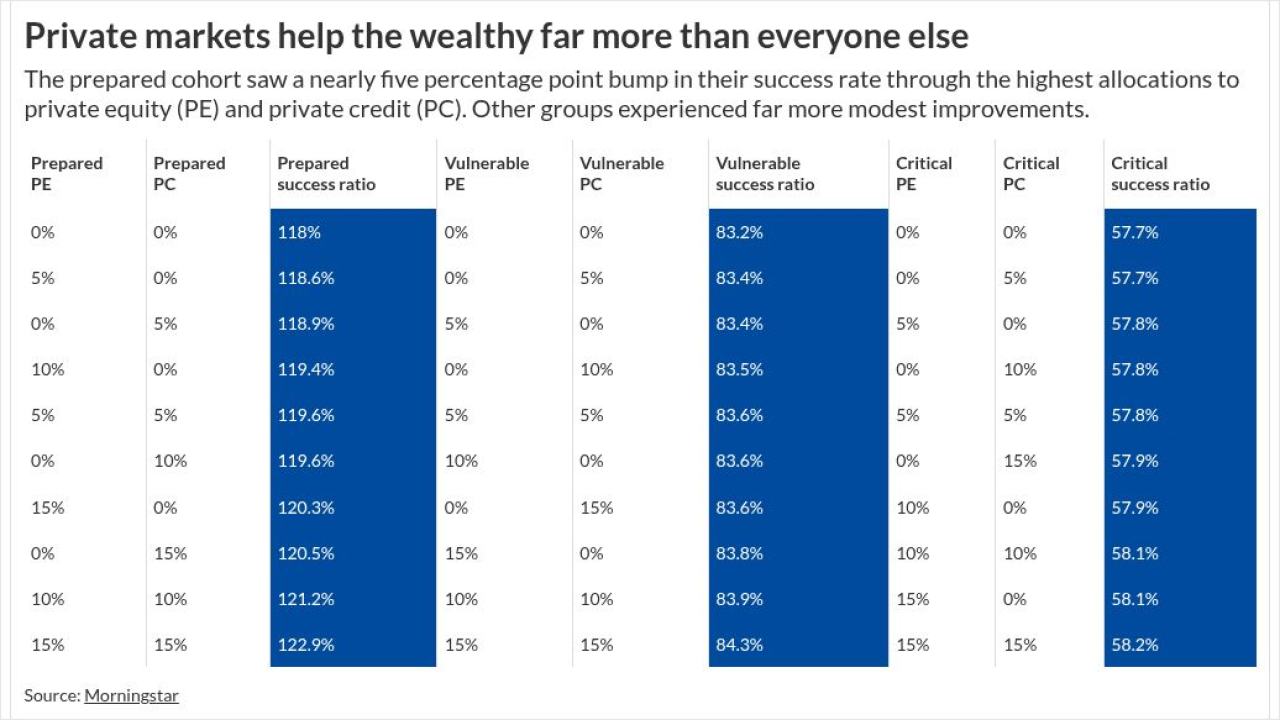

Private allocations can give retirees on a glide path a modest lift in returns, new Morningstar research shows — though the impact isn't uniform across savers.

December 2 -

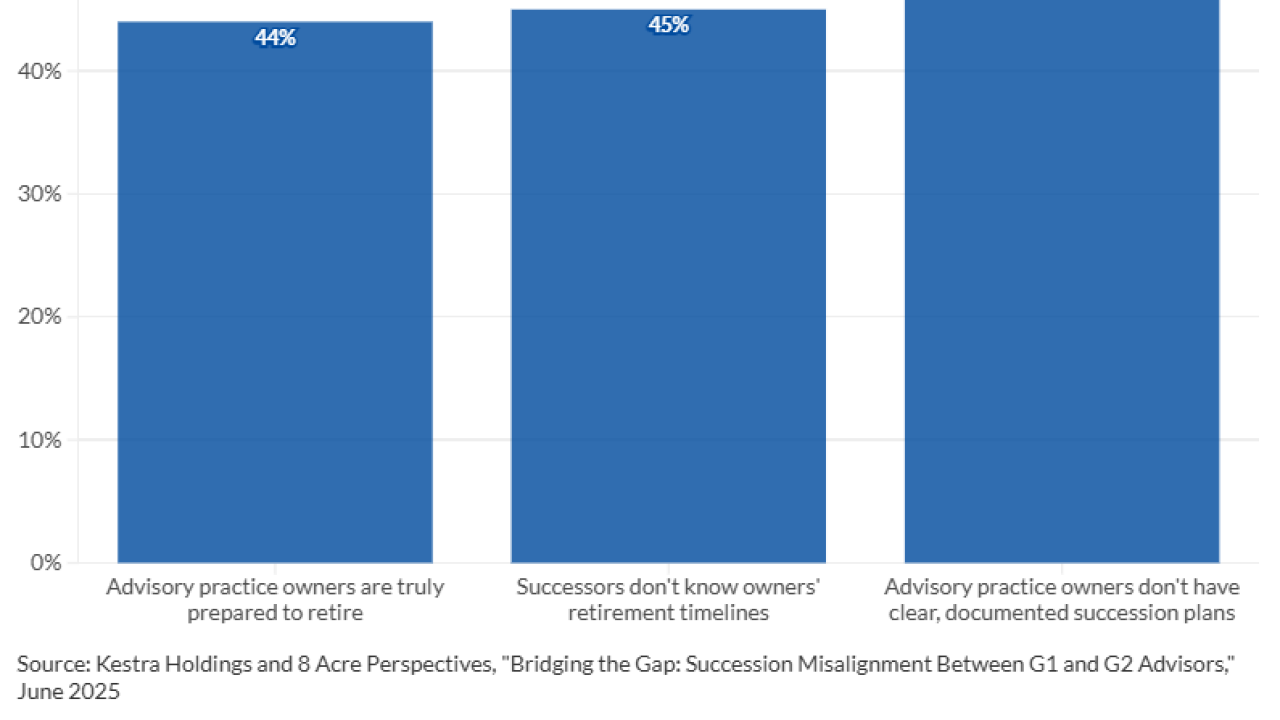

Preparation is everything: If clients are aware of the transition well in advance, experts say the risk is pretty low they'll leave the firm.

December 2 -

Artificial intelligence isn't an algorithmic takeover but an essential wealth management tool.

December 2 Aidentified

Aidentified -

UBS chief data and analytics officer Joe Cordeira says AI won't replace advisors. But it can help them by providing little nudges to do everything from rebalancing a portfolio to wishing a client happy birthday.

December 1