One wealth manager had a financial advisor and a sales assistant who defrauded their clients in separate schemes while operating out of the same office, according to investigators.

Midsize independent broker-dealer American Portfolios Financial Services agreed to pay $225,000 under a Dec. 10

Sredich began her two-year federal prison sentence in late September after pleading guilty to money laundering and conspiracy to commit wire and mail fraud. Hopkins faces an SEC

“The lesson for broker-dealers is, when firms grow quickly, they run the risk of outpacing back-office ability to properly supervise and track their advisors,” IBD recruiter Jon Henschen said in an email. “Combining fast growth with a broker-dealer that prides itself in operating their firm like Southwest Airlines, keeping heavy cost controls in place which equates to substandard staffing levels, further adds to the probability that compliance issues will arise.”

Representatives for American Portfolios, the No. 19 firm on Financial Planning’s annual

One attorney who represents Hopkins, 54, before the SEC declined to discuss the case, while another who represents him in the criminal proceeding didn’t respond to requests. An attorney who represented Sredich, 45, didn’t respond to inquiries either.

The FINRA case settled by their prior brokerage firm doesn’t include their names. However, the timing of the allegations and amounts of money involved match their criminal and SEC cases, along with a lawsuit filed by an insurance company seeking restitution from Sredich after indemnifying American Portfolios for the losses it incurred paying her victims.

FINRA investigators probing the December 2018 termination of Hopkins, the onetime owner of Grand Blanc, Michigan-based Worklife Wealth Management, and a case that barred Sredich from the industry that same month uncovered the supervisory problems at American Portfolios, according to the regulator. Between September 2011 and June 2018, Sredich converted about $390,000 from 22 accounts held by 18 clients, most of them older adults, through 46 fraudulent check disbursements and 16 wire transfers with forged authorizations, investigators say.

While American Portfolios made clients whole after detecting the fraud on a tip from a client’s daughter, FINRA pointed out that it failed to set up exception alerts that could have detected the suspicious transactions. Instead, the firm relied on an official’s manual review of the daily blotter that includes trades and cash distributions but lacks details, therefore missing the transactions from multiple client accounts to the same third party, according to the regulator.

“The firm failed to detect the sales assistant's conversion of customer funds for nearly seven years,” FINRA said in the settlement order. “American Portfolios had considered in 2011, but declined to adopt, an exception report for transmittals from multiple customer accounts to the same third party after it discovered similar misconduct by a registered representative in Florida.”

It’s not immediately clear whether American Portfolios faces any additional liability from her case or that of her former boss, whose clients received at least two respective settlements for $400,000 and $175,000 after filing FINRA arbitration cases in 2019,

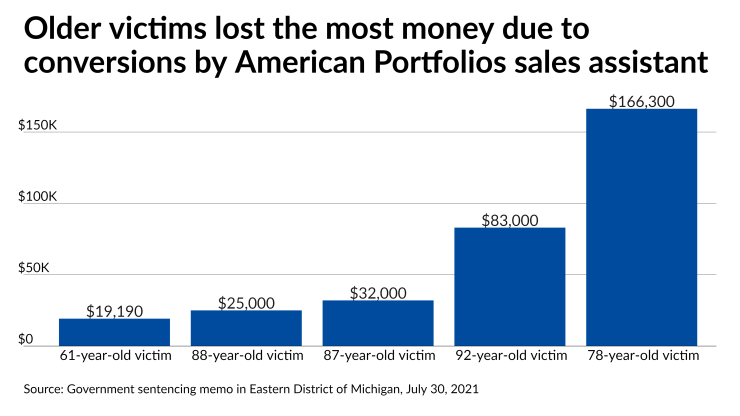

Sredich’s August prison sentence of 24 months plus two additional years of supervised release came in well below the government’s recommendation of 4.5 years, although it includes a restitution order of $392,000. The insurance firm would receive about $303,000, while American Portfolios would get roughly $89,000 of the total. Four widows she defrauded out of the majority of the losses were respectively 78, 87, 88, and 92 years old, according to federal prosecutors. Sredich used forged authorizations to steer the money to accounts controlled by herself and members of her family, then used the money for personal expenses, investigators say.

“She flew under the radar for so long by targeting elderly victims; by diversifying her targets, stealing funds from over 15 different victim accounts; and, by essentially annuitizing the payments to herself over months and years,” federal prosecutors said in their July sentencing memo. “She strategically siphoned funds from multiple accounts, staggered the distributions to herself and thereby disguised the thefts amidst the daily churn of online investing.”

Her own letter to the court expressing regret and reflecting on her actions may have helped get the shorter sentence. She requested that District Judge Laurie Michelson enable her to help the youngest of her three sons, a teenager, balance his schoolwork with a job and put her on a faster track to paying off her debt. Michelson ordered Sredich to enroll in a financial responsibility program at her prison, a minimum security facility in southern West Virginia.

“I completely lost myself for many years and cannot apologize enough,” Sredich had told the court. “I know what I have done is very wrong and will never go down this dark path again.”