With the mass movement to index-tracking funds giving asset managers vast amounts of shareholder votes at publicly traded companies, the firms are facing more pressure to use that power to drive change.

A group of unions, corporate responsibility organizations, faith leaders and other investors is accusing asset managers of making “public statements in support of racial equity and justice without taking meaningful action to dismantle systemic racism at the level commensurate with the risks it poses to investors’ portfolios,”

Firms such as BlackRock, Vanguard, State Street, Fidelity Investments and J.P. Morgan Chase drove a

“There are companies who are doing good things. One particular action or one donation or even a couple of donations — that doesn't necessarily address the root problem, which is systemic racism,” Kate Monahan, the director of shareholder advocacy at ESG-focused firm Trillium Asset Management, said in an interview.

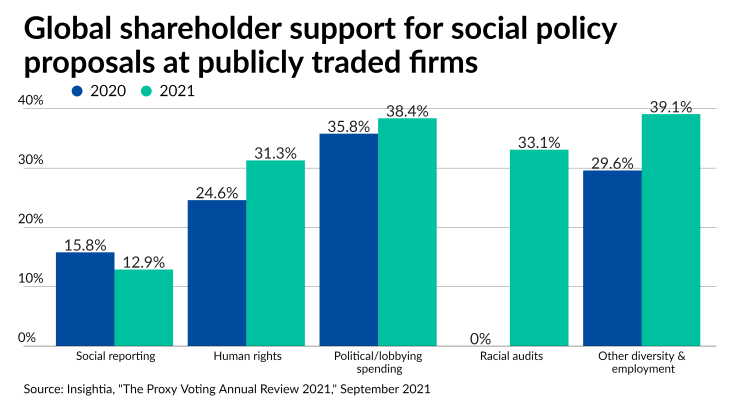

The 2021 shareholder proposal season displayed “significant investor support” for racial equity audits, according to Monahan. “When large asset managers vote against those proposals while also maintaining that they're supportive of racial justice, there's a disconnect there.”

The proposals

Monahan attended an event this week unveiling the coalition’s report, alongside a union pension-funded corporate responsibility organization called SOC Investment Group and the Interfaith Center for Corporate Responsibility. Last April, the coalition wrote

Despite the rhetoric, the group gives some asset managers credit for their votes last year. They’re calling on the firms to go further by rejecting boards without any minority members or “arguably token representation” with a single one; voting against members they say have “failed to address” their respective companies’ roles in the financing of politicians involved with last year’s Jan. 6 riot in the U.S. Capitol or voter suppression; and getting fully behind proposals for racial audits, political contributions and lobbying disclosures and equitable workplace practices.

For example, they point out that four of the eight racial equity audit proposals could have received majority support if Vanguard, State Street and Fidelity had joined Morgan Stanley, UBS, Amundi and BlackRock in voting for the audits. Out of 34 proposals requiring more public information and oversight of political spending and lobbying, seven got majority support. With votes from BlackRock, Vanguard, State Street and Fidelity, another 15 would have garnered a majority of stockholders’ votes at publicly traded companies.

“‘Business as usual’ corporate behavior has long perpetuated and exacerbated systemic racism,” the report says. “Making real change will require conscious and comprehensive effort on the part of boards of directors to take responsibility for oversight of racial equity consequences of corporate behavior toward internal and external stakeholders, and to transform those practices to reduce and ultimately eliminate the harm caused to communities of color.”

On the other hand, many of the same firms have come under criticism from the opposite end of the political spectrum for votes that Republicans say are placing a liberal agenda above the companies’ duties to shareholders. Since BlackRock and State Street are the managers of federal employees’ Thrift Savings Plan for their retirement, Sens. Pat Toomey of Pennsylvania and Ron Johnson of Wisconsin wrote

“We are concerned that BlackRock and SSGA may be prioritizing their CEOs’ personal policy views over retirees’ financial security,” Toomey and Johnson wrote. “Federal law explicitly requires all fiduciaries of the plan, including BlackRock and SSGA, to discharge their responsibilities ‘solely in the interest of the participants and beneficiaries and for the exclusive purpose of providing benefits to participants and their beneficiaries.’”

Gearing up for a busy season

In 2021, the two firms and other asset managers helped create a proxy season that was “revolutionary in many respects,” including more majority support for environmental proposals than ever before and nearly unanimous votes for disclosure of workforce diversity figures,

“First off, some boards of directors may be tempted to dismiss an activist investor’s focus on diversity as a cynical ploy to exploit the current zeitgeist,” Pat McHugh, founder of proxy and shareholder consulting firm Okapi Partners, wrote in the report. “But the fact remains that many investors — not just activists — view diversity in the boardroom and among the workforce as critical factors in a company’s performance — and a failure to address such issues as a significant risk to value.”

Such questions are looming over asset managers in the 2022 proxy season. At the same time, reports such as the SEIU-led group’s latest and

“I've spent over 30 years of my career leading DEI strategies for several multinational organizations in different industries in the U.S. and abroad, so I understand the complexities and nuances as well as the challenges of this work across businesses and cultures,” Michelle Gadsden-Williams, BlackRock’s global head of diversity, equity and inclusion, said at a hearing held by the subcommittee last month. “We still have a lot of work to do at BlackRock, but through our continued commitment and focus, I know that we are on the right path to making meaningful and sustained progress.”