A year after adding thousands of financial advisors from a massive acquisition, Advisor Group is taking steps to build connections across its six firms.

The 11,000-advisor network held the first quarterly meeting of its new National Advisory Board of a dozen advisors last month, according to Erinn Ford, the Phoenix-based wealth manager’s

Advisor Group’s independent broker-dealers each have their own advisor councils, but the new council will supplement their work. Other wealth managers have created similar councils in recent years, as well as groups collaborating with executives on diversity and inclusion efforts and technology upgrades. After taking over her new role a couple of weeks ago, Ford also says she’s planning a comprehensive program aimed at advancing women and people of color across Advisor Group’s expanded network after last year’s

Describing herself as “a fan of honest and direct feedback,” Ford says the discussion at the inaugural board meeting revolved around tech and the varying needs of practices based on whether they’re solo firms, ensembles or large enterprises.

“We definitely came out with some really distinct themes that they shared with us,” Ford says. “It brings that culture of connection and makes that feedback for us very actionable.”

Besides Brennan Tagg of BFS Advisor Group, the committee includes Brian Heapps of Innovative Financial Group; Kevin Myeroff of NCA Financial Planners; Dean Harman of Harman Wealth Management; Aaron Titze of GT Financial Advisors; Mary Sterk of Sterk Financial Services, Mike Rees of Bay View Capital Advisory Group; Chad Parmenter of Mirus Planning; Kim Kropp of Moylan Kropp; Vince Morris of OneDigital Investment Advisors; Melanie Anderson of Financial Counseling Company; and Chuck Walker of Cornerstone Wealth Management.

“The National Advisory Board will provide real-time, on-the-ground intelligence to Advisor Group to inform future enhancements to the tools we use to serve our clients, as well as the development of new services, platforms, and corporate strategy,” Brennan Tagg said in a statement.

The new board and "further reinforcing the lines of communication between the parent company and the advisor community" will help Advisor Group strengthen its relationship with practices nationwide, according to Kropp, whose firm is affiliated with Securities America and based in Omaha, Nebraska. In an email, she acknowledged that some advisors decided to go to other firms after Advisor Group bought Ladenburg.

"Each advisor has their own thought process when it comes to the long-term decisions they make for their practice, and it’s not unusual for some of those advisors to be approached with large upfront recruiting offers when there’s a change of control of their broker-dealer," Kropp says. "With that said, Advisor Group has done a great job of quickly re-establishing a sense of stability and reassurance that they understand advisors’ views and are committed to helping us grow."

While the group hails from 10 different states, each of Advisor Group’s firms, and a range of tenures with the network, it doesn’t include any members who are Black, Latino or other minorities. However, diversity and inclusion will be “an area of real focus and energy” of Ford’s role, she says, adding that the firm’s new program will roll out within the next few months.

“Our whole profession needs to become a better reflection of the communities that we serve,” Ford says. “I’m looking to bring forth definitely a number of proposals.”

Rival firms have garnered praise from advisors through programs like the

Advisor Group built its annual W Forum for women advisors into an event attracting hundreds of them each year. In addition, the firm has several executives who are women, including Chief Strategy Officer Cindy Hamel, Head of National Sales Allison Pratt and the

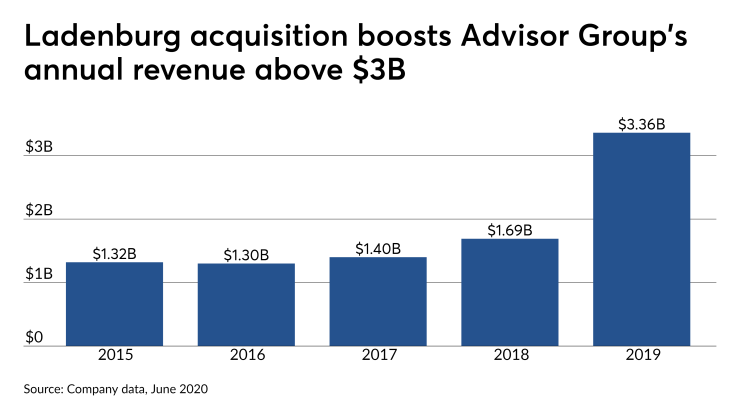

Ford had served as president of Cetera Advisors for six years before she joined the ex-Ladenburg firm KMS Financial Services in 2018. Reverence Capital Partners-backed Advisor Group purchased KMS and the four other Ladenburg wealth managers for $1.3 billion before

The next meeting of the new board of advisors in April will focus on tech, with participation from Advisor Group’s

As her team considers additional councils, Advisor Group’s goal is to “drive solutions and find those growth opportunities” through the groups, Ford says. “I always want to make sure that we help make every council alive, that we're really listening to and accountable to that feedback.”