The American College of Financial Services’ new Center for Economic Empowerment and Equality has a plan for turning the industry’s oft-stated goal of boosting financial literacy and generational wealth among underrepresented groups into a reality.

It’s one that, in the early stages at least, won’t rely on financial advisors.

The new center comes as part of the four-pronged plan CEO George Nichols III

The heart of a pilot program, slated to start this year in one or more cities, involves finding local financial literacy “ambassadors” in collaboration with The

“We decided that it was important that we be very deliberate and methodical in saying, ‘What we create must be actionable,’” Nichols says. “I don't know of any financial institution that doesnt have some content about financial literacy. … We haven't been able to really move the needle on that for so many underrepresented groups.”

Nichols says the early stages of the program won’t feature existing advisors, although the college welcomes ideas and other help from them. Citing research on the level of distrust in financial firms among predominantly Black, Latino and other minority communities, he says organizers want to avoid the appearance of sales pitches.

Instead, the center anticipates tapping ambassadors from groups such as local affiliates of the Urban League, the NAACP or Black fraternities and sororities to take paid training in financial literacy, which they can then disseminate to their communities. It’s an approach that has worked for the financial education society in the past: In 20 years, such ambassadors have gone on to hold financial seminars for more than 250,000 students at 90 universities, primarily historically Black colleges, its website

“I am looking for groups and individuals who have proven to be genuinely committed to this work, and in particular, those that have been providing these services within their communities without the ability to scale due to lack of funding or brand recognition,” Hill said in an email. “This is where the College can come in to extend an avenue for these groups to help provide financial literacy to broader communities in a scalable and modularized capacity.”

Hill spent 20 years in banking with Wells Fargo, Bank of America, Capital One, and Citizens Bank, including in roles overseeing aspects of the institutions’ philanthropy. Last year, he joined the board of the BDC Capital Community Corporation, a community development financial institution. He has also been CEO of the New England Business Association since 2015, and he co-founded an anti-racism partnership building organization called the Black Vanguard Alliance.

“I understand why previous efforts have failed, and I feel I am uniquely qualified to address those issues,” Hill says. “I also understand why underrepresented communities do not trust the financial services industry, and I believe the college is uniquely positioned to inform the industry on how to start repairing and strengthening trust within those communities.”

Nichols’ organization

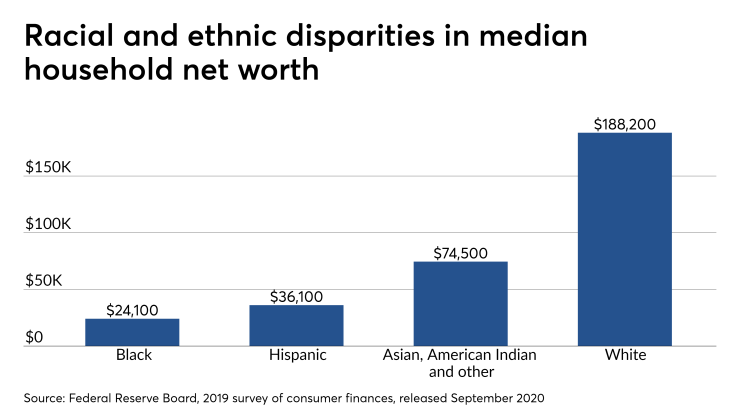

Citing examples from history all the way to present disparities in wealth, homeownership and access to capital, Nichols compares the lack of faith in financial services among underrepresented groups to the difficulty of convincing some people to get coronavirus vaccines. The industry should avoid past approaches that essentially say “we're going to show you” how to be financially literate rather than working with communities, he says.

“If your whole focus is selling me another product or another service, then it doesn't add up,” Nichols says. “If we can’t be a catalyst to bring the financial services industry to understand that this is a long-term deal and that there are things you have to do to build the long-term trust, then we're not going to be successful.”