Fintech giant Addepar is gearing up to do battle in a wealth management marketplace being reshaped by the coronavirus crisis.

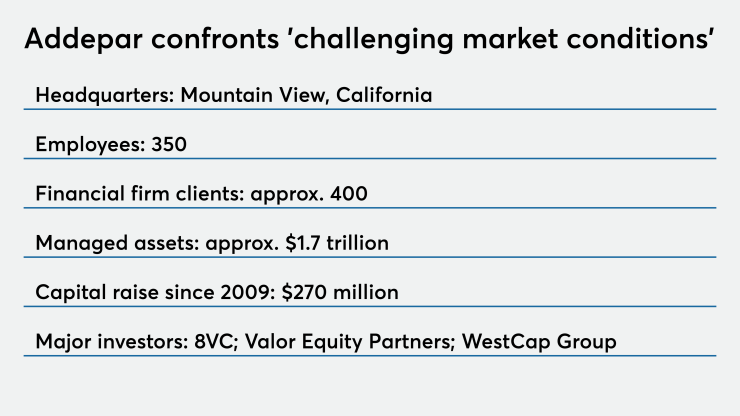

The Silicon Valley portfolio management and performance reporting platform provider, which works with around 400 RIAs and other financial institutions, received a $40 million investment from private equity firm WestCap Group.

“This capital will go towards R&D efforts that will support our further growth and enable us to continue expanding our offerings across the markets we serve,” says Addepar CEO Eric Poirier.

Noting that Addepar was founded in the wake of the Great Recession of 2008-2009, Poirier contends that the firm is well positioned to adjust to the new realities the crisis has imposed on RIAs and broker-dealers.

“We’ve been ready for this moment,” Poirier says. “Market demand is reaching a new level as clients and prospects turn to us to help navigate the challenging market conditions.”

But Addepar’s competitors, already in fierce competition for RIA dollars, see the same challenge and the same opportunity.

Accurately assessing the prospects of the RIA business in a coronavirus world is the central challenge facing Addepar and its competitors in the wealth management platform market, says Celent analyst and head of wealth management Will Trout.

“With COVID-19, the growth engine of the advice engine appears to have stalled,” Trout says. “Addepar was already in a dogfight with Private Client Resources and Orion for RIA business. Addepar has a great product, and it’s fine to demand top-shelf prices, but when margins tighten, even the most profligate, or profitable, clients are going to cut back on spending.”

Addepar has been around long enough to be generating real revenue, no?

Trout also questioned why Addepar is still going after funding dollars after being in business for 10 years and having raised $140 million in a Series D recapitalization in 2017.

“They’ve been around long enough to be generating real revenue, no?” he asks.

Poirier responds: “We are very well capitalized and the fundamentals of our business continue to be very strong. To date, we have raised $270 million and we’re well positioned to remain an independent company for a long time.”

As a private company, Addepar doesn’t disclose its revenues, but Poirier says the company grew its platform’s managed assets from $1.3 trillion in 2018 to $1.7 trillion last year.

After focusing on the ultrahigh-net worth market for years, Addepar launched Addepar Go last month, a scaled-back version of its high-end software targeted at firms with high-net-worth and mass affluent clients.

Citing investments in technology and its data platform, Poirier says Addepar is now “able to address a wider range of client needs by delivering new capabilities efficiently.”

And, in an effort to attract RIAs using SS&C Advent’s legacy portfolio management software Axys and APX, Addepar hired Steve Strand, co-founder of Advent software and original Axys coder, earlier this year.

The Mountain View, California-based fintech firm also wants to expand its presence on the East Coast and last month doubled its office space in midtown Manhattan.