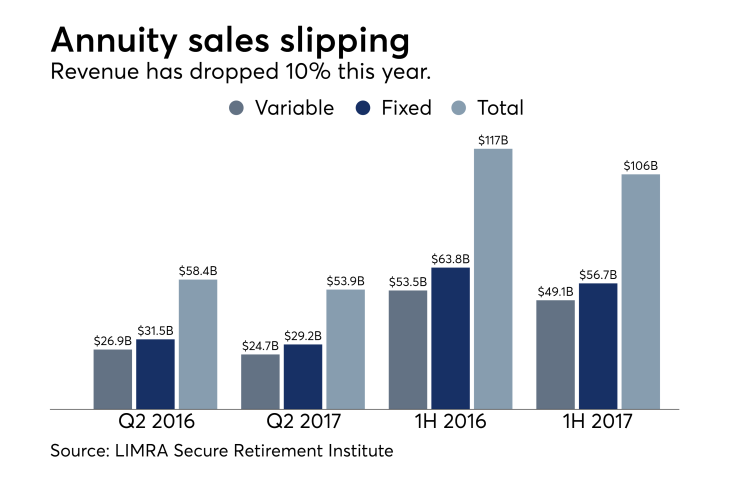

Annuity sales have fallen to their lowest level since the collapse of the dot-com bubble in 2001, with overall revenue shrinking by 10% to $105.8 billion for the first half of the year.

If this continues for the full year, the contraction means variable annuity sales will plummet by 10% to 15% to less than $100 billion — a level not seen since 1998 —

-

Experts say such cases are commonly filed by advisors yet difficult to win.

August 30 -

The products protect clients against losses, but significant caveats emerge in the fine print.

August 21 -

The broker’s written promise of 7% returns on a variable annuity made for a simple case, the lawyer for the claimant says.

April 21

LIMRA experts point to the Department of Labor’s fiduciary rule as contributing to a long-term downward trend and shift from variable to fixed products. Total sales have declined year-over-year for five quarters in a row, while fixed sales beat variable sales for the sixth straight quarter for the first time in almost 25 years. The rule has also increased product scrutiny, with annuities figuring into recent

Variable annuity buyers spent $24.7 billion on the products in the second quarter, an 8% drop over the year-ago period. Non-qualified sales have taken up a growing share of the market, notching a 5% increase for the quarter, while qualified sales tumbled 16%, according to the Institute. The DoL rule may be driving that shift, says Todd Giesing, its director of annuity research.

Other products on the annuity shelf also saw increased sales, or at least signs that they could expand in the future, and that leads some

And even though all fixed products took a hit except structured settlements, fixed index annuities took in 15% higher sales over the first quarter, with nine of the top 10 issuers reporting sequential growth. Fixed index sales still fell 4% year-over-year, though, and the Institute predicts a 5% to 10% decline for 2017.

The Institute’s quarterly survey culled data from 97% of the annuities market.