Registered investment advisors are hiring, and the firms with the best value proposition for their employees' compensation have the edge, according to new data from Charles Schwab.

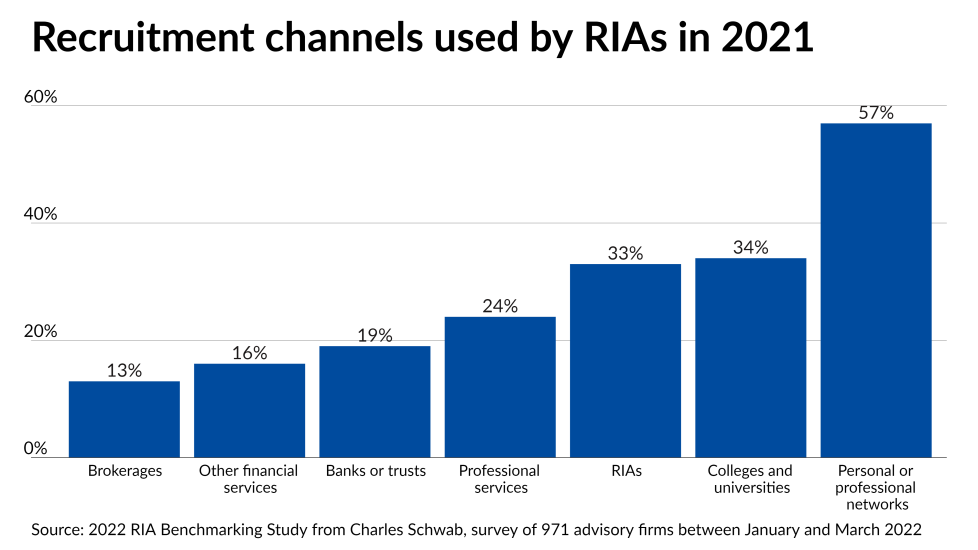

Recruiting new staff emerged in the

Questions about staff pay, locating talent, remote work and training represent about half of those currently fielded in meetings with RIAs by consultant Cameo Roberson of

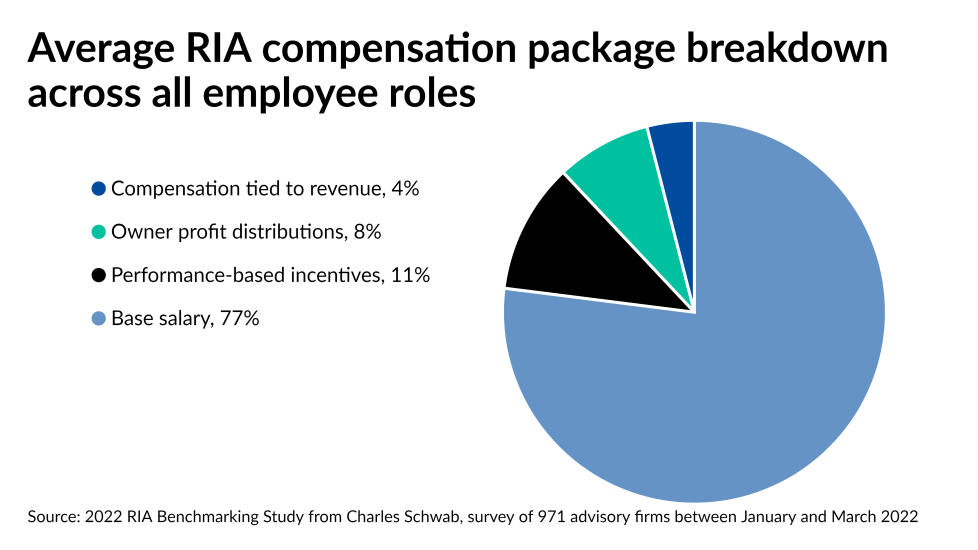

RIAs should "consider non-salary benefits that contribute to better work-life balance and professional development" and "be upfront with the salary range in the job description," she said. "Compensation can also be viewed as a progressive scale, so talent sees the compensation trajectory as they acquire more skills and experience. The latter is attractive from a sense of long-term planning and incentivizes the talent to stay longer and build skills to move from a junior role into a more senior one."

Roberson and Gabriel Garcia, the

"You recruit them, you develop them — the mentor-apprenticeship model — and then you promote from within," Garcia said, pointing out that staffing losses during the so-called Great Resignation and the rising amount of business are driving more recruiting outside the firms. "External talent does come at a premium, and I think that hiring externally is going to be more common in 2023," he added.

SEI's survey projects that more than 70% of RIAs will hire staff next year, a share that comes near Schwab's finding that 80% of RIAs said in the first quarter of 2022 that they would hire at least one employee this year. A median firm will need to add at least a half dozen new roles in the next five years, according to Schwab. Staff recruiting supplanted the need to acquire new clients through referrals as the top strategic priority among participants in this year's survey. However, the median firm hiked total cash compensation by only 6% between 2020 and 2021, and just 28% of the smallest RIAs provide their teams with health insurance.

"The past few years have underscored that people are truly a firm's most important asset," Lisa Salvi, a managing director for business consulting and education with Schwab Advisor Services, said in a statement. "Compensation is one piece of the broader puzzle to attracting and retaining talent in today's market. Compensation tied to a strategic plan is what can help set firms apart."

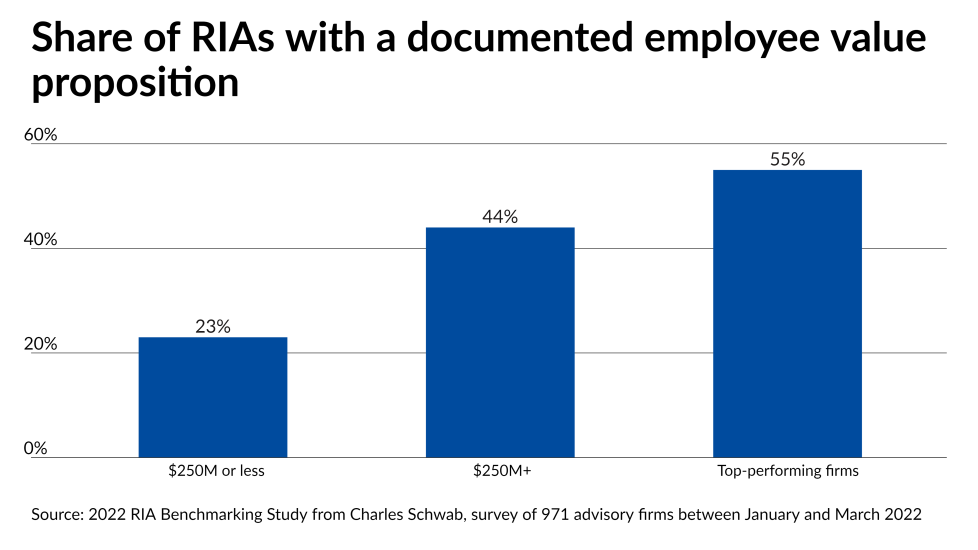

That's why "a documented employee value proposition" that "explains what a firm offers its employees in return for the skills, capabilities and experiences they bring" can help RIAs stay ahead of their competition for talent, according to Schwab's study. The top-performing 20% of firms on 15 different metrics analyzed by Schwab are more likely than their peers to have an employee value proposition and a stated commitment to diversity, equity and inclusion.

Scroll down the slideshow for a look at some of the most interesting takeaways for financial advisors and other wealth management professionals from

To read a deep dive with experts into the compensation trends shaping the industry,