With the new tax law, 2019 contribution limits for HSAs

But are your clients in the plan that will maximize returns on their investment? It may be difficult to tell.

HSA brokers aren’t publicly disclosing information needed to determine which HSA plan will be most lucrative, according to a recent

“It’s an area where we think there is pretty low transparency, and it’s pretty hard for investors to make informed decisions easily,” says Leo Acheson, an associate director of multi-asset and alternative strategies for Morningstar.

Still, HSA accounts are growing. The total number grew to 23.4 million at the end of June 2018, up 11.2% from the year-ago period, according to the HSA research firm Devenir. Total investment of assets in the plans was close to $10 billion.

The reason for growth? Primarily employers. Direct employer relationships led to 42% of new accounts opened in the first half of 2018, according to Devenir.

“A lot of my clients even this year have noted that their employers are starting to talk about it more,” says Amy Hubble, a CFP at Radix Financial.

However, not all clients have access to HSA plans through their jobs, and some employers don’t allow employees to invest through their plans, according to Hubble.

“Because of that, most of the money going into HSAs is staying in cash and then being withdrawn immediately as health expenses arise,” she says, so some employees miss long-term tax savings as a result.

For whatever reason, clients do open their own accounts outside of their companies. About 14% — or almost $1.4 billion — of all HSA dollars contributed to a plan came from an individual account not associated with an employer, according to Devenir. The average individual contribution to these accounts was $350 higher than those associated with employers.

But how to pick one?

Hubble chose HealthSavings Administrators a few years ago for her clients, because she found it easy to use and cost-efficient, with good investment options. She and her clients have been satisfied with the decision, she says.

HealthSavings Administrators is one of only four of the most-used providers that publicly disclose all this data through websites and customer service call centers. The majority of providers don’t provide information on maintenance and investment fees, interest rates or investment lineups, according to the Morningstar study.

“We spent a lot of time trying to gather this information, and it was really challenging,” Acheson says.

The information cannot only be difficult to find but can change regularly, he says. Three of the plans Morningstar evaluated completely overhauled their investment lineups in two years. Another two increased investment fees during Morningstar’s evaluation, according to the study.

FEES ARE WIDESPREAD

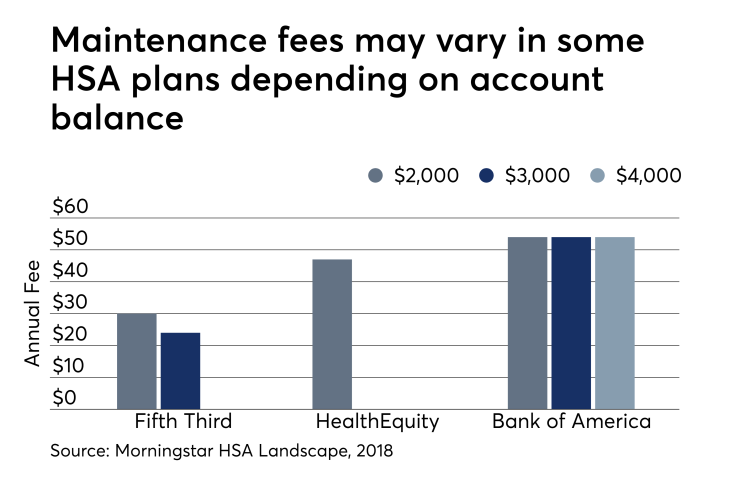

Maintenance fees are the most significant burden for clients, according to Morningstar.

Only one plan option has no maintenance fee: the HSA Authority. Other plans charge from $2 to $4.50 a month.

Additionally, all the providers (except for Further) charge additional fees, which are listed on each company website. They can be avoided – or they can pile up.

Bank of America charges only two fees, but they are substantial. Closing an account costs $25. Legal processing fees are $75. HealthSavings Administrators has 15 additional fees, at an average of $21.10. The HSA Authority has an average fee of $16.60.

While fees can become expensive, interest rates are miniscule.

For an average HSA checking account, the balance would earn .01% to .10%. Fifth Third offers the best rate at .25%, according to Morningstar.

Most checking accounts are tiered; the more money a client keeps in an account, the higher the earnings. However, money kept in the checking account can’t be invested, so the amount left there is usually low.

THE MOST LUCRATIVE PLAN

What plan will save clients most?

“No plan earns positive marks across the board for use as a spending or investing vehicle, indicating continued room for improvement,” the report said, but of the plans available, the HSA Authority is best.

One variable is how clients use their savings. HSAs can be used either to spend money on health expenditures or to save for them.

Because of tax incentives, using an HSA as an investing vehicle is the superior option, according to Hubble. Yet many clients will instead use them for spending.

On spending accounts, advisors should pay close attention to maintenance fees, limited additional fees, reasonable interest on deposits and, ideally, FDIC insurance, according to Morningstar.

Those who would consistently keep at least $4,000 in an HSA account can find a worthy alternative to the HSA Authority at Fifth Third, which waives its maintenance fee when balances reach that level, according to Morningstar.

Bank of America, HealthSavings Administrators and Further have permanent maintenance fees, regardless of account size.

Bank of America is the least attractive plan, costing approximately $50 to $74 a year more than other HSA plans, according to Morningstar.

For individuals looking to invest money in an account to save for future expenses, more than fees must be considered. Other factors, including what investment products are offered, are important. The plans need to have well-rounded portfolios in core asset classes (including large, small or mid-cap equities, equities in developed nations and other international stock, investment-grade bonds and cash-equivalent or short-term bond strategy).

Generally, the quality of investments across HSA plans is strong, according to Morningstar, which found that at least 50% of the options in the top 10 plans earn gold, silver or bronze Morningstar ratings.

-

The right health insurance is all that’s needed to use this triple-tax advantaged savings account.

August 2 -

Investments as a percentage of HSA assets are growing, but advisors should give clients a complete picture of risks and rewards.

May 30 -

The investment research firm debuted three new data sets that can help advisors evaluate investment options for clients.

June 11

BenefitWallet scores the lowest because it includes a negative-rated fund, “which calls the plan’s investment-selection process into question,” according to Morningstar.

HealthEquity offers the least diverse options, primarily passive underlying strategies and only Vanguard funds.

Health Savings Administrators, Fifth Third, BenefitWallet and Further favor active strategies.

Investors looking for passive exposure will do best at Further and the HSA Authority, according to Morningstar.

HSA Bank and HealthEquity are very expensive, with average total fees of more than .70%, more than double that of Further and the HSA Authority.

For active exposure, the HSA Authority (closer to .85%) and Bank of America (around 1%) offer the cheapest plans. BenefitWallet and HSA Bank are the most expensive, with total fees of 1.20% and 1.24%, respectively.

The good news? HSA plans are getting better.

“The HSA plans we evaluated have mostly improved their quality of investments and investment menu designs since last year,” says the Morningstar report.

No matter which plan you choose, HSAs are saving clients significant tax dollars.

"They are the most superior savings vehicle that the United States government offers today, especially in the long term, to pay for health expenses,” Hubble says.