-

The DoL rule has contributed to both the overall drop and a market shift, say LIMRA experts.

August 31 -

Advisors must be prepared with tax and planning strategies to help when clients fall ill.

August 30 -

Hurricane Harvey provides a grim reminder of how traumatic it can be to face the effects of severe weather. Here’s how to be effective if it happens to your clients.

August 30 -

Evacuating floodwaters with his pregnant wife, two children and a “very angry cat,” an advisor gets a personal reminder that the people he serves are a lot more than just names and numbers.

August 29 Tri-Star Advisors

Tri-Star Advisors -

The cleanup goes on long after the storm has passed. Here’s how financial planners can provide advice for one of clients’ most expensive traumas.

August 28 Life Planning Partners

Life Planning Partners -

Certain laws may require them to maintain the coverage with their former spouse.

August 25 -

What clients don’t know could cost them hundreds of thousands of dollars.

August 21 -

The products protect clients against losses, but significant caveats emerge in the fine print.

August 21 -

Congress may have a difficult time closing tax code loopholes that benefit households more than corporations, an expert suggests.

August 11 -

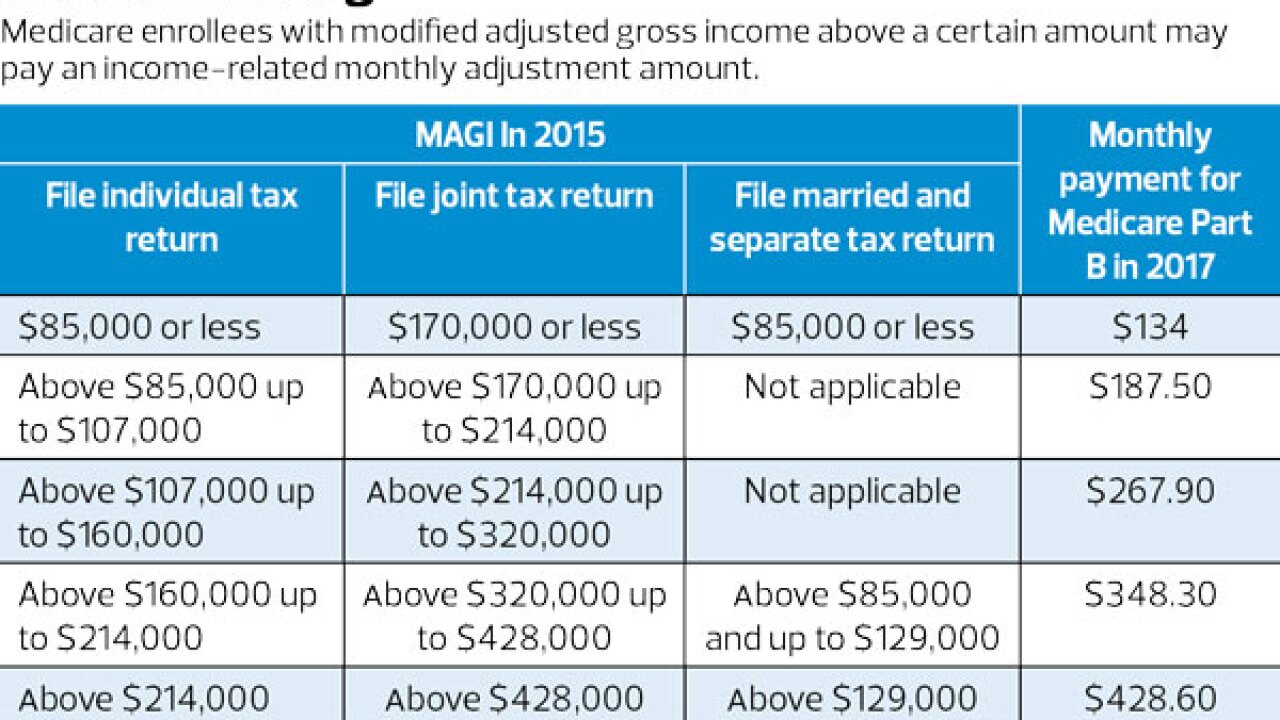

Planning may help high-income seniors avoid paying up to four times the going rate for Part B and Part D coverage.

August 8