-

Planners and their clients can use the annual cost-of-living adjustments as a helpful reminder to consider tweaks to retirement savings and strategies, experts said.

November 13 -

The service issued its annual adjustments for retirement plans, with some reflecting changes in the SECURE 2.0 Act.

November 1 -

The late actor's estate fell short in a five-year quest involving the distribution of a hedge fund position when his financial advisor left UBS for Merrill Lynch.

October 24 -

Missouri requires brokers who recommend investing on environmental, governance or social principles to sign statements saying they "are not solely focused on maximizing" returns.

August 16 -

The agency pushed back required minimum distributions for most beneficiaries again for 2023, but the old "stretch" strategy is long gone.

August 3 -

Federal officials have long warned of the dangers of accounts with few guardrails on what they can invest in.

May 31 -

A lawyer in New Jersey doesn't expect to get sued, but she knows it can happen to anyone. Would her nest egg be safer in a 401(k) or Roth IRA?

May 17 -

Signed into law last December and now partly in force, the sweeping retirement overhaul package presents new planning opportunities for millions of Americans and financial advisors.

May 15 -

From accidentally paying state taxes on T-bill income to wonky filing deadlines, these tips will help make a federal tax return sparkle. Or at least clean.

April 12 -

Americans pay billions of dollars in taxes each year when draining their retirement plans as they change jobs. The "leakage" doesn't bode well for long-term savings, data shows.

April 11 -

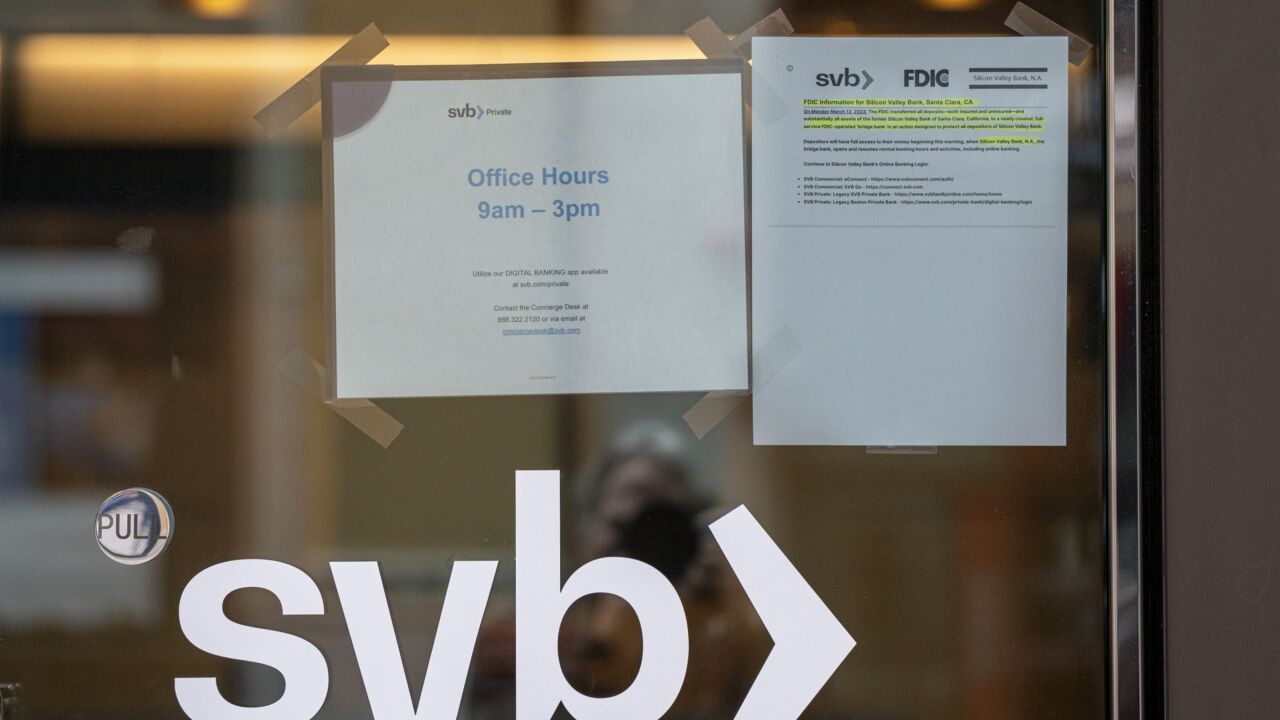

Financial advisors are flooded with questions from panicked clients. Here's a field guide to answers.

March 21 -

After three banks collapsed, a New York teacher wonders if the wreckage could reach her nest egg. Should she be worried?

March 16 -

The 4% rule isn't the only option. Plus, one counterintuitive idea says retirees can live larger this year.

March 14 -

A new study by FINRA and NORC offered encouraging signs that people who put money into stocks and bonds for the first time in 2020 are in it for the long run.

March 8 -

Contributions to 401(k)s and IRAs now can reduce your 2022 taxes soon due this filing season. Here's what advisors, many of whom can themselves benefit, need to know.

March 7 -

New data from Fidelity Investment shows disparate reductions in account balances for IRAs and employer-sponsored retirement plans last year.

February 26 -

A proposed amendment to the Investment Advisers Act would require planners to vet third-party custodians before entrusting them with clients' cryptocurrency, real estate or other alternative investments.

February 15 -

With 10 to 20 good working years left, financial advisors describe what their middle-aged clients are doing to get ready for a non-work life.

February 14 -

The federal regulator's annual list of inspection priorities shows particular concern that hybrid advisor/brokers aren't properly explaining to clients how they're compensated.

February 8 -

The SEC, FINRA and NASAA issued an investor alert warning of fraud, fees and tax complications for self-driven retirement accounts that invest in alternative assets.

February 7