A year of economic dislocation brought on by the pandemic has left many clients thinking more deeply about their finances, with many advisors reporting that clients have low levels of confidence in their own financial wellness.

The COVID-19 pandemic instilled in clients a greater appreciation of their financial vulnerabilities, leading them to think more strategically about retirement and other long-term goals, according to Financial Planning's latest Financial Wellness Report.

"People are much more open to completing a comprehensive financial plan," one advisor says in the quarterly survey.

But that was not a universal sentiment. Other advisors described the frustration of working with clients who reacted emotionally to COVID-related headlines over the past year. Some advisors even saw clients moving away from their goals-based financial plans during the pandemic.

"This last year has caused too many people to stop thinking long-term," one advisor says.

Advisors variously described clients as getting spooked by market volatility or concerned about immediate financial needs, factors that led some clients to want to pull out of the markets altogether.

"Keeping them invested during the pandemic has been the biggest challenge," one advisor says.

But overall, advisors were fairly positive about their clients' financial wellness — even if the clients didn't feel that way themselves.

For instance, half of the advisors polled say that the percentage of their clients who were on track for retirement had increased since March 2020, while just under 14% say their clients' retirement readiness had decreased. Only one advisor says clients' retirement readiness had "decreased significantly" since last March.

"For the majority of our clients, their financial wellness has improved since the pandemic," one advisor says.

The pandemic experience cut both ways when it came to clients' retirement plans. Substantial minorities of advisors polled say that at least half of their clients are now either planning to retire earlier (20.5%) — or later (24.8%) — than they had been expecting to at the outset of the pandemic.

One advisor suggests an explanation for that seeming bifurcation, observing that clients responded to the extreme circumstances arising from the pandemic by doubling down on their well-established financial habits.

"The pandemic has exacerbated client behavior," that advisor says. "For poor savers, [with] the surplus in cash savings (through stimulus or savings that they couldn't spend because they couldn't go out, etc.), they're finding new ways to spend the money instead of putting it towards their goals. For the good savers, they've taken the opportunity to pay down debt, including the mortgage, aggressively."

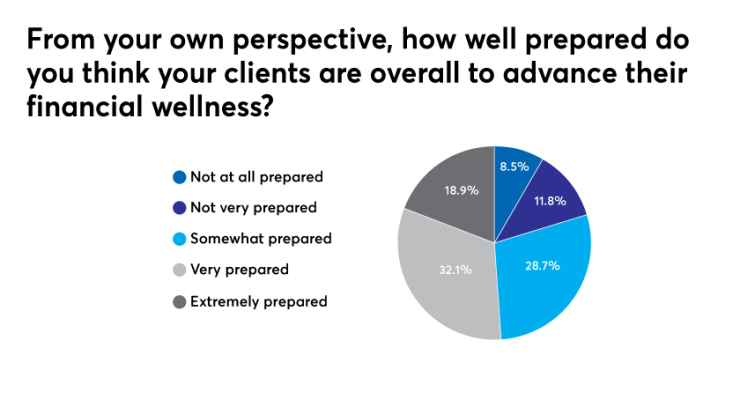

The survey revealed an apparent disconnect with how clients view their own financial wellness with their advisors' assessments.

In short, advisors say, clients are too hard on themselves.

When polled about their own assessments, 79.7% of advisors say they believed their clients were somewhat, very or extremely prepared to advance their financial wellness.

"The pandemic has made my clients more focused on the importance of being financially prepared and more open to taking advice on how to be better prepared," one advisor says.

But when asked about their clients' thoughts on their own financial wellness, 84% of advisors say that between 0% and 25% of their clients are "extremely confident." More than 92% of advisors polled said that no more than 50% of their clients are even "somewhat confident."

"We teach financial wellness to all of our clients," says one advisor. "It's up to them to put that in place, but we touch base and encourage at every chance we get."

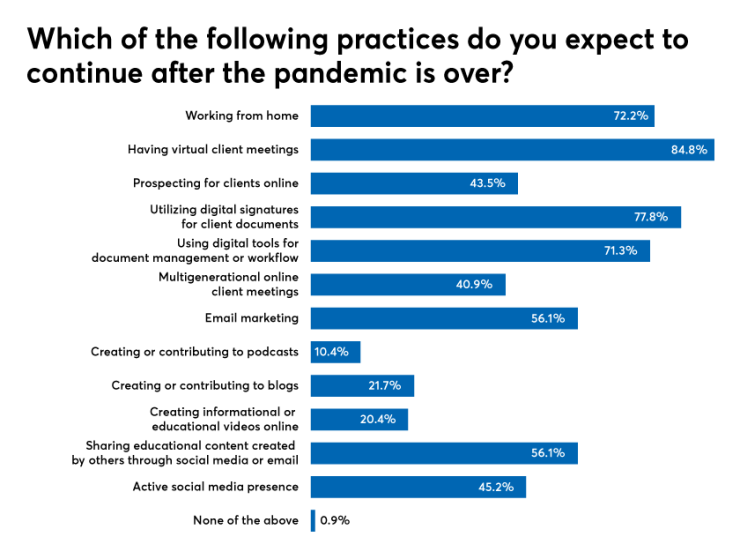

Advisors also reflected on how they adapted their own practices to pandemic realities. Sixty-five percent of respondents say that they began conducting virtual client meetings over the past year, which, combined with the 31% who say they were already doing remote meetings, suggests it has become a near-universal practice.

The figures were nearly as high when advisors were asked about working from home. Fifty-three percent of respondents say they began working from home during the pandemic, added onto 36% who say they had already been doing so.

A substantial majority of those surveyed expect that they will continue working from home (72%) and holding virtual client meetings (85%) after the pandemic is over.

Advisors were also asked to rank a long list of financial wellness priorities they intend to focus on with their clients following the pandemic. Most advisors say their top priorities would be working on retirement and estate planning, 50% say they are focused on helping clients build up cash reserves, while 43% are looking to help clients reduce interest on mortgages and other loans.

Repeatedly, advisors surveyed in the most recent Financial Wellness Report stress the importance of communication and education as keys to improving clients' financial wellness.

"At this time it is paramount to be in contact with clients," one advisor says.

Another puts the process of educating clients in the context of advisors' larger duties of loyalty and care.

"Our role as fiduciaries should involve not only managing their wealth," the advisor says, "but helping them increase their knowledge so we are working together towards the same goal."