Want unlimited access to top ideas and insights?

“Fee-only” compensation — for over a decade an effective rallying cry for the RIA movement — is now more strictly defined under the CFP Board’s revised rules, whose enforcement period began this month.

The increasing ubiquity of high-profile compensation labels in recent years — especially the “fee-only” label — combined with

Under the CFP Board’s

The prior standards also required that CFP professionals not engage in any form of “misleading advertising” about their services.

While these rules didn’t necessarily require that advisors provide detailed descriptions of the exact amounts of compensation they would receive, it did inherently require that they provide an accurate description of how the advisor was compensated.

In fact, to help ensure that advisors used such labels properly, the terminology section of the prior standards of conduct included an explicit definition of what it meant to be fee-only, stating:

“A certificant may describe his or her practice as fee-only if, and only if, all of the certificant’s compensation from all of his or her client work comes exclusively from the clients in the form of fixed, flat, hourly, percentage or performance-based fees (emphasis added).

In other words, not commissions or any other type of compensation.

Notably, though, the word “compensation” itself in the 2008 definition of fee-only was also explicitly defined further in terminology, as: “Any non-trivial economic benefit, whether monetary or non-monetary, that a certificant or related party receives or is entitled to receive for providing professional activities (emphasis added).

The key aspect of the compensation definition — as an extension of fee-only — was that related parties, e.g., the financial advisor’s firm, or another business entity that the financial advisor owns, could receive only fees and not commissions as well. Any commission compensation received by a related party would “taint” the fee-only status of the CFP certificant, according to the rules.

How ‘entitled?’

In fact, the treatment of commissions received by related parties became a major issue over the past decade when it came to the use of the fee-only label and was the basis for the enforcement of compensation disclosure rules against CFP certificants.

In early 2011, a Florida firm filed a complaint against a local competitor, Jeffrey and Kimberly Camarda, alleging improper use of the fee-only label by the CFP certificants, who provided both fee-only financial planning from their RIA (Camarda Advisors) and also implemented insurance products for their clients through a commission-based insurance agency they also owned.

The Camardas claimed that “fee-only” was an accurate description of the compensation received for services provided by Camarda Advisors, and was in accordance with the SEC’s rules. However, the CFP Board noted that its rules pertained to the Camardas as CFP certificants, and not specifically their RIA entity (which by definition was fee-only since the RIA itself had no brokerage or insurance product affiliates), such that all of the related entities must be considered when evaluating how they held themselves out to the public.

Accordingly, under the CFP Board’s “related party” rules, the Camardas were similarly found to be in violation of the compensation disclosure rules for describing themselves as fee-only with respect to their financial planning services as CFP certificant under Camarda Advisors when in practice clients were also paying insurance commissions to a related party (Camarda Consultants, which the CFP certificants owned).

In the wake of this case, and in an attempt to create further clarity around the issue, the CFP Board issued a Notice To Members in August 2013, in which it further emphasized that CFP professionals must provide accurate descriptions of their compensation based on compensation they, or a related party, received or are entitled to receive, including:

- Compensation that the CFP professional receives or is entitled to receive from a client or prospective client for providing professional activities;

- Compensation that related parties, such as the CFP professional’s employer, receives or is entitled to receive from a client, prospective client, or other source for providing professional activities; and

- Compensation the CFP professional receives or is entitled to receive from related parties, such as the CFP professional’s employer or other sources, for providing professional activities.

A key aspect of the CFP Board’s “entitled to” framework, where compensation that a CFP professional or their firm either received or could (i.e., was “entitled to”) receive must be disclosed, was that even just being affiliated with a broker-dealer — whether by registration (in an employment context) or ownership — was enough to disqualify a CFP professional from being a CFP certificant.

Similarly, the CFP Board’s August 2013 notice also emphasized it would no longer be valid for CFP professionals to simply disclose their compensation as “salary,” as that salary would only be earned based on the compensation the CFP professional’s firm generates (as revenue) in the form of fees or commissions from the client.

The end result of these compensation disclosure concerns was that, after the 2013 notice, , CFP professionals were required to explain their compensation as fee-only (if applicable), commission-only (if applicable), or fall in between in the broad category of “commission and fee.”

Even so, the ongoing desire and marketplace pressure to use the fee-only label resulted in ongoing improprieties. This was detailed in a

‘Only’ if

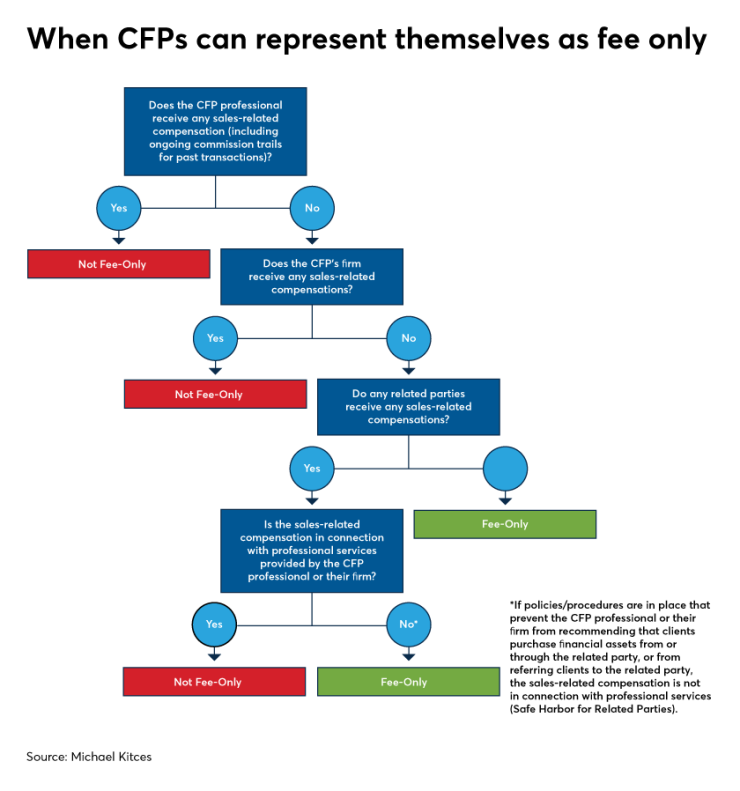

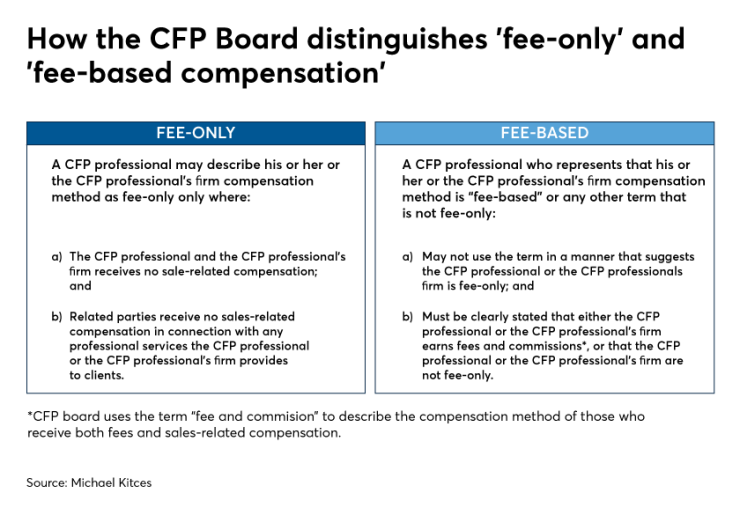

At their core, the

- The CFP professional and the CFP professional’s firm receive no sales-related compensation; and

- Related parties receive no sales-related compensation in connection with any professional services the CFP professional or the CFP professional’s firm provides to clients.

Notably, in the new fee-only compensation definition, the key requirement is not that the advisor only received compensation from a series of specified types of fees, but instead that the CFP professional does not receive any “sales-related” (i.e., commission) compensation.

Specifically, sales-related compensation is now defined by the CFP Board as: “More than a de minimis economic benefit, including any bonus or portion of compensation, resulting from a client purchasing or selling financial assets, from a client holding financial assets for purposes other than receiving financial advice, or from the referral of a client to any person or entity other than the CFP professional’s firm. Sales-related compensation includes, for example, commissions, trailing commissions, 12b-1 fees, spreads, transaction fees, revenue sharing, referral or solicitor fees, or similar consideration.”

Unsurprisingly, the core of the definition of “sales-related compensation” is around commissions that are generated from a client purchasing or selling financial assets, e.g., the traditional sales or transaction-related commission, or similar payments on an ongoing basis for continuing to hold such assets, e.g., levelized commissions that continue to be paid after the original sale.

As the CFP Board’s own definition notes, this may include (upfront) commissions, trailing commissions such as 12b-1 fees, spreads,e.g., for individual bond transactions, and other transaction fees.

In this context, it is important to note that the receipt of ongoing commission trails, even for transactions that may have occurred in the distant past, still runs afoul of the CFP Board rules on the receipt of sales-related compensation for CFP professionals who want to use the fee-only label.

12b-1 issues

Similarly, even receiving “just” the shareholder servicing portion of a 12b-1 fee is still deemed to be sales-related compensation, such that even advisors working at Vanguard may not characterize themselves as fee-only, as Vanguard’s brokerage platform receives 12b-1 servicing fees to support investors using the technology platform.

In fact, because FINRA defines mutual funds that pay only the 0.25% shareholder servicing portion of a 12b-1 fee as “no-load” (no sales-charge), but the CFP Board treats all 12b-1 fees as a commission, it is even possible for a CFP professional or his/her firm exclusively using “no-load” funds to still be ineligible for fee-only treatment.

In addition, the new rules also explicitly note that payments for the referral of a client to any person or entity will also be deemed sales-related compensation. This does not include the CFP professional’s own firm (thus, revenue-based compensation that the firm pays to its advisors upfront or on an ongoing basis for business development and client servicing will not run afoul of the rules), but advisors who are paid solicitor fees to refer to other advisory firms (e.g., serving as a solicitor for another RIA) would be treated as sales-related compensation.

TAMPs and soft dollars

Similarly, serving as a solicitor for a TAMP would also be treated as sales-related compensation (though a TAMP that collects the advisor’s own fees, keeps a portion to cover the TAMP’s expenses, and remits the remainder of the advisor’s own revenue will not be treated as receiving sales-related compensation).

On the other hand, these rules would not prohibit a fee-only CFP professional from paying solicitor fees to get clients and remain fee-only (even/including fees to a related party that it owns); it’s only sales-related compensation to receive such compensation from an external/third party in exchange for an introduction to/referral of the client.

Other exceptions to what may otherwise constitute sales-related compensation include:

1. Soft dollars (any research or other benefits received in connection with Client brokerage that qualifies for the “safe harbor” of

2. Reasonable and customary fees for custodial or similar administrative services if the fee or amount of the fee is not determined based on the amount or value of client transactions; or

3. Non-monetary benefits provided by another service provider, including a custodian, that benefit the CFP professional’s clients by improving the CFP professional’s delivery of professional services, and that are not determined based on the amount or value of client transactions.

Ultimately, it’s up to CFP professionals about whether they will operate on a fee-and-commission basis or as fee-only, and whether it’s worthwhile from a business and/or marketing perspective to adopt the fee-only approach. The CFP Board’s only concern is that compensation disclosures, and compensation labels in general, just be an accurate reflection of the entire advisor-client relationship.

Michael Kitces, MSFS, MTax, CFP, a Financial Planning contributing writer, is head of planning strategy for