As advisors

"The Future of the Data-Driven Workplace," a new research report from

The study polled 386 management-level respondents across the wealth management, banking, mortgage and insurance sectors. Survey participants ranged from managers to C-level executives with 61% describing themselves as a department or division head, vice president or higher.

Once viewed as a novel business tool, the study finds that AI's impact on data-driven decision making across every financial services industry is now undeniable. From simple functions like scheduling and planning, to complex tasks like underwriting and fraud detection, AI and machine learning are a part of the equation.

Nearly 90% of leaders at financial services firms believe their companies are taking the necessary steps in data access, management and integration efforts to stay competitive in their respective industries. But even with that high confidence, just 51% of those surveyed say their companies are actively implementing AI and machine learning tools beyond planning and investigative phases.

"The tools have allowed some firms to jump ahead of their competitors, utilizing hardware and software to improve efficiency, reduce costs, manage risk and in a more stark realization, eliminate the need for once-vital personnel," the report says.

The emergence of AI and analytics in data-driven decision making is not without controversy. The use of AI in lending decisions is in the crosshairs of federal agencies like the Consumer Financial Protection Bureau, which says algorithms cannot always issue fair lending decisions because of their inability to be free of bias.

But the industry-wide AI love fest persists due to its power to tackle risk management and other industry-specific objectives. Wealth management firms were found to be particularly high on artificial intelligence, while insurance companies use the technology at a lesser rate, according to the study.

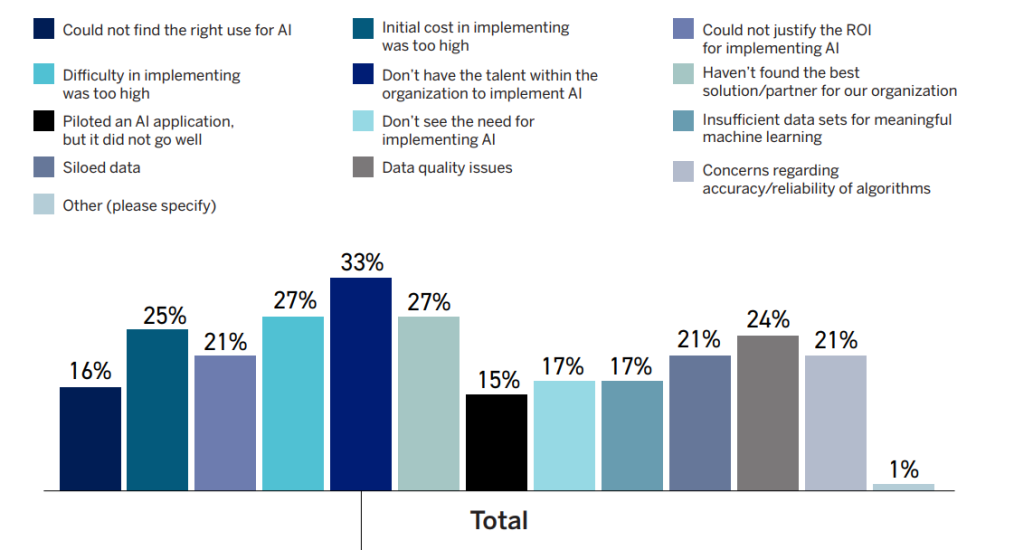

Companies not yet utilizing the technology cite a lack of talent, unreliable datasets and high costs as roadblocks. Those already on board say AI's power to cut costs and generate new revenue give them a strong foundation to build on.

Scroll down to see more wealth management takeaways from the new research. The entire analysis