-

Private equity in 401(k)s may face significant liquidity strains, reducing returns and complicating plan management, according to new Morningstar research.

February 27 -

After a long price correction in the art market, Bank of America is expanding its advisory services for collectors — and it's not alone.

February 25 -

A few weeks ago, analysts at UBS laid out a worst-case scenario for defaults in the private credit sector. Their outlook just became more grim.

February 25 -

With AI concerns crimping wealth management firms' stock values, an analysis by Fitch Ratings reveals the companies' underlying dynamics after a strong 2025.

February 24 -

Blue Owl's decision to halt withdrawals from one of its private credit funds raises further questions about the already obscure world of private credit.

February 23 -

Impact investing experts admit that the first year under President Trump has brought changes to the rhetoric around ESG. The realities look far more murky, though.

February 23 -

The 6-3 Supreme Court ruling against one of President Donald Trump's signature economic policies was consequential, but experts say volatility is unlikely to be over.

February 20 -

Seeing a pattern of stop-and-go federal support, financial advisors clamored for a chance to ask questions about what President Donald Trump's agenda means for municipal budgets and the bonds tied to them.

February 20 -

Retail investors increased their allocations to private equity, private credit by a whopping 36% last year as advisors look for diversification and strong returns.

February 19 -

Betterment is further encroaching on Charles Schwab and Fidelity's turf with a new referral program and portfolio options.

February 18 -

A solid sixth man for the Milwaukee Bucks built his family's wealth after his playing days. Here's what financial advisors and investors can learn from his example.

February 18 -

SyntheticFi co-founder Joseph Wang says his firm's investment and trading technology makes an options strategy long embraced by hedge funds more accessible to advisors and their clients.

February 17 -

Given recent renewed interest in the medium, top enthusiasts' collections can be worth six figures. But quality generally beats quantity, and it pays to be informed about which rare pressings are most sought-after.

February 13 -

Rich Guerrini said the bank plans to expand its advisor ranks by about 50% as it targets mass affluent and other new clients with personalized branch-based service.

February 12 -

The focus of retirement planning is shifting, according to Morningstar experts, moving away from simple saving toward bespoke decumulation strategies and guaranteed lifetime income solutions.

February 12 -

The "sticker shock" of tax rates and IRS reporting rules may place the recent record highs and falls in a different context for investors, one expert says.

February 11 -

Sean Snaith, Director of the Institute for Economic Forecasting at the University of Central Florida, will provide insight into the FOMC meeting.

-

Financial advisors say they are increasing client portfolio allocations to international stocks in the latest Financial Planning survey.

February 10 -

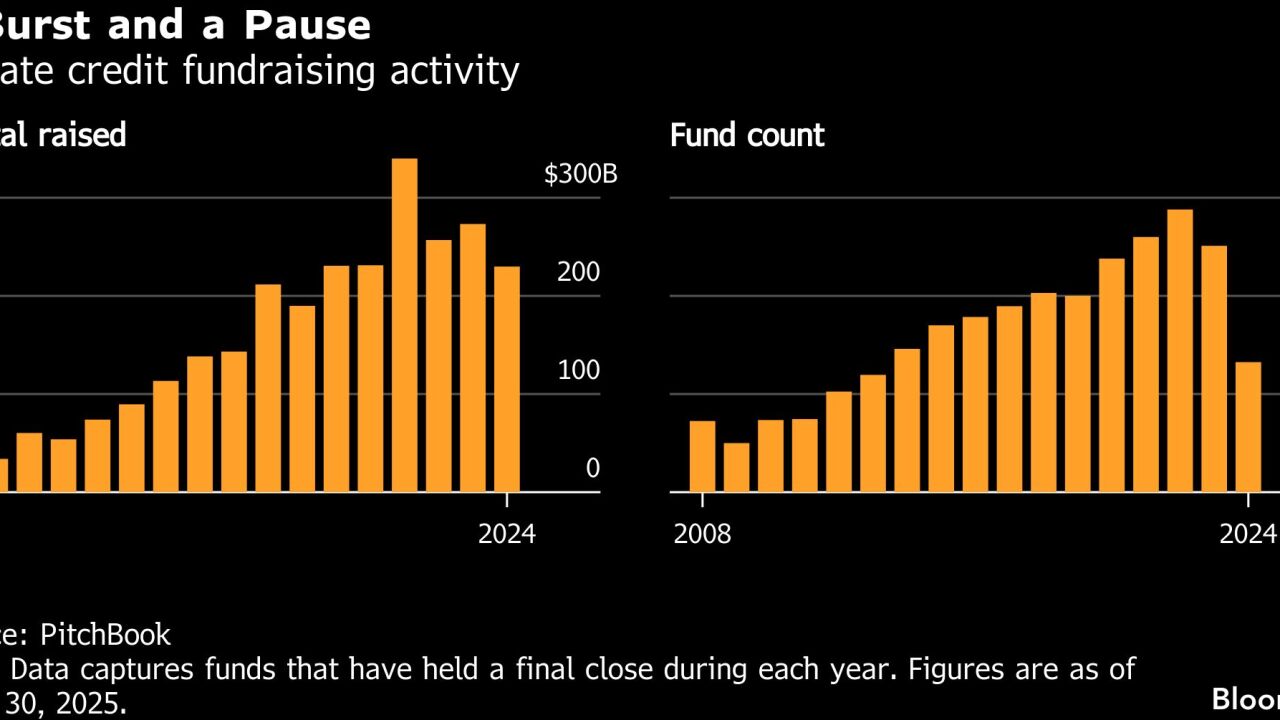

Virtually every major firm on Wall Street has joined the push into private markets, with many trying to get in early on the biggest "next big thing" to hit financial services since the exchange-traded fund.

February 6 -

A federal judge rejects arguments that U.S. Bank has a fiduciary duty toward uninvested cash sitting in clients' brokerage accounts.

February 5