High prices aside, emerging market funds with the best returns of the past year have delivered significant outperformance.

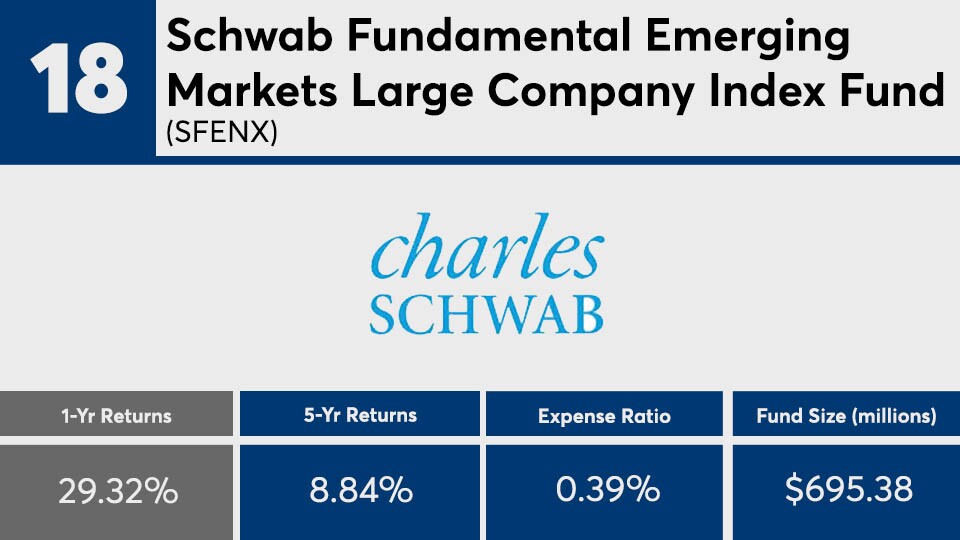

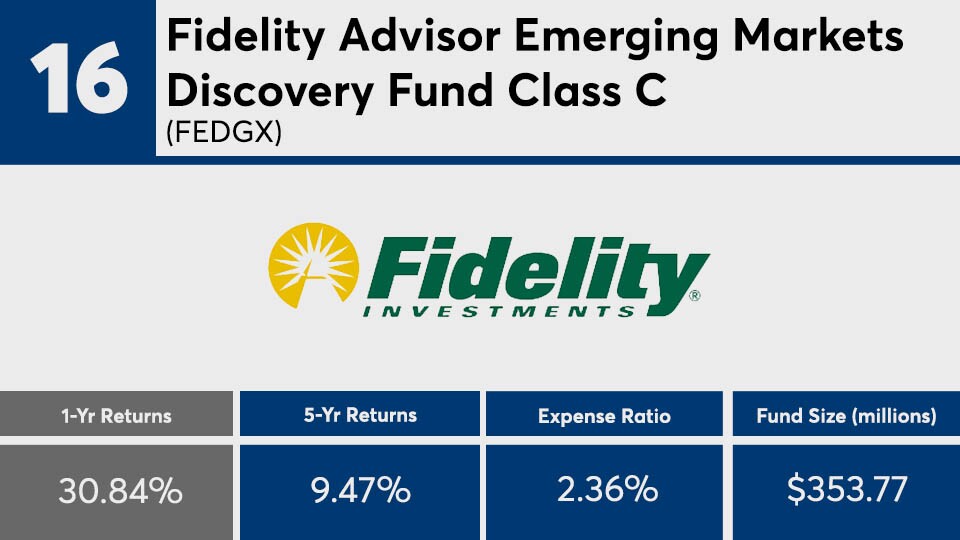

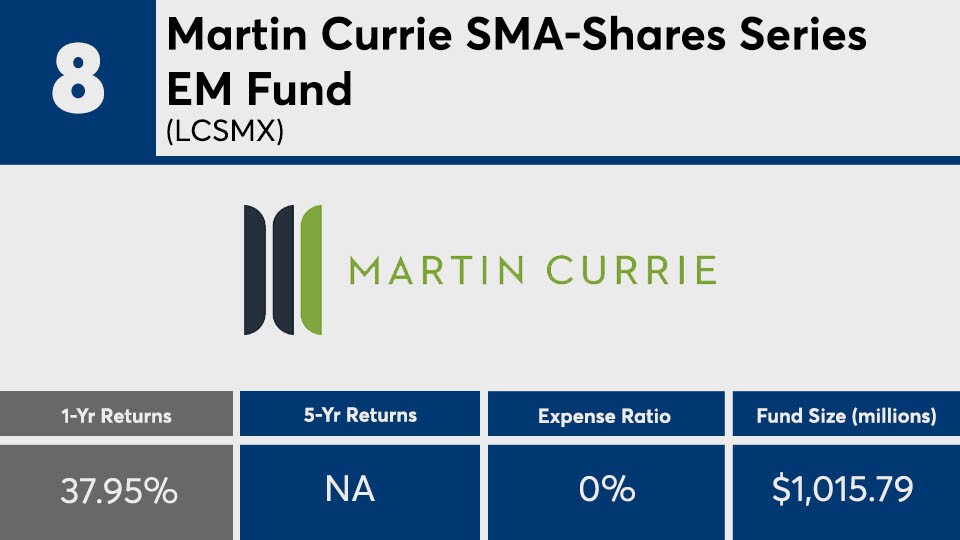

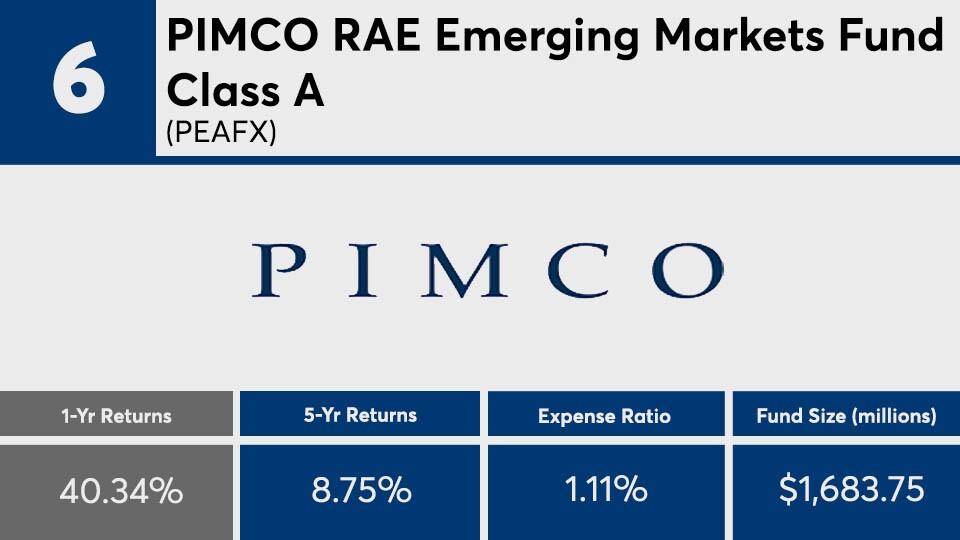

Emerging market sector funds with the biggest gains over the past year, and with at least $100 million in assets under management, posted an average return of 36.97%, according to Morningstar Direct. Over the past five years, the same funds managed a gain of 11.08%.

The list includes a mix of value and growth-focused funds, and small and large cap funds. All funds except Schwab Fundamental (

“It’s no surprise that some of the best performers were actively managed funds, especially those that are not tied to one style box or another,” Engelbart said. “There is a lot of value in many emerging market companies — some of those look very cheap on traditional metrics and others are growing at such a rapid pace that those metrics are less relevant."

Funds in this ranking, which tend to divide their assets among 20 or more nations and tend to focus on Asia and Latin America rather than on those of the Middle East, Africa, or Europe, are categorized by Morningstar as diversified emerging market portfolios, according to Morningstar. “These portfolios invest predominantly in emerging market equities, but some funds also invest in both equities and fixed income investments from emerging markets,” a spokesperson said in a statement.

For comparison against their emerging market peers, the Vanguard FTSE Emerging Markets ETF (

Pitted against broader markets, index trackers, such as the SPDR S&P 500 ETF Trust (

In bonds, the iShares Core U.S. Aggregate Bond ETF (

As expected in the often high-priced category, these long-term leaders carried with them significantly higher fees than the broader industry. With an overall net expense ratio of 1.61%, the top 20 funds in this ranking are more than triple the 0.45% investors paid on average for fund investing in 2019, according to

“An experienced active manager can be very important in asset classes that tend to be less efficient than the U.S. market — such as emerging markets,” Engelbart said. “It’s also important to remember that no matter how experienced or seasoned your active manager is, there are always going to be outliers in markets, and emerging markets tend to be a place where outlier events happen frequently — so volatility is to be expected, but the reward can be high.”

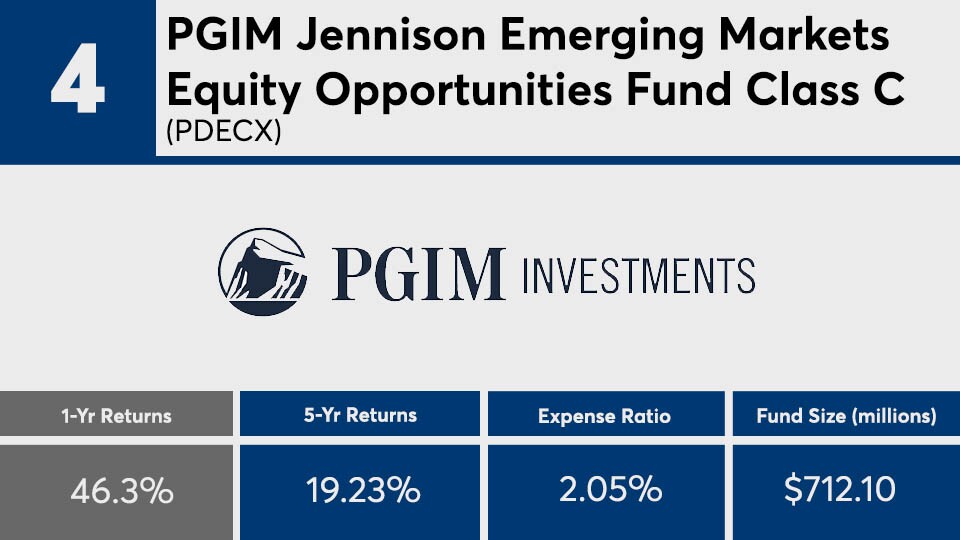

Scroll through to see the 20 best-performing emerging market funds for the past year. There is also data on each fund’s three-year returns, expense ratios and total assets. Funds with less than $100 million in assets were excluded, as were institutional funds and those with investment minimums of above $100,000. All data is from Morningstar Direct.