-

More retirees are going back to work amid financial pressures and economic uncertainty, an AARP survey finds. Advisors weigh in on when "unretiring" makes sense.

February 17 -

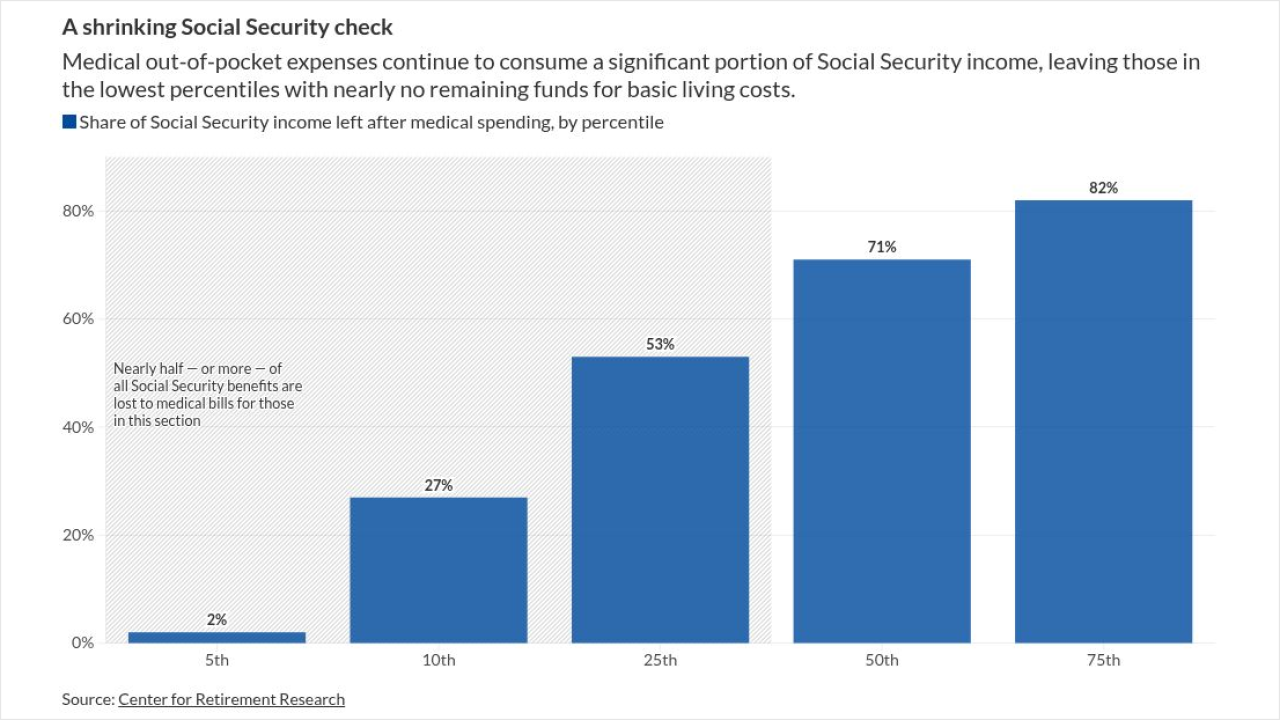

Medical inflation is projected to climb at double the rate of Social Security cost-of-living adjustments, leaving a growing number of retirees with a shrinking share of their benefits.

February 9 -

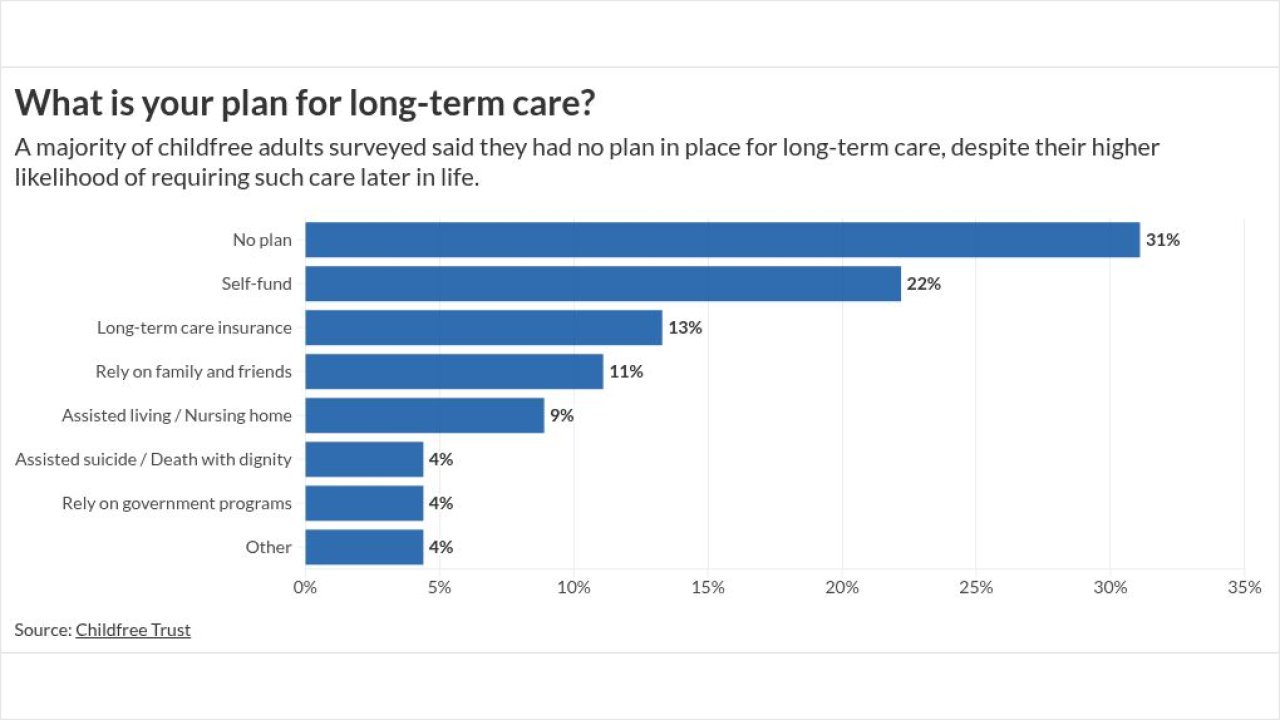

New research highlights a widening planning gap among childfree savers, with lagging estate and long-term care planning exposing unique risks — and opportunities for advisors.

December 19 -

Rising Part B costs will absorb much of Social Security's 2026 cost-of-living adjustment — leaving less room in retirees' budgets.

November 24 -

More seniors than ever are choosing Medicare Advantage, but the growth isn't universal. In some states, most still prefer original Medicare, according to a recent SmartAsset study.

October 20 -

Rising health care and long-term care costs are reshaping retirement planning. Advisors need to know how the landscape is shifting for retirees.

September 4 -

Trump's One Big Beautiful Bill Act opened HSA access to millions, but big gaps remain. Here's what financial advisors need to know.

August 27 -

A new bipartisan bill has the potential to significantly decrease the number of retirees who deplete their savings due to long-term care expenses, according to Morningstar researchers.

August 25 -

Customer satisfaction with Medicare Advantage plans is down, according to a new survey from J.D. Power. But some financial advisors say zero-premium plans remain a lifeline for cash-strapped seniors.

August 20 -

As major insurers reduce Medicare Advantage benefits and exit markets, retirees face higher costs and limited options. Advisors need to understand the implications for retirement planning.

August 13 -

Many retirees mistakenly believe Medicare will cover all their medical costs, but new Fidelity research reveals that even without long-term care, routine health care expenses can add up to tens of thousands of dollars.

August 6 -

A rise in gray divorce presents distinct planning challenges for advisors. A majority of married Americans say that a divorce would derail their retirement plan, a new Allianz Life study found.

July 25 -

A vast majority of Americans yet to enroll in Medicare say they're worried about whether the program will be there for them, according to a new survey from Retirable and eHealth.

July 21 -

A new Morningstar study found that long-term care costs can dramatically impact retirement plans, with 41% of households projected to run out of money when such expenses are incurred.

May 16