An interesting split has emerged. Clients are sharply divided between bullishness and bearishness, with very little middle ground.

Some advisors say their clients are increasingly nervous about a stock market decline, while others say clients are emboldened by valuations that have weathered severe domestic and international political turbulences.

Flows into equities, bonds and cash have all increased as clients make divergent bets, according to the latest Retirement Advisor Confidence Index — Financial Planning’s monthly barometer of business conditions for wealth managers. The component measuring allocations to equities rose 2.8 points to 61.8, while allocations to bonds rose 4.1 points to 53.3 and cash allocations were up 0.7 points to 53.1. Readings above 50 indicate expansion; readings below 50 show contraction.

“Clients are either raging bulls or are very scared, little in between,” one advisor says.

In one camp, clients fear an eventual stock market sag, and are moving to lock in gains and protect themselves. “I am raising cash for my clients by progressively selling the most overvalued assets,” one advisor says.

But relatively low volatility and strong gains have drawn other clients into stocks, with several advisors saying a “fear of missing out” mentality is setting in.

“Investors are thinking that a correction is coming soon, but they don't know when,” one advisor says. “In the meantime, they don't want to miss out on any gains while the bull market is still going. And who knows how long the bull market will continue?”

Some advisors traced the divergent sentiment to clients’ political inclinations. Allocations are being influenced by “the political environment, and perception thereof,” one advisor says.

According to another advisor, “Clients are either raging bulls or are very scared, little in between.”

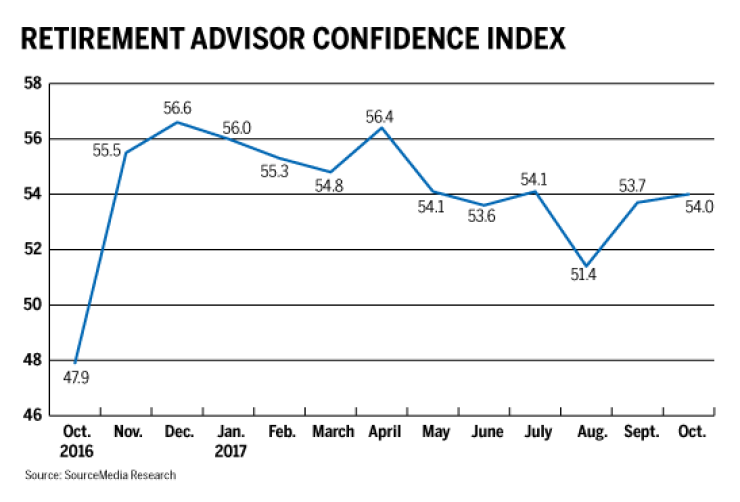

Despite the tension, the composite index ticked up 0.3 point to 54, extending a long streak in expansion territory. (The composite incorporates components tracking asset allocation, investment product selection and sales, client risk tolerance and tax liability, new retirement plan enrollees and planning fees.)

Similarly, the component tracking client risk tolerance remained in expansion territory, despite notching down about 0.1 point to 53.8. But whether clients are channeling bulls or bears, several advisors say they are urging discipline in sticking to long-term plans.

One advisor says the instinct to follow momentum is “disturbing, but it allows me to remind clients to be properly diversified.”

Fees charged for retirement services also continued to expand, although the index component tracking them decreased 1.1 points to 54.4. The fee reading has been above 50 for more than a year as rising stock prices have increased assets under management.