Insurance companies and broker-dealers sold more than $156 million in annuity products in 2011, the Depository Trust & Clearing Corporation announced.

Of those products sold, qualified accounts, such as 401(k) s and IRAs, retained 42.5% of the $37.6 billion that flowed into the accounts for a net asset inflow of $22.4 billion, the DTCC found in its 2011 Annuity Market Activity Report. Nonqualified accounts held onto just 4.3% of the $37.6 billion that they took in, for an ending net flow of $1.6 billion.

“Financial planners are typically trying to increase AUM,” says Andrew Bloomberg, a DTCC consultant who worked on the project. “There is, that at least in terms of annuity products, almost as much money coming out of non-qualified accounts as there is that goes in.”

The DTCC culled data from the Insurance & Retirement Services to compile the report.

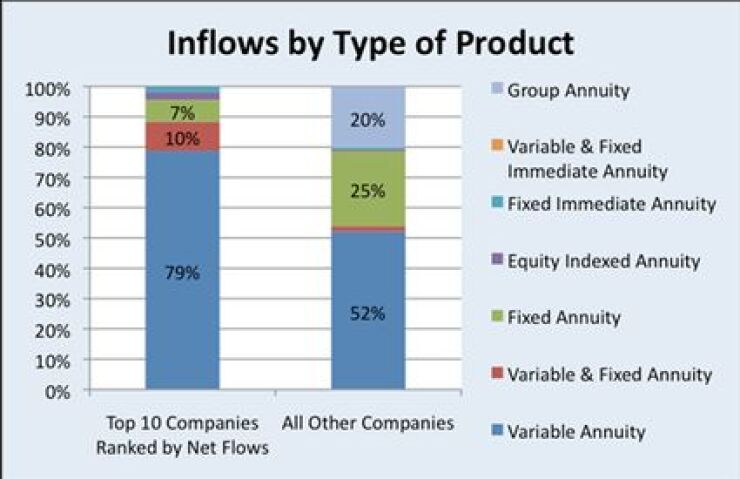

Variable annuities, in particular, accounted for 52% of all the transactions, excluding the top to companies in the tally, according to a rundown of all the contracts that the Insurance & Retirement Services processed in 2011. Fixed annuities had the second-biggest haul, accounting for 25% of the total, and group annuities accounted for 20%.

The top 10 companies accounted for 79% of total inflows, the Insurance & Retirement Services reported. Monthly inflows averaged $7.5 billion, outflows averaged $5.5 billion, and net cash flows averaged just under $2 billion per month.

In terms of the top annuity providers, the DTCC found that the top five parent companies accounted for almost half of total inflows. MetLife had about $15 billion, with a market share of 17%; Jackson National took in $11.2 billion, for 12% of the market; Prudential sold $10.3% of annuities for 11% of the market; AIG companies did about $7 billion for 7% of the market, and Lincoln National sold $6.6 billion for 7%.

Donna Mitchell writes for