In its second billion-dollar deal of the year, Advisor Group is absorbing its next biggest rival.

Advisor Group — owned by private equity firm Reverence Capital Partners

The parties said the transaction will create a network of nine independent broker-dealers with nearly 11,500 financial advisors and more than $450 billion in client assets following its expected close in the first half of 2020. The deal would make publicly-traded Ladenburg private.

Both firms pledged there would be no mergers between any of the five Ladenburg IBDs and Advisor Group’s four existing firms. Of the 30 largest firms in Financial Planning’s

The acquiring firm is paying cash for Miami-based Ladenburg’s common stock at a price of $3.50 per share, as well its preferred stock and its outstanding debt, according to the firms. Ladenburg’s average outstanding debt balance skyrocketed by more than 100% year-over-year to $330.8 million in the third quarter,

Advisor Group will also maintain Ladenburg’s other units, including an investment bank, a trust company and an insurance brokerage. Advisors won’t have to make a custodial transition because both firms use Pershing and Fidelity Clearing and Custody Solutions National Financial Services.

“Advisor Group and Ladenburg have a shared commitment to the flexibility of third-party clearing, together with maintaining a 'small firm feel' delivered through the distinct management teams and cultures of a multi-brand network model,” Advisor Group CEO Jamie Price said in a statement.

“In today's fast-consolidating marketplace,” Price went on, “where advisors fear becoming just another number in the crowd, the more intimate service culture and sense of community that our multi-brand approach offers is increasingly in demand."

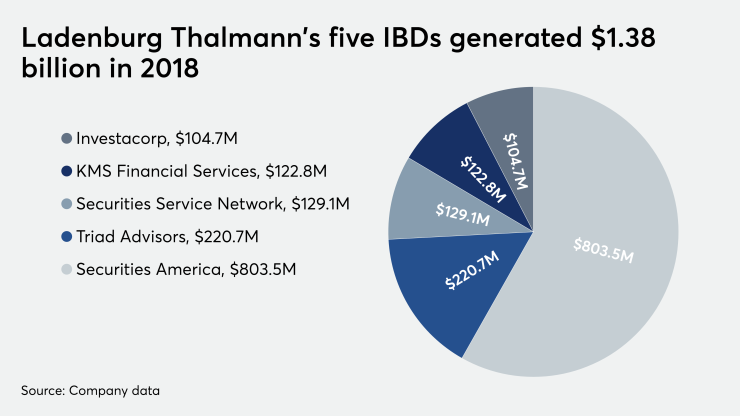

Royal Alliance Associates, SagePoint Financial, Woodbury Financial Services and FSC Securities make up Advisor Group’s existing network, which produced revenue of $1.69 billion in 2018. Under the deal, the network is adding Securities America, Triad Advisors, Securities Service Network, KMS Financial Services and Investacorp, which generated $1.38 billion last year.

Price will lead the combined network after the expected regulatory clearances for the definitive merger agreement, which Ladenburg’s board of directors unanimously approved. Senior executives with Ladenburg will join Advisor Group’s executive ranks as well.

“This is a transaction that maximizes value for our shareholders, while positioning our financial advisors for continued growth and success,” Ladenburg CEO Richard Lampen said in a statement.

Reverence reportedly