-

The first phase of FINRA's pilot program for continuing remote branch inspections drew the most interest from firms with 500 representatives or more.

July 29 -

Former President Trump is disavowing the conservative blueprint, which advocates for radical shifts in regulations and taxes that would reverberate in the industry.

July 17 -

The SEC, FINRA and other agencies have been closely watching social media posts related to financial advice. Consultants share how to attract young investors on social media without encountering regulatory pitfalls.

July 17 -

A broker argues the Supreme Court's recent decision in the Jarkesy case means he should get to defend himself against fraud allegations before a jury.

July 15 -

FINRA's settlement with Merrill gives the wirehouse credit for "extraordinary cooperation" with its investigation.

July 3 -

The broker-dealer self-regulator argues that the enforcement decline is a result of its success in driving bad actors from the industry.

June 28 -

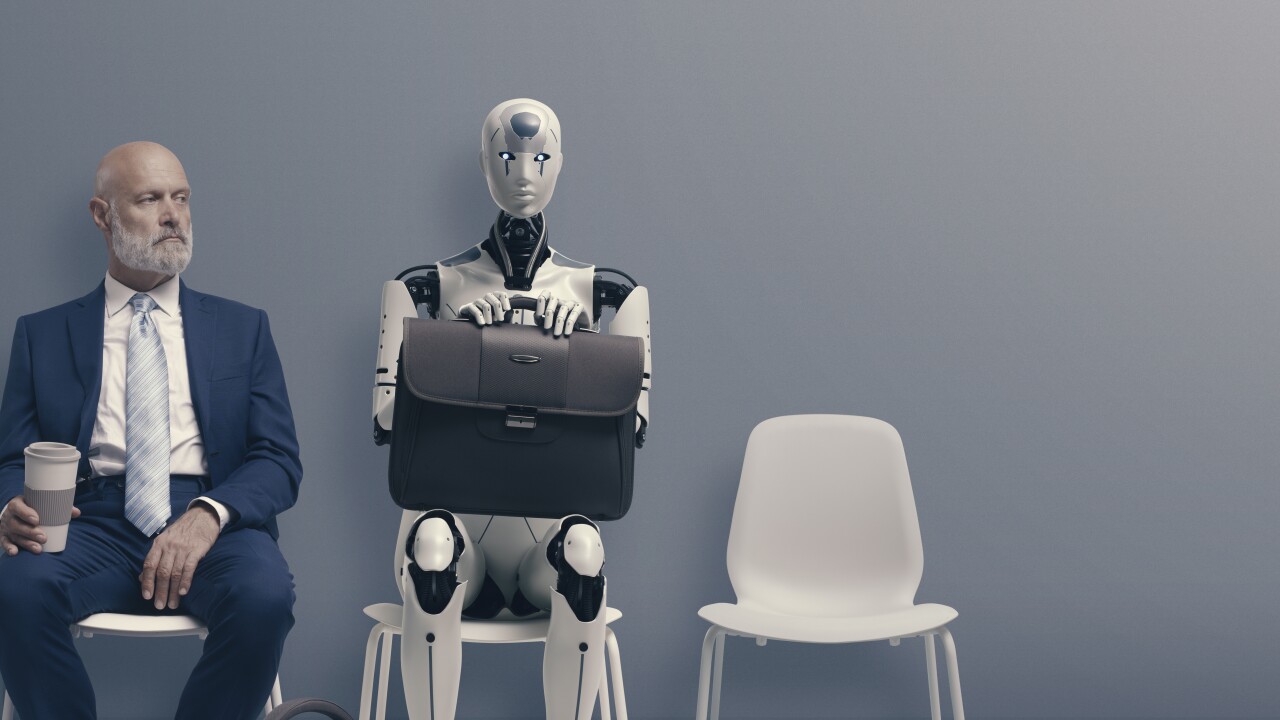

The terminations come amid a renewed push by firms to haul employees back into the office.

June 13 -

A recent poll by the FINRA Investor Education Foundation found that consumers trusted a financial statement made by AI nearly as much as the same statement made by an advisor — in some situations.

June 7 -

Relationships with vendors can make or break an advisor's business; FINRA officials and industry experts discuss best practices.

May 29 -

The financial industry regulator contends firms are unnecessarily sounding the alarm that new policies will require going into the office five days a week.

May 23 -

Brokerages and industry lawyers say the conduct standard's key provision is its requirement that advisors consider alternatives to risky and expensive investments.

May 16 -

Officials from FINRA and SEC spoke on how they are examining AI and emerging technology while also raising new risk concerns like deepfakes, which could make voice recognition software obsolete.

May 14 -

The self-regulator has stressed a shift away from mere compliance and toward active self-surveillance to uncover improper off-channel messaging.

May 2 Mirrorweb

Mirrorweb -

An expungement lawyer contends firms have an incentive to tar the reputation of departing brokers in an attempt to retain assets under management.

April 11 -

The giant insurer fired three financial advisors based on false claims about their specialty insurance consulting business, according to their attorney.

April 4 -

Industry lawyers think the watchdog agency may be handling low-level missteps through informal means and saving the big fines for violations that harm clients or undermine markets.

March 14 -

The emergency rules for brokers operating out of home offices since the pandemic will expire at the end of June.

February 1 -

Helen Grace Caldwell told her employees about her side film hustle but neglected to add that her clients were helping her fund it.

January 24 -

The GameStop saga is long over, but the retail investors who drove it could turn into long-term clients if wealth management firms adapt to changing times.

January 19 -

The broker-dealer industry's self-regulator warns of risks also related to cryptocurrencies and off-channel communications.

January 9