More about InVest: As new digital tools transform wealth management, the industry’s largest players are rushing to adapt to ever-increasing customer expectations, while smaller firms strive to keep pace. Behind the scenes, many are investing more on technology and hiring to drive growth, but margins remain under pressure. In|Vest West is exploring all the dynamics at play — from front to back office — and the technologies that are shaping the future of the firm.

-

The "in-kind" method allows investors to diversify highly appreciated stock without handing over a chunk of the profit to the IRS.

January 6 Exchangifi

Exchangifi -

Bill spent 30 years at growth-oriented healthcare companies as a controller, chief financial officer and president. He's led multiple acquisitions ranging in size from a few hundred thousand dollars in revenue to hundreds of millions. Bill also led sourcing, due diligence, financing and financial integration for these transactions.

January 5 -

Andrew Duke is the CEO of the Online Lenders Alliance. He previously led the Consumer Financial Protection Bureau's Consumer Education and External Affairs division.

January 5 -

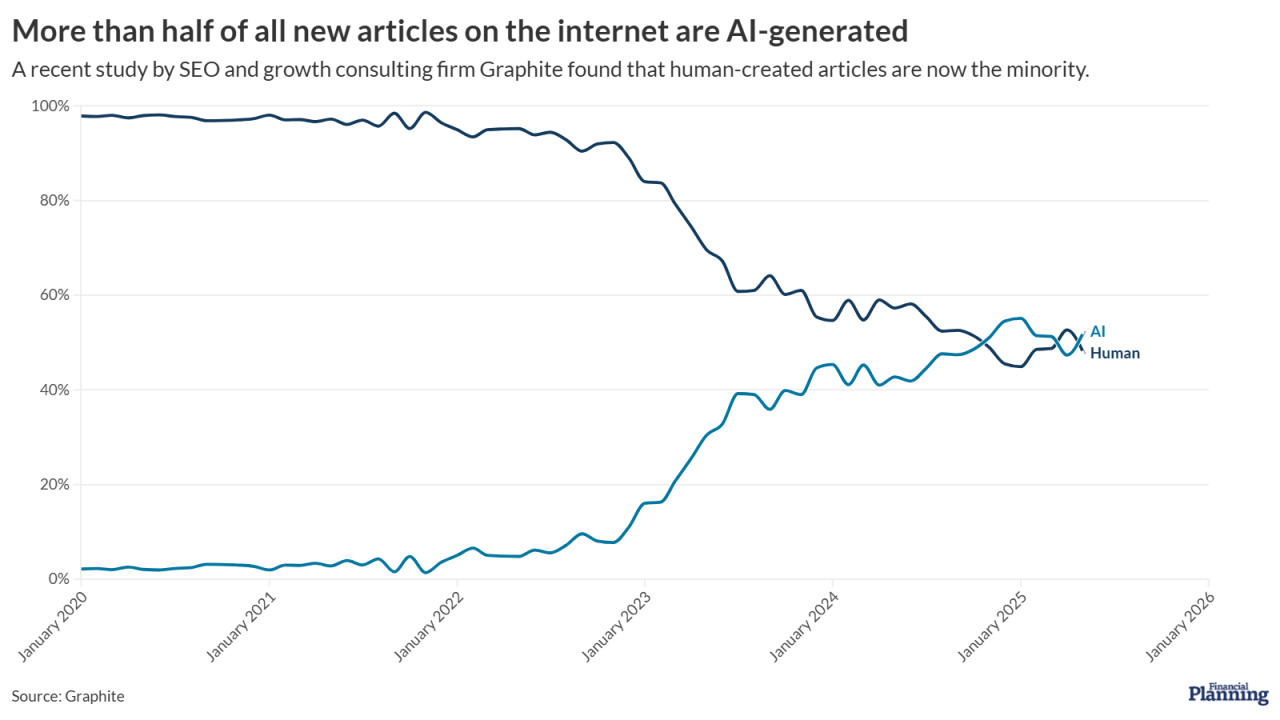

A recent study found that more than half of all new articles on the internet were AI-generated. How can advisors help their own content stand out when this deluge threatens to drown them out?

January 5 -

Under a new proposal, clients would have to opt in to receiving account statements and other documents in paper form.

January 5 -

Matt Bucklin is the founder of

ExchangiFi , a capital markets platform that enables ETF issuers to raise seed capital through Section 351 tax-deferred exchanges. Previously, he founded Valley Cove Capital, a search fund focused on small business acquisition and growth. He is based in West Palm Beach, Florida.January 5 -

Getting away from the office to create or revise a firm's concrete goals and teammates' roles can help RIAs tap into organic growth, experts say.

January 5 -

-

The U.S. and more than 100 other countries finalized an agreement that would exempt American companies from some foreign taxes.

January 5 -

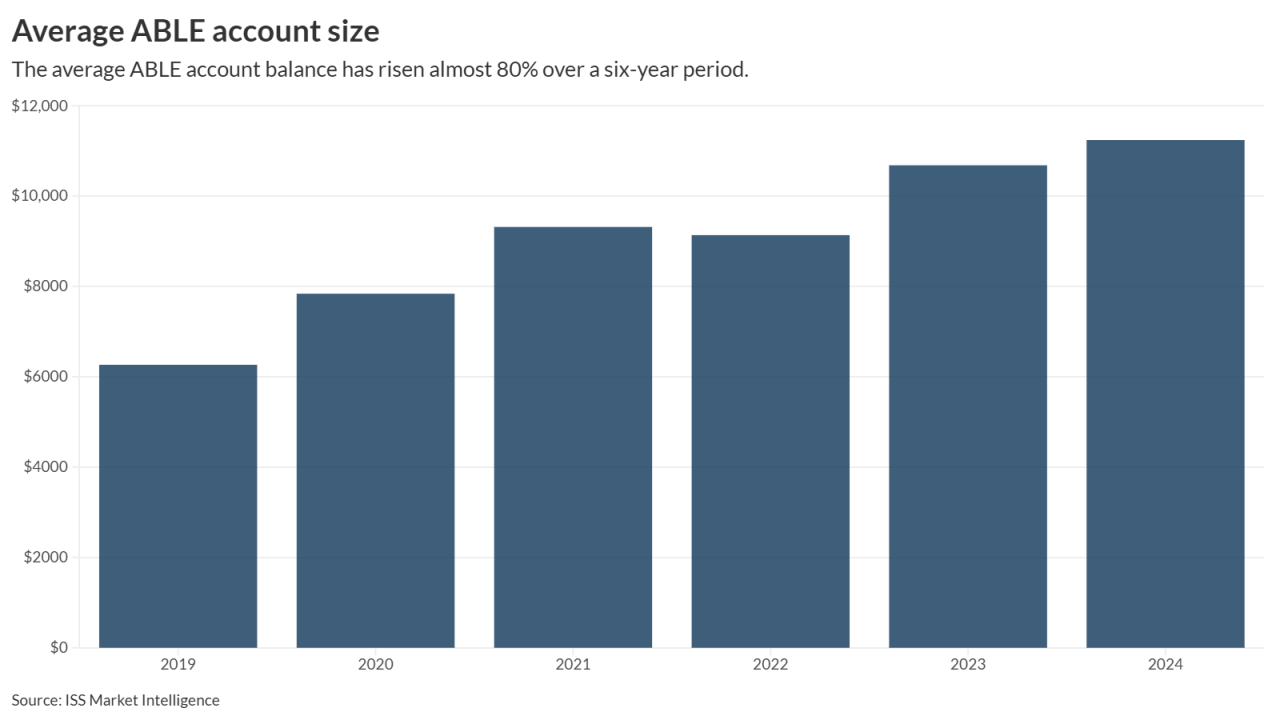

Starting in 2026, the starting age limit for those with significant disabilities to take advantage of these tax-advantaged savings accounts has been raised by 20 years.

January 2