Woodbury Financial Services is now 400 advisors and $12.2 billion in client assets bigger as insurance giant Allianz Life Insurance Company of North America exits the independent broker-dealer space.

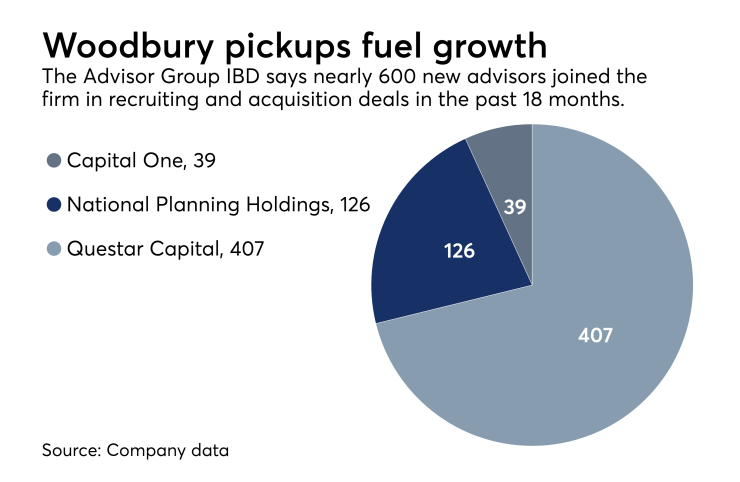

A Lightyear Capital-backed Advisor Group subsidiary, Woodbury has expanded to more than 1,600 advisors on the strength of both its parent’s acquisitions and notable recruiting additions. Woodbury retained 86% of the client assets from Allianz’s IBD, Questar Capital, the firm said March 5.

The parties agreed to a

Private equity firms like Advisor Group’s backer Lightyear — the part owner alongside Canadian pension manager PSP Investments — are crowding into the IBD sector as insurance firms leave. Allianz followed Hancock and fellow insurers like onetime Advisor Group parent AIG, former Kestra Financial parent

Suburban Minneapolis-based Woodbury is reaping the benefits, having

Teams of employees worked throughout the weekend to transfer 407 Questar advisors and their assets to Woodbury, according to CEO Rick Fergesen, describing the transition as “much, much easier than a full repapering,” because both companies have Pershing as a clearing firm.

“For a lot of advisors, the move to Woodbury will feel very, very similar to what they're used to,” says Fergesen, noting the firms’ Twin Cities-area headquarters and similar structure with home-office supervision rather than offices of supervisory jurisdiction. Advisor Group’s technology platform, asset management and marketing also add value for the incoming group, he says.

-

CEO Jamie Price and other executives met with some 1,000 prospective advisors after inking one of the largest M&A deals in the IBD space this year.

November 6 -

Allianz became the second multinational insurance firm to step away from the IBD space this year under a plan to shutter Questar Capital.

October 11 -

The move to acquire the No. 16 firm from John Hancock reflects the acceleration of industry trends and a potential giant in the making.

June 25

The combined amount across the top 10 firms has jumped 37% to $385.3 million over the past three years.

Representatives for Allianz declined to answer any questions but issued a prepared statement from Questar Capital and Questar Asset Management CEO Sherri Du Mond.

“We are pleased that the majority of the Questar reps will be transitioning to Woodbury Financial,” Du Mond said. “We wish all former Questar reps well in the next chapter of their careers.”

The terms of the preferred affiliation deal were not disclosed, and Fergesen declined to state how much Woodbury offered as a retention bonus. The firm tapped former employees of Questar for the majority of the new positions it opened to serve the incoming advisors, though he didn’t provide specific figures.

The firm did say its advisors boosted their revenue by 11% year-over-year in 2018, net of investment gains. Woodbury produced $285.6 million in 2017, a 13% increase from the previous year and the most recent data available from

Woodbury’s gross revenue jumped 31% and its advisory revenue soared by 56% for the year, the firm says. The four-IBD, 7,000-advisor network’s gross revenue surged by 20% to $1.7 billion while total client assets also grew by 20% to $228 billion.

Advisor Group’s three major acquisition deals were no doubt part of the gain, but Fergesen says the firm’s five-year strategic plan doesn’t include acquisitions. The firm continues to be open to evaluating further “opportunity that surfaces” for potential acquisitions, though, he says.

“Our primary five-year plan is an organic growth plan,” Fergesen says. “When you look at 2019 — just by virtue of what we did in 2018 — our revenue will be much, much higher.”