If millennials are as risk averse as experts say, how can they be prompted to start investing?

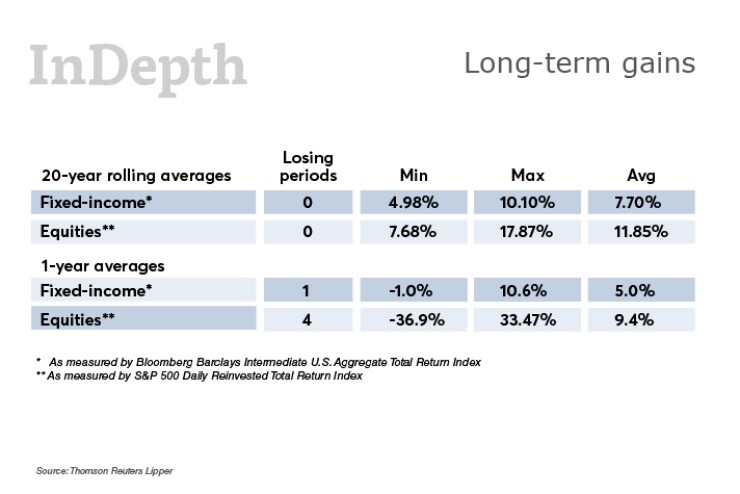

For this InDepth series on portfolio construction, we asked Tom Roseen, who has been crunching numbers at Lipper for 21 years, about risk management and what millennials need to understand about it. To help answer our question, he looked at market returns for 20-year rolling time periods. In fact, he looked at 20 such 20-year periods. Plus, he looked at 20 one-year returns.

What Roseen found is pretty compelling—while the one-year periods usually posted gains (equities only 4 annual losses), the averages were all over the map. They ranged from -37% to 33.5% with an average of 9.4%. Meanwhile, none of the 20-year periods posted a loss in equities, and the ranges were much more contained; from a low of 7.7% to a high of 17.9%, with an average of 11.9%. (These equity numbers are from the S&P 500 Daily Reinvested Total Return Index, and the fixed-income results are from the Bloomberg Barclays Intermediate U.S. Aggregate Total Return Index. Roseen also crunched numbers for emerging markets, money markets and technology indexes and found the same general trends.)

Compare those returns to a savings account – which may pay 1% if you’re lucky – and the bottom line becomes clear: the biggest risk for millennials is sitting on the sidelines and not investing.

None of the 20-year periods posted a loss in equities, and the ranges were much more contained; from a low of 7.7% to a high of 17.9%,

Here is an edited version of our discussion with Roseen about his findings and what that means for millennial investors.

Bank Investment Consultant: What do millennials need to understand about investing and risk management?

Tom Roseen: When we look at the millennial mind set, they really are tired of big businesses, banks, broker-dealers telling them what to do…. [they] should ignore that noise. Yes, there are going to be self-serving agents out there. Yes, there are going to be Lehman brothers out there. There are going to be Bernie Madoffs. The biggest risk [for millennials] is to not take advantage of history. We have to be mindful of risk, but remember risk is a two-sided coin.

If we look over a 20-year period of time, starting somewhere in 1997, there was never a 20-year period where we saw negative returns for a well-diversified portfolio. None.

Now at the five-year mark it becomes a little murky. When I looked at five-year time periods, over the last 20 years, if they had put all of their money into European funds, there were eight five-year time periods that were negative. If I look at emerging markets, six out of 20 experienced losses. But when I take a look at bonds and put money markets in there and diversifiable assets, there were only two time periods that actually experienced negative returns.

With a one- to three-year time period, there is a lot of risk, a high probability that you are going to have a market decline. We’ve seen them just in the last 10 to 15 years. If you go from 2003 until 2008, we saw double digit decline. In 2003, we saw a wipeout. In 2008, we saw a wipe out.

In the shorter time periods, I think people have to compartmentalize and say, ‘Ok, in a three-year time period I want to buy a car.’ Then, I would be very conservative. I would focus on money market funds, very low volatility bond funds, and no equity whatsoever. That would be my risk management tool.

BIC: How should millennials allocate their assets?

TR: If I want to buy a car in one to three years, I am going to use my money market bonds. At the five-year mark, I am a little more conservative. I might not be in every tech stock out there. I might be in conservative balanced type of funds that have a little bit of both. Then, as I get to the 10-year mark, I can be really aggressive. I know at the 10- or 20-year mark it is very unlikely that I am going to experience any negative return if I am diversified and I am using good asset allocation.

At the end of the day, our goal is savings. If we get them to start investing a little bit earlier and putting just a little bit away, it makes it so much easier. If you are at age 18 to 26 and you were to max out your IRA during that time period and then someone else started investing at age 27 and they kept on investing, there is no way they would catch up with the one who invested from age 18 to 26. That’s how powerful compounding is.

BIC: If millennials aren’t interested in investing to begin with, how do you get this information to them?

TR: I guess to get people interested you have to say we are all trying to save. Everybody talks about saving for retirement, and I talked to my kids and they are not even thinking about retirement.

Instead of always focusing on retirement, which is very important, let’s focus on the bigger items that they want now. They want to be able to live in the city. They don’t want to be able to buy a house. They want to rent. I am ok with that, if that’s what they want to do. They are probably going to move in a couple years and go somewhere else. Let’s focus on the things that they want—that next trip, that next car, maybe a kid coming on the way. Give them goals that they can realize.