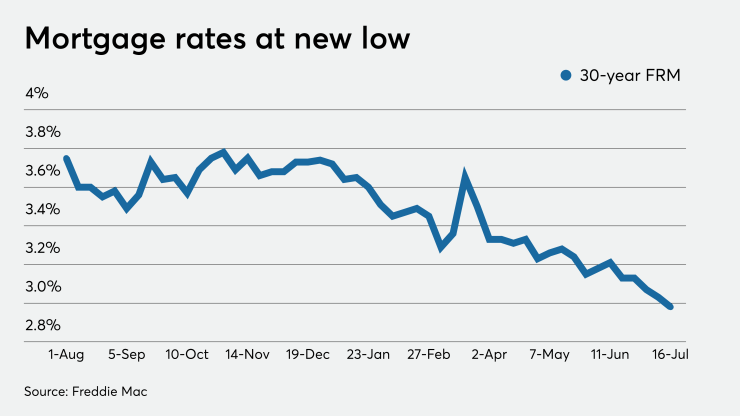

Mortgage rates slid further this week, as the conforming 30-year fixed loan fell below the 3% mark for the first time in the 50 years Freddie Mac has tracked this information.

The 30-year fixed-rate mortgage averaged 2.98% for the week ending July 16,

"The drop has led to increased homebuyer demand and, these low rates have been capitalized into asset prices in support of the financial markets," Sam Khater, Freddie Mac's chief economist, said in a press release. "However, the countervailing force for the economy has been the rise in new virus cases which has caused the economic recovery to stagnate, and this economic pause puts many temporary layoffs at risk of ossifying into permanent job losses."

The 15-year fixed-rate mortgage averaged 2.48%, down from last week when it averaged 2.51%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.23%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.06% with an average 0.3 point, up slightly from last week when it averaged 3.02%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.48%.

Zillow's own tracker found that rates stayed flat during the seven-day period ended Wednesday night.

"Rates have been remarkably consistent and it's likely that will continue," Zillow economist Matthew Speakman said in a statement. "Recent economic data have generally shown what investors expected to see: Economic activity has rebounded from early-spring lows, but remains well below pre-pandemic highs.

"What markets don't know is whether this latest surge in COVID-19 cases is going to send the economy careening back downward, or if any positive developments regarding the pandemic exist on the horizon. Both of these factors will impact mortgage rates going forward, with the latter likely having a larger impact," Speakman said.

"Meaningful progress on a vaccine or treatment will be what jostles rates from these long-term lows, sending them up strongly, whereas near-term bad economic news, as well as ongoing support from the Federal Reserve, will continue to apply light downward pressure on rates. Absent any meaningful developments, it’s unlikely that rates will make significant movements."