Two major IBD networks are joining forces against the largest firms in the space.

Nearly a year after cashing out its former principal shareholder, Ladenburg Thalmann found a buyer building a new giant of the independent broker-dealer sector. The buyer, Advisor Group, is also assembling more debt under its latest massive private equity deal.

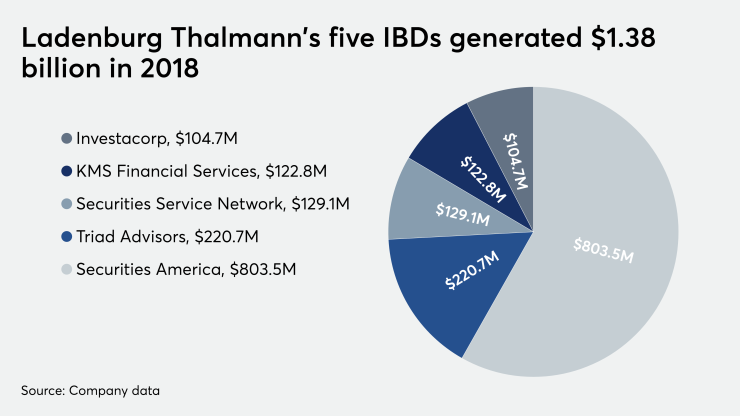

Reverence Capital Partners-backed Advisor Group struck a deal to acquire Ladenburg's five IBDs with 4,400 advisors for $1.3 billion, the firms

With some $3.07 billion

The notable revenue and client assets — not to mention the scale of the expanded firm — also come with risks:

Ladenburg's $130-million

“Mergers like this typically don’t work if there isn't a good cultural fit, first and foremost,” says Price, who is slated to lead the combined firm out of Advisor Group’s Phoenix headquarters “We felt there was a need in the marketplace for it.”

Price added that Advisor Group saw value for its existing 7,000 advisors in resources from Ladenburg’s other divisions, which include an investment bank, asset manager and trust company. He also praised Securities America’s practice management and coaching, as well as the hybrid RIA platforms at Ladenburg’s largest subsidiary IBD and its second-biggest one, Triad Advisors.

“Our focus has always been supporting the growth and success of our advisors,” says Lampen. “We delivered everything that we have always said was important to us, in terms of doing right by our advisors and employees.”

Neither Lampen nor Price disclosed the specifics of how the definitive merger agreement would take Ladenburg private, though they said more information would become available in coming months. Lampen and other insiders own approximately one-third of the company’s stock.

While Ladenburg

The final purchase price also includes the cost of the seller’s preferred shares and its outstanding debt. Ladenburg’s average outstanding debt balance soared by more than 100% year-over-year to $330.8 million in the third quarter,

Meanwhile, Reverence Capital’s acquisition of a 75% stake in Advisor Group earlier this year

The ratings agencies put Advisor Group in the middle or upper tranche of risky issuers. While S&P rates Advisor Group a “B+” issuer with a negative outlook, Moody’s gives it a “B2” rating with a stable outlook. The firm’s adjusted debt-to-2019 EBITDA is 6.3x, Moody’s states.

“Advisor Group will focus on growth through recruiting of financial advisors and deployment of capital towards bolstering the firm's position in the independent broker-dealer space,”

Price says that the combined earnings power of the two companies is “more than prudent” for paying down the debt under any scenario. Reverence — which three Goldman Sachs alums started in 2013 with a focus on middle-market financial services — also has Russell Investments and First Republic in its current and former portfolio firms, its

The Reverence-backed parent’s setup will resemble the existing one: none of Ladenburg’s five firms will merge into Advisor Group’s four IBDs. While some advisory accounts may require client notifications, the firms’ custodians will stay the same with no repapering.

Price also said that, while it was early and the decision may be subject to change, the parties haven’t planned any retention bonuses for advisors because there won't be repapering. Only added value is being brought to bear under the deal, he says.

In a call for advisors that followed an

The combined firms’ headcount would push it well above Cetera Financial Group’s 8,000 advisors but below LPL Financial’s force of more than 16,000. Ladenburg COO Adam Malamed told advisors on the call that the buyer and seller already share a great deal in common.

“The company operates a network model very similar to Ladenburg’s,” he said. “This transaction creates one of the most innovative leaders across the entire wealth management space.”