Following the passage of the $2 trillion stimulus package intended to ease the pain from the coronavirus pandemic, interest in high-yield bonds has surged to record levels. As a result, advisors are now tasked with helping their clients navigate the thorny field — many of the funds with the biggest long-term gains have also posted double-digit losses in the first quarter.

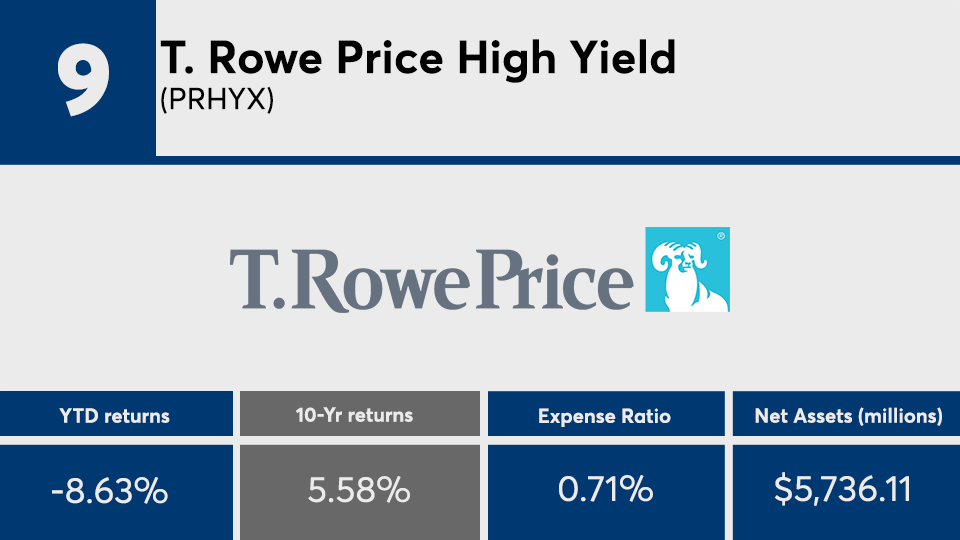

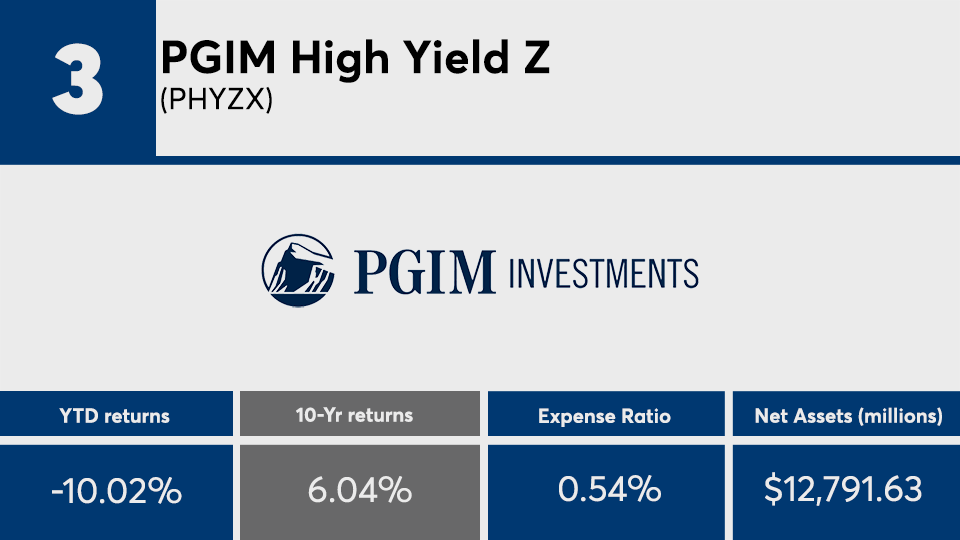

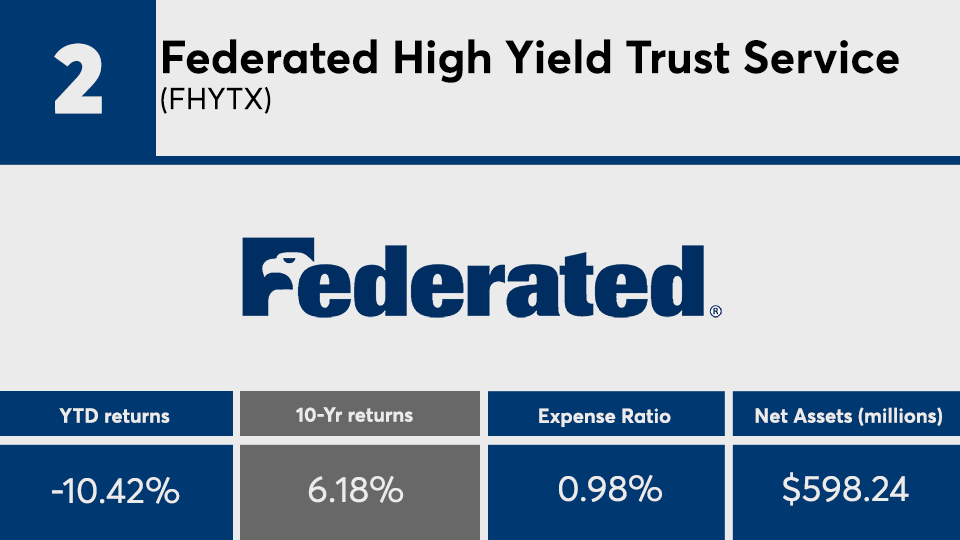

The 20 high-yield category bond funds with the best 10-year gains — and with at least $500 million in assets under management — have posted an average return of 5.58%, Morningstar Direct data show. That is slightly higher than the Bloomberg Barclays US Aggregate Bond Index etched a 10-year return of 3.93%, as measured by the iShares Core US Aggregate Bond ETF (AGG), data show. Despite these gains, these long-term outperformers have also posted an average Q1 loss of more than 10%, undershooting the AGG’s 4.93% gain over the same period, data show.

“These funds got an assist from the Fed when they were told they would backstop the higher end of the high-yield credit industry,” says Marc Pfeffer, CIO of CLS Investments. “That certainly put a lid on the declines and since that time — since we’ve seen more optimism that the economy could shore up sooner than later — the death toll is less than expected. The fear of owning high yield as an asset class has diminished.”

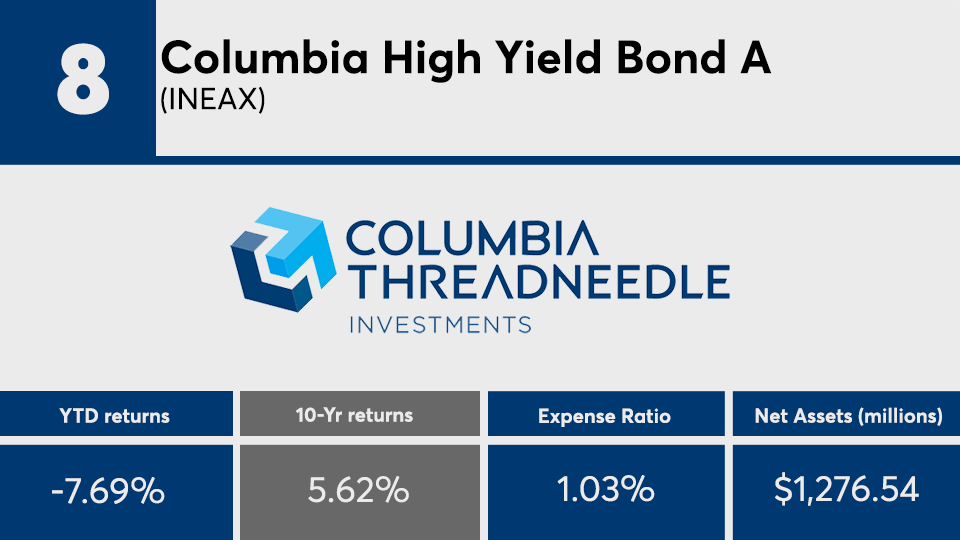

With a large showing from actively managed mutual funds, it’s no surprise these top-performers carry high fees. With an average net expense ratio of 71 basis points, these were much higher than 0.48% investors paid on average for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs.

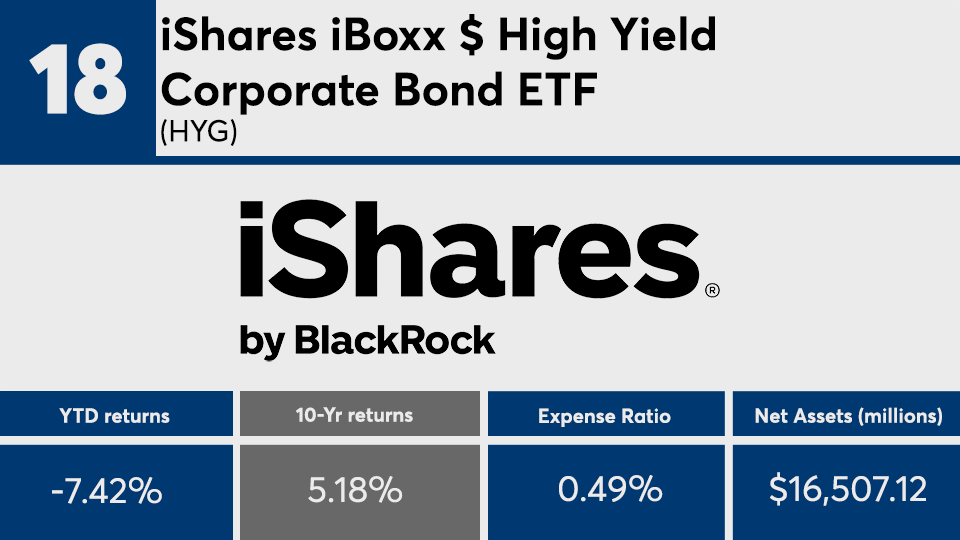

Analysis of the category’s largest fund tells a similar tale. Carrying a 0.49% expense ratio, the high-yield bond sector’s biggest— the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) — recorded a 10-year gain of 5.12% and YTD loss of 7.72%, data show. The industry’s largest overall bond fund, however — the $259.3 billion Vanguard Total Bond Market Index Fund (VBTLX) — has a 0.50% expense ratio and notched a 10-year gain of 3.97% and YTD gain of 5.21%, data show.

On the equities side, the $736.7 billion Vanguard Total Stock Market Index Fund (VTSAX) — the industry’s biggest overall fund — has a 0.40% expense ratio, generated a 10-year gain of 10.73% and YTD loss of 14.54%, data show.

As high-yield bond funds have grown in popularity this year, attracting

“When looking for a high-yield mutual fund to go into, I don’t believe investors should look at one data point,” Pfeffer says. “You want to look at the history of the managers themselves. The expense ratio should be one component and a 10-year number is just one data point. You want to look at how they’ve done in different interest rate environments, different economic environments and when there is duress.”

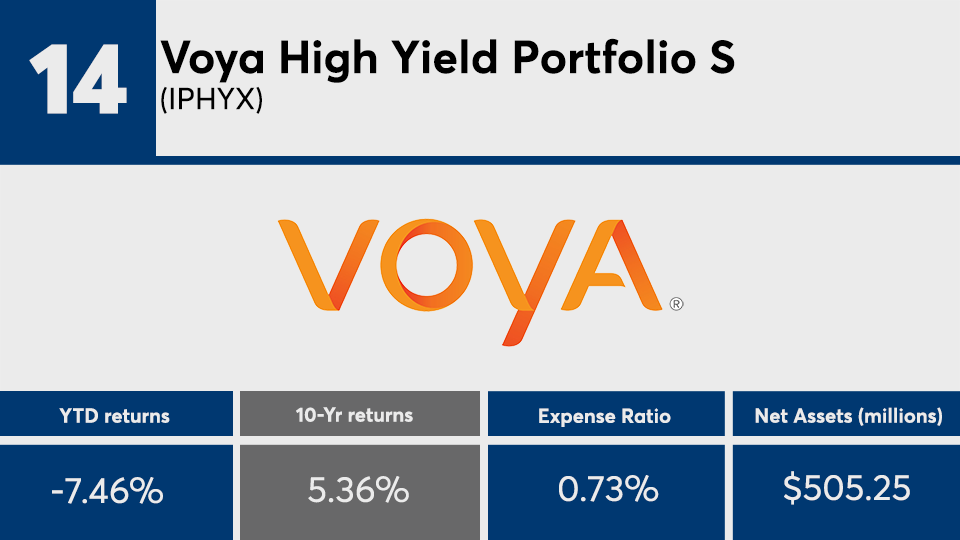

Scroll through to see the 20 Morningstar category high-yield bond funds with the biggest 10-year returns through April 13. Funds with less than $500 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios, as well as year-to-date, one-, three-, five- and 10-year returns are listed for each. The data show each fund's primary share class. All data is from Morningstar Direct.