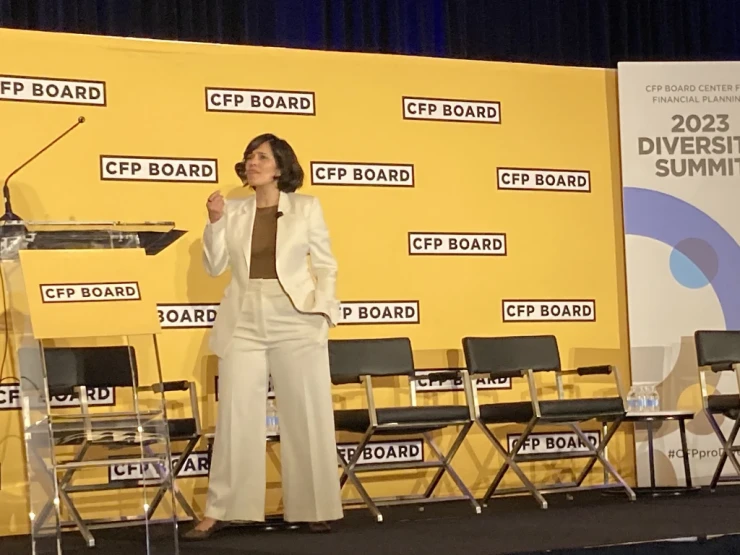

Wealth management professionals interested in seeing

So for the past 12 months, they've put in the work and taken action to reshape the business into something that is more welcoming to everyone.

From

And while most of them are quick to remind us that there is still more work to be done, their efforts have

Scroll down to see how the Financial Planning team has covered matters of race, diversity and inclusion in 2023.