Scientists

But experts in artificial intelligence argue that many wealth management firms and financial advisors are failing to tap into the full potential of the technology — beyond its ability to be a meeting notetaker.

Those transcriptions and summaries are "a great solution," but advisors could be using AI to replace about a half dozen tools while consolidating many others in a way that is "prioritizing the advisor" and their full view of a client's needs, said Sindhu Joseph, founder and CEO of

"There is a huge thought-leadership piece that is missing," Joseph said. "It's like they are considering AI a notetaking assistant."

For their parts, more than a half dozen independent brokerages that are part of Financial Planning's

That fear comes from the notion of "tools that will catch on and potentially draw more consumers to work independently of financial advisors," said Andrew Altfest, president of New York-based registered investment advisory firm

"There's, first of all, a risk of being left behind by not doing things fast enough and their advisors becoming less competitive," Altfest said. "Enterprises need to evaluate their offering and their value proposition and put technology in the hands of advisors to allow them to offer a service that would be a premium service to the direct-to-consumer offerings."

READ MORE:

- Find a printable PDF of this year's annual IBD Elite rankings

here . - Follow

this link to see the data in an interactive table. - Click here to read

last year's feature .

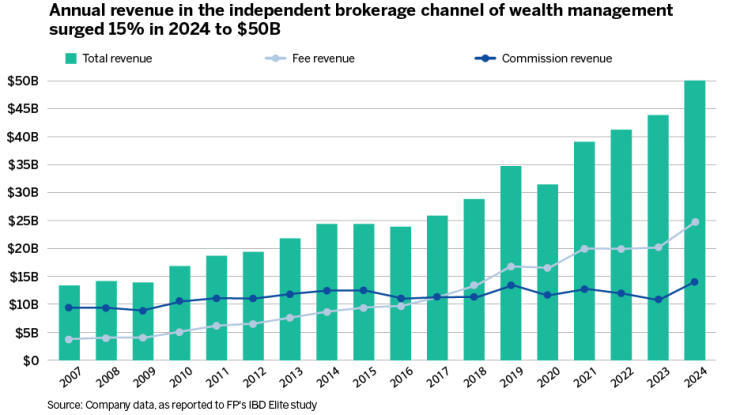

Cash flow, capital to invest

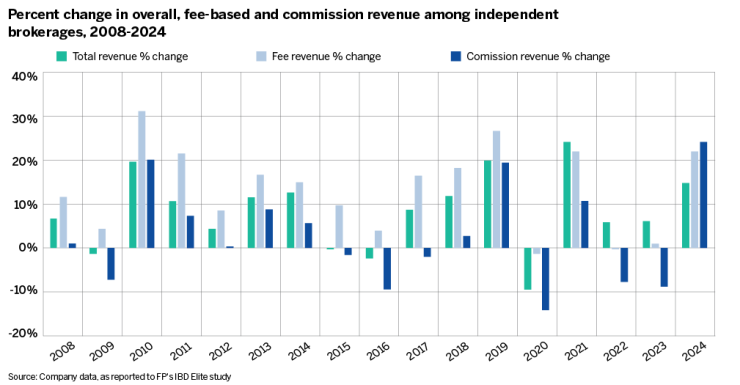

Those threats look distant and surmountable through the lens of the firms' business metrics. In 2024, the 38 independent wealth management firms in the IBD Elite topped $50 billion in annual revenue for the first time, as the channel's collective topline surged 15% from the prior year to $50.03 billion.

That was the biggest jump, percentage-wise, since 2021, and the firms' commission revenue soared by 25% to $13.28 billion for the largest percentage increase in sales transactions over nearly two decades. Advisory fees climbed by a healthy 22% to $24.5 billion.

The growth generated by the largest firms in

Among other areas, LPL is developing its software through the GitHub Copilot, operating a new AI chatbot that acts as an aid to corporate service professionals and advisors and their teams during calls, and using the technology to speed up the compliance and supervision review process for advertising, said Vaughn Harvey, the chief data and AI officer for

"The tool can take meeting notes, summarize them, sync the notes with the advisor's [customer relationship management system], and draft emails to the client," Harvey said in an email. "The focus is shifting next to insights that will help with follow-up and with client meeting preparation."

READ MORE:

Independent wealth management case studies

LPL and competitors Ameriprise (No. 2), Osaic (No. 3), Cetera Financial Group (No. 4), Raymond James Financial Services (No. 5), Commonwealth Financial Group — the No. 7 firm,

AI represents "a strategic lever to reimagine how we serve both our financial professionals and their clients," said Colleen Bell, president of the Innovation and Experience division at

"A prime example of what this looks like in action is our recent work to create an agentic AI system designed to autonomously open accounts, initiate fund transfers and populate client data directly into our systems, all through natural language prompts," Bell said. "Although we are at early stages of adoption, we expect this system to have a significant impact on our ability to streamline the execution of complex workflows that previously took hours."

Integrations

"Osaic's AI program is focused on three key objectives: supporting the organic growth of our advisors by allowing them to deepen their relationships with their clients, improving the productivity of our advisors and their staff and allowing them to scale their practice and making it easier for our advisors to do business both with Osaic and their clients," Chandler said. "Each of these objectives is tied to measurable performance indicators that are deeply embedded within Osaic's corporate strategy."

Independent Financial's team speaks every week with vendors "about how their solutions can help us elevate the experience we provide financial professionals affiliated with the firm," said Kevin Keefe,

"Right now we are working to leverage AI to accelerate our new account onboarding process, and in a separate initiative we are using AI to assist our in-house compliance team in reviewing time-sensitive materials to support the marketing efforts of financial professionals at IFG," Keefe said in an email. "In yet another technology effort here, we're working with an AI provider to help our business development team more quickly and accurately identify the most viable prospective financial professionals for recruitment to our firm."

Commonwealth has implemented AI agents and other tools throughout its services to advisors and clients, according to Chris Blotto, the company's

"We're committed to bringing our affiliates along on our AI journey by launching an AI Think Tank — designed to explore how AI can enhance office efficiency and client engagement, while ensuring our roadmap aligns with the evolving needs of our community," Blotto said in an email. "We work closely with our tech vendors to explore opportunities with products already available to our affiliates, like [Microsoft 365's] capabilities, such as Copilot Chat. We're partnering with leading AI education vendors to provide best practices to ensure effective adoption and guidance are provided."

READ MORE:

Increasing AI competition

With that backdrop, the

Last month,

Savvy "pairs Silicon Valley tech with the advisor-first culture I spent 15 years building at LPL," a combination that "will reshape the industry," Casady, who has since joined Savvy's board, said in a quote posted

Casady's participation represents "first and foremost the validation" of Savvy's AI tools, and "he's really, really good about articulating what worked for LPL and what did not work for LPL," in a way that brings "that level of maturity, but also the experience and wisdom," Malhotra said in an interview.

Savvy launched in 2021, and, in a

AI is altering the competitive dynamics across the industry for advisors and firms that work with them, according to Malhotra.

"The things that they're obviously experts in, we want them to spend more time on, and so do advisors," he said. "The outcome here really is that, what used to 10 years ago would have been only possible for — call it a team of advisors managing $1 billion — that level of capability can be done by a solo advisor."

READ MORE:

The AI vendor view

Jump has developed meeting assistants and other AI tools for wealth management firms across a relationship base that spanned a single advisor at the beginning of February 2024 and now reaches 12,000, according to Parker Ence,

"It's very clear that generative AI and other types of AI are going to transform everything that we know," Ence said. "This is like a fundamental shift in technology that's going to change everything. I think advisors need to realize that and not wait to get into the game."

The impact of AI on wealth management tech will resemble that of financial planning and CRM software to the industry from "nonexistent to default in the last 25 years," said Mark Gilbert, CEO and co-founder of

However, he believes that transition will play out at least two times as fast. More than half of the questions that advisors and wealth firms have for Zocks revolve around how best to adapt the technology toward time savings and growth and the need to protect client data rather than anything about operating the software.

"The adoption is quite fast and quick. I've worked on a lot of different technologies in the last 25 years, mostly in the financial services," Gilbert said. "I haven't seen anything move this quickly, to be blunt."

He and other fintech developers stress that the meeting notes or transcription simply mark the beginning of the AI resources that bring efficiency to client interactions.

To Joseph of CogniCor, the tools can assist advisors in figuring out how "you probably are focusing on the wrong meetings" across a client base with any number of specific factors affecting their accounts that AI can sort into those with the most urgent timing attached to them. Advisors and their teams can then reach out to those clients to proactively set up a meeting, rather than waiting on the customer to identify the pressing planning or investment issue or life event with financial implications.

In an industry that "has been struggling

"Here is where AI can often be the biggest help, in terms of creating an experience that is unified, a system of intelligence that is unified," she said, adding that the challenge for advisors and wealth firms is the degree that they are embracing the full potential. "Those are two big questions for the industry: Are we being thoughtful? Or are we missing a huge opportunity that is in front of us?"

READ MORE:

Upshot for advisors and wealth firms

Advisors "who get there first" in implementing AI across their firms are "going to see more results" in bulking up and enhancing their services for new and existing clients, according to Altfest of FP Alpha. Firms of all sizes must make some pivotal choices.

"They have to decide how well they can build and then where to go for greater expertise," Altfest said. "Every advisor has to be thinking about their respective practices with regard to AI."

Particularly for independent advisors, AI-powered services that bring every capability to bear in one place on the desktop carry huge possible benefits, according to Malhotra.

If those who are not among the earliest adopters are wondering where to begin, they should consider where there are "tasks that you might need to hire an external third party consultant" to perform and first come to "a really clear understanding of where you want to focus," he said. "Those types of things that you're thinking about likely have an AI solution that can probably alleviate some of it."

Of course, the tech could eventually render some wealth management and advisors' positions obsolete. But the industry can keep growing its business and client base by combining advisors' human connection to clients with AI's ability to streamline the business, said Ence of Jump.

"It will replace some of them. I would worry less about that. I would worry more about the advisors who are adopting AI before you are," he said. "You've got to get on the bus and start using these things to augment and enhance what you're already doing so well."

Another reframing that may benefit advisors figuring out their AI tools may stem from a simple examination of the parts of their days when they "are spending their time doing data retrieval and entry and just trying to optimize that as much as we can," said Gilbert of Zocks. Some grandiose ambitions around the tech can sound intimidating sometimes, he said.

"The thing that I think is surprising for people is that it's very easy to start," he added. "It really removes a lot of work. Nobody loves typing in notes and filling out forms and doing that stuff, so it can really help them. … It's very, very easy to get going."