The operators of the Chicago Board Options Exchange said its futures exchange achieved record volume in 2011, based on its fear index.

The CBOE said its Futures Exchange handled 12 million contracts in a year for the first time. The record activity was driven by “robust volume” in the exchange’s flagship product: futures on the CBOE Volatility Index (VIX).

VIX futures set new highs for annual, quarterly, monthly, weekly and single-day volume.

The record was 12,041,102 contracts traded, an increase of 174 percent from the 4,402,378 contracts traded in 2010.

Average daily volume was 47,782 contracts, also a gain of 174 percent from the 17,470 contracts traded per day in 2010, the previous high mark.

Almost all the activity was due to the VIX. CBOE Volatility Index (VIX) futures volume totaled a record 12,027,955 contracts in 2011, up 174 percent from the 4,392,446 contracts traded in 2010, the previous high.

Average daily volume in VIX futures during 2011 registered a new record of 47,730 contracts, also up 174 percent from the previous record of 17,430 contracts traded per day in 2010.

The biggest month was August, when Standard & Poor’s downgraded U.S. debt for the first time. In that month, 1,826,241 contracts were written and the highest volume was on August 5, right after the downgrade, with 152,067 contracts written.

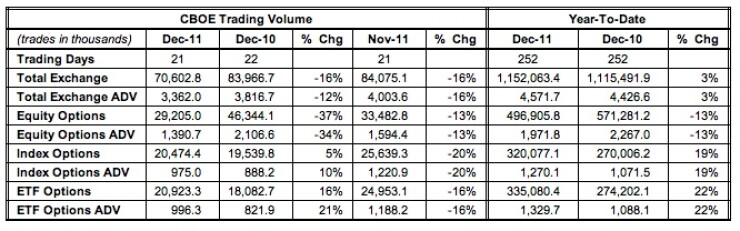

But the futures volume is relatively low, compared to options. CBOE Holdings said its options trading volume hit 1.20 billion contracts in 2011, a record. That is the comined options activity for the Chicago Board Options Exchange (CBOE) and C2 Options Exchange (C2). In 2010, the voume was 1.12 billion contracts in 2010.

Average daily volume in 2011 reached a new all-time high of 4.78 million contracts, an eight-percent increase from 2010 ADV of 4.44 million contracts.

The year 2011 marked

Tom Steinert-Threlkeld writes for