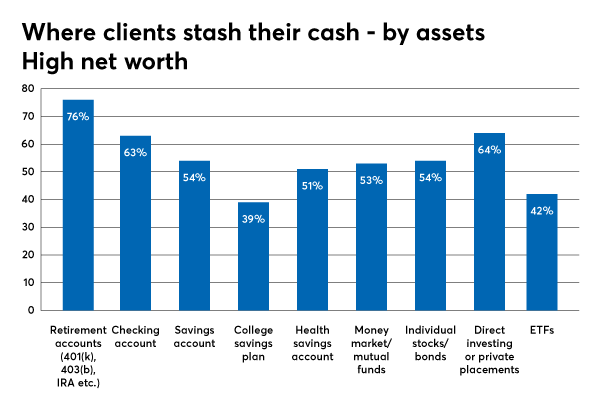

One in four advisors say that half of their high-net-worth clients are living paycheck to paycheck, according to Financial Planning’s inaugural Financial Wellness Survey.

The study also revealed that, despite advisors’ attempts to teach the rudiments of smart saving, budgeting and long-term investing, clients are still saving too little for retirement and demonstrate a lack of basic money management skills. “Financial illiteracy is a plague that has infected the majority of Americans,” one planner said.

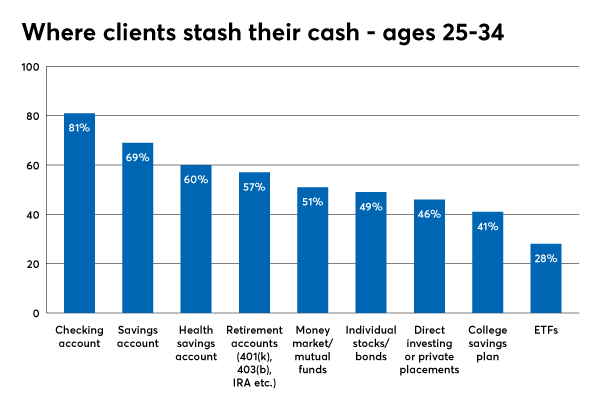

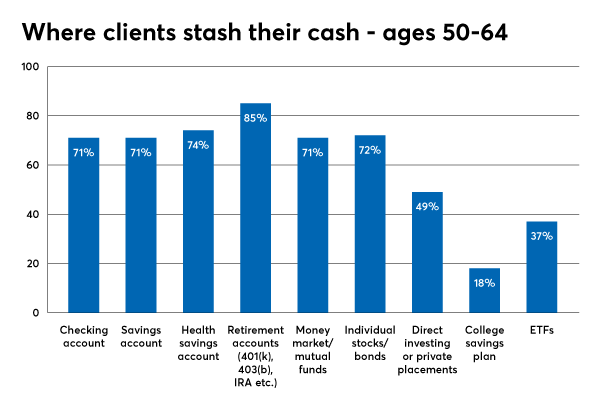

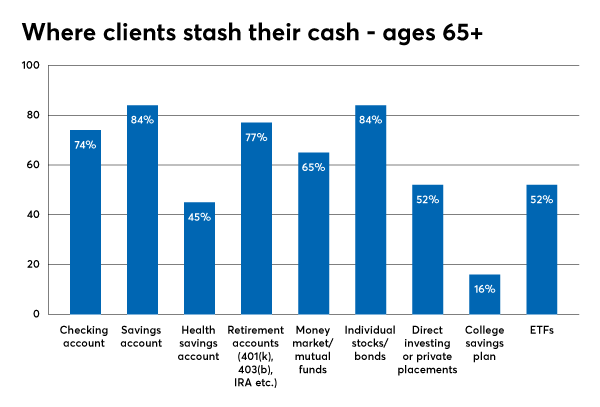

Scroll through to see how clients how clients are saving and investing depending on their assets and at each stage of life.

The Financial Wellness Report, published in partnership with ADP, is created by the editors of Financial Planning and is based on a survey of about 300 advisors in April and May 2019. Clients were segmented by age and investable assets: less affluent (less than $250,000), mass affluent ($250,000 to $999,999), HNW ($1 million to $9.9 million) and UHNW ($10 million and more).