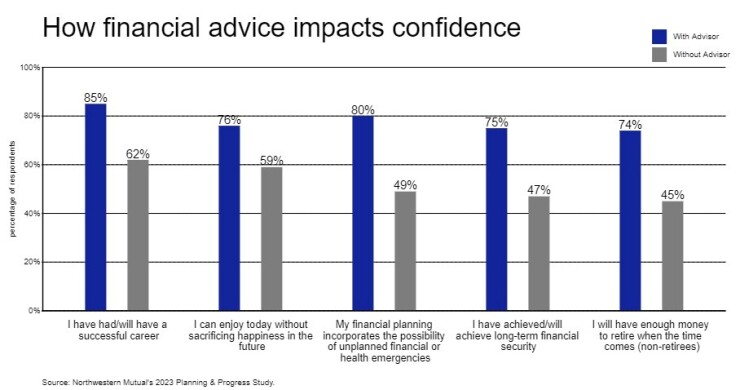

Most Americans say their personal financial planning efforts could benefit from the confidence boost that comes with having a financial advisor.

But the number of people who actually work with one is still eclipsed by the number of people who don't.

According to the

The study finds this to be especially true among younger adults as 79% of Gen Z and Millennial respondents agree with that statement.

Tim Gerend, chief distribution officer at Northwestern Mutual, said one factor driving this could be the current economic landscape. Nearly 1 in 5 people say that recent economic uncertainty has led them to either begin working with a financial advisor or plan to work with one at a later date.

"Financial uncertainty is up in 2023, and the question for many Americans is what to do about it," Gerend said in a statement. "The good news is many are taking action to plan and tapping advisors for help in an increasingly complex financial environment so that they can reach their goals."

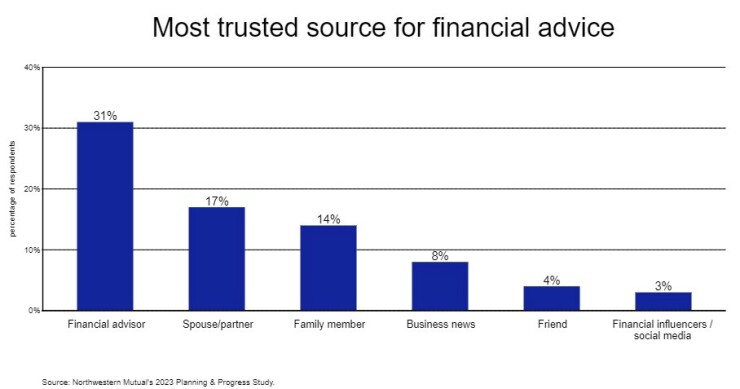

The study also provides a look at how some Americans consider the tips being dished out by "finfluencers" —

While not all finfluencers are malicious, experts warn that many of them spread misinformation, confuse investors or even push stocks that they're secretly paid to promote. Finfluencers were the focus of a

READ MORE:

The advisory warns that finfluencers are not bound by the same regulations as financial advisors, and the rules that do apply to them aren't always enforced. That means there are few limits on what they can say and little reason for them to disclose who's paying them to say it.