Our weekly roundup of tax-related investment strategies and news your clients may be thinking about.

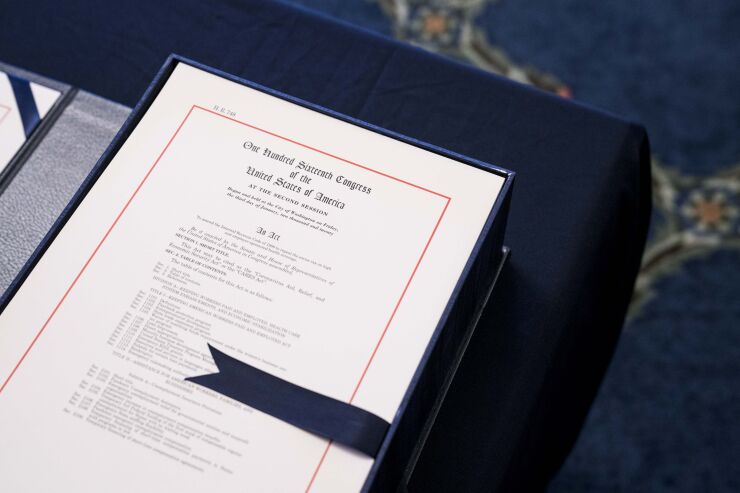

Under the rule changes that came with the CARES Act, clients now have the option of donating up to 100% of their adjusted gross income to charity in order to maximize their charitable tax deductions this year, according to this article in Forbes. The rule change and tax provisions are meant to encourage an immediate impact in the fight against COVID-19 and applies only to cash donations made directly to charitable organizations, according to an expert. Taxpayers can also carry forward donations that exceed their AGI for five years, but it will be subject to the 60% limit, the article says.

Creating a plan is necessary for clients to make the most of their Social Security benefits, writes an expert in Kiplinger. They can start by brushing up on the basics of retirement planning, such as getting a Social Security account online, meeting the 40-credit requirement to qualify for retirement benefits and delaying their benefits to boost the payouts. When creating a plan, they are advised to adopt a proactive approach and should be realistic about their longevity and break-even point. They are also advised to account for income tax, as it can have a big impact on their retirement plan.

Clients have the option of tapping their life insurance coverage to improve their cash flow, according to this article in MarketWatch. For example, they can make a full or partial cash surrender, but they will face an income tax bill if the payout amount is bigger than the premiums they paid. They may also take a loan against the policy or skip the out-of-pocket premium payments using the cash value of the policy.

Retired clients are advised to adopt a total return approach to portfolio withdrawals in a low-yield environment and make a few considerations to mitigate the impact of a market correction on their retirement and financial plan, writes Morningstar's Christine Benz. For example, delaying Social Security can be a smart move, as the 8% increase in benefits for every year they defer their retirement benefits is bigger than potential annual returns from stocks and bonds, the expert says. Paying down mortgage debt can also be better than holding safer assets, especially for pre-retirees, as it can guarantee a return and make them qualify for a tax deduction.

Financial advisors, broker-dealers, custodians and other firms are trying to do their part amid a public health and economic crisis.

Retirees are advised to consider taking advantage of the chance to skip RMDs from their IRAs this year, especially if they don't need the money in order to recover from the market correction and to lower their 2020 income tax bill, according to this article in Yahoo Finance. Seniors who have already taken the mandatory distributions may opt to roll over the money to a retirement account within 60 days to avoid the tax bite, according to the article. Another option is to classify the RMD as a COVID-19-related distribution. "This gives you the opportunity to spread the taxes over a three-year period or put the money back over a three-year period," says an expert.