Want unlimited access to top ideas and insights?

In the not-so-distant past, the primary estate planning concern for mass-affluent and high-net-worth families was avoiding the federal estate tax. Over the past 20 years, though, the estate tax exemption has

Thanks to these increases, as well as other generous

Accordingly, tax planning has become less about estate tax planning, and far more about the income tax planning opportunities at death, particularly with respect to opportunities to maximize the cost basis of assets inherited at death.

Two important asset categories

When an individual dies and leaves assets to an heir, those assets fall into one of two categories.

The first group can be categorized as

The rules for IRD assets are outlined in

IRD assets include a deceased sole proprietor’s or pass-through business owner’s outstanding accounts receivables, embedded gains on U.S. savings bonds, other accrued but unpaid bond interest, embedded gains of non-qualified annuities, the gain associated with outstanding installment sales payments,

In contrast, any and all other (non-IRD) assets receive a step-up in basis.

The “step-up in basis rule”, as outlined in

Thus, the beneficiary of such assets is generally free to sell such assets immediately without any income tax consequences (assuming no gain/loss since the decedent’s death). Plus, from a sheer convenience perspective, this means the beneficiary can sell the asset and know what the cost basis is (fair market value on the date it was inherited), without needing to try to retroactively reconstruct cost basis from historical purchase and transaction information that may no longer be available after the original owner has passed away.

A misnomer

While the phrase “step-up in basis” has become the colloquial way of describing the tax treatment that a beneficiary’s non-IRD assets receive upon inheritance, the reality is that the phrase does not always ring true.

Instead, as noted above,

One would hope this amount is greater than the decedent’s own basis, especially if they’ve owned the asset for a long period of time. But that’s not always the case. Sometimes investments lose value between their date of purchase and when their owner passes away. In that situation, a beneficiary will generally have to step down the basis of the inherited property to its value on the date of death.

Example #1: In 2015, Marsha purchased 500 shares of Beverly Hillbillies Oil stock in her taxable brokerage account for a total of $400,000. Recently, Marsha passed away. On the date of her death, owing to a steep decline in energy prices since their purchase, her Beverly Hillbillies Oil shares were valued at only $70,000. (As far as we know, her death was not a result of losing $330,000 in her portfolio, but a mere coincidence!)

The heir to Marsha’s Beverly Hillbillies Oil shares will be treated as though they purchased those shares on her date of death. As such, their cost basis in the acquired-by-inheritance Beverly Hillbillies Oil stock will be decreased from the original $400,000 down to $70,000, its fair market value on Marsha’s date of death.

Accordingly, if Beverly Hillbillies Oil stock were to have a dramatic turnaround and Marsha’s heir were to sell the stock two years later for $400,000 – the same amount Marsha initially paid for her shares in 2015 – her heir would owe long-term capital gains tax on the $330,000 gain that occurred after Marsha’s death (even though neither Marsha nor her heir ever got a tax deduction for the prior $330,000 loss).

How the step-down in basis impacts spouses’ joint accounts in separate property states

The step-down-in-basis rules apply to non-IRD assets transferred to a beneficiary by reason of the owner’s death, which can include both traditional inheritances (e.g., from the original owner to their children), but also include bequests to a beneficiary who is a spouse of the original owner.

However, to apply the rules for the step-up (or step-down) of basis for property transferred between spouses at the death of the first spouse, it’s necessary to first determine which spouse actually owned the property for income tax (including step-up/step-down in basis) purposes in the first place.

Notably, the rules to determine ownership of property is generally a matter of state law — not federal law. In essence, federal tax code provides the “how” as in “How should property be treated upon passing to a beneficiary?”. But state law provides the “what” as in “What property is treated as having belonged to the decedent?”.

Thus, understanding both state property laws and the federal income tax laws is necessary.

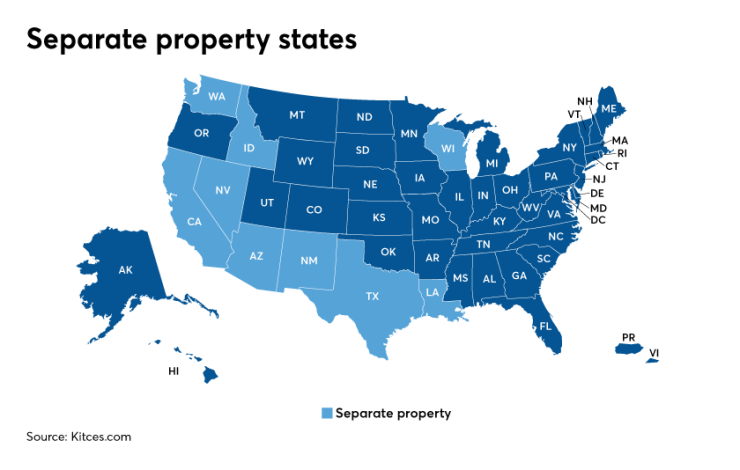

The vast majority of states use a “separate property” regime, where common law is used to determine property ownership. Under common law, ownership is determined by how property is actually titled, and property in one spouse’s name is generally treated as belonging solely to that spouse.

Accordingly, the beneficiary of property owned entirely by one spouse will get a full step-up/step-down in basis upon that spouse’s death — even if the beneficiary of the decedent-spouse is the other spouse.

For a variety of reasons, though, many married couples prefer to hold most, if not all, of their taxable investments in joint accounts. And those accounts tend to be joint accounts with rights of survivorship.

Under

That stepped-up/stepped-down basis amount (50% of the fair market value) is then added to the basis already attributed to the surviving spouse via the 50% of the assets that they were deemed to have owned prior to the deceased spouse’s passing.

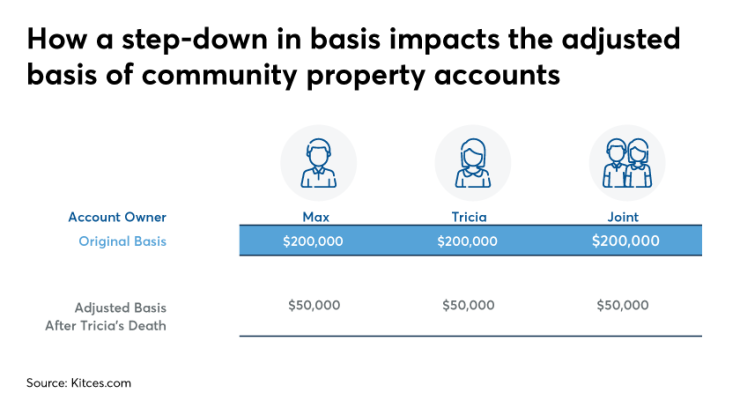

Example #2: Max and Tricia are married and live in Virginia, a separate property state. They have three taxable brokerage accounts: one that is titled only in Max’s name, one that is titled only in Tricia’s name, and one that is titled as a joint account. Each of the accounts contains CPR stock that was purchased for $200,000 (each).

Unfortunately, Tricia has just passed, and on Tricia’s date of death, the CPR stock in each of the three brokerage accounts noted above was worth $50,000. Thus, the couple had a total of $150,000 of CPR stock as of Tricia’s passing, which had been collectively purchased for $600,000 (original cost basis). Notably, however, because of the three different ways in which the stock accounts were owned (titled), there will be three different basis treatments for the stock owned in the accounts when received by the spousal beneficiary.

The stock owned in Tricia’s name only will receive a full step-down in basis. Thus, the basis of the stock in that account will drop to $50,000, its fair market value on the date of Tricia’s death.

Similarly, half of the joint account will receive a step-down in basis (since it is deemed to be owned 50% by Tricia as a joint account held between a married couple), resulting in a total of $125,000 of basis ($25,000 step-down in basis equal to the value of Tricia’s half of the account upon her death + $100,000 of Max’s own existing basis on his half of the account upon Tricia’s passing).

Finally, the stock owned in Max’s name only will receive no step-down in basis at all because it was fully owned by Max, leaving Max’s original basis of $200,000 intact. Thus, after Tricia’s death, Max will have a total of $50,000 + $125,000 + $200,000 = $375,000 of basis on the $150,000 total value of the CPR shares.

Accordingly, as a result of Tricia’s death, the ownership of the couple’s cumulative CPR shares at that time, and the step-down in basis rules, Max loses a cumulative $600,000 – $375,000 = $225,000 of basis upon Tricia’s passing.

Not always a viable solution

Many times, the knee-jerk reaction of advisors to the problem of disappearing capital loss at death is to sell the asset with the capital loss prior to death, to lock in the realized loss on the couple’s tax return. Alas, this is often not a viable solution.

More specifically, while couples filing joint tax returns tend to think that everything on their tax return is theirs, the reality is that while a joint tax return reports a couple’s combined income, deduction, credits, etc., on a common return, the building blocks of that return still largely belong to the respective individuals making up the couple.

Take, for instance, carryforward capital losses, which are losses that have already been ‘locked in’ by the sale of loser investments, but which have not yet been used up in previous tax years.

In general, taxpayers are allowed to use capital losses to offset any capital gains, plus an additional $3,000 of ordinary income. Any losses in excess of those amounts (net capital gains plus $3,000 of ordinary income) cannot be deducted in the current year but may be carried forward to future years, up to and including the year of death.

Capital loss carryforwards are reported on Schedule D, Capital Gains and Losses, which, like the Form 1040, records the combined amounts of a couple (and not the gain and losses of each member of the couple separately). However, the building blocks of gain and loss that are used to complete that form still belong to each member of the couple separately.

Thus, and as Revenue Ruling 1974-175 made clear over 40 years ago, the capital loss associated with one individual from a couple disappears with the death of that person who owned the asset.

“In the absence of any express statutory language, only the taxpayer who sustains a loss is entitled to take the deduction. See Calvin v. United States, 354 F. 2d 202 (10th Cir. 1965). Therefore, the business loss and the capital loss sustained by the decedent for the period ending with the date of his death are deductible only on his final income tax return. Thus, no part of such net operating loss or capital loss is deductible by the decedent’s estate or carried over to subsequent years.” (emphasis added)

It is, therefore, a well-settled matter that while a married couple can use each other’s income and deductions to offset one another when electing to file a joint return, the actual items of income and deductions (and credits, etc.) remain the property, of the person (or persons) generating them (or of the assets that person held). And since a joint return can only be filed up to the year in which a spouse passes away, after that, any unused deductions, credits, or other tax benefits attributable to the deceased spouse will, unfortunately, generally die with them.

Example #3: Bruce and Pearl are married and have filed a joint income tax return for each year since their wedding. Sadly, Bruce died on January 15, 2020. At the time, there had been no trades (realized gains or losses) in any of the couple’s taxable accounts in 2020, nor has Pearl made any since Bruce’s death.

In 2000, Bruce and Pearl met with a broker and purchased $250,000 worth of RonEn stock in their joint brokerage account. Unfortunately, as luck would have it, in 2008, RonEn went bankrupt while Bruce and Pearl still owned the stock in their joint brokerage account. Thus, the couple became the not-so-proud owner of a combined long-term capital loss of $250,000.

Over the course of the following decade and until Bruce’s death, via both the sale of some investments with capital gains and the $3,000 annual capital loss amount allowed to be written off against ordinary income, the long-term carryforward capital loss on the couple’s joint tax return was whittled down to ‘just’ $123,000.

If Pearl takes no action with respect to investments in her own taxable account(s) before the end of 2020 (e.g., sells some investments with a capital gain to be offset by the existing carryforward capital loss), another $3,000 of the $123,000 capital loss carryforward will be used to offset ordinary income on the couple’s final joint income tax return. The remaining $120,000 of carryforward capital loss, however, will be cut in half.

More specifically, since 50% of the RonEn shares sold at a loss were deemed to be owned by Bruce, 50% of the carryforward capital loss was Bruce’s as well. Therefore, any amount of his loss not used up by the last year ‘he’ files an income tax return is irrevocably lost, along with its tax-saving power.

If a surviving spouse is able to sell assets with enough gain in the same year as the capital-loss-owning deceased spouse’s death, then the decedent’s realized capital loss can be fully ‘used up’ on the year the tax return was filed for the year of death (the final joint tax return).

But what if the surviving spouse doesn’t have enough taxable assets with a gain? There’s no way to make use of that now-realized capital loss.

Community property twists

While most states employ a separate property regime based on common law, a number of states (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin) use a different system, called community property, to determine ownership of property for married couples.

In general, community property for married couples includes assets that are acquired during marriage while living within a community property state (with some exceptions, such as assets acquired during the marriage but received via gift or inheritance), assets that are converted to community property via mutual agreement, and any other property that otherwise clearly can’t be identified as an individual spouse’s separate (i.e., non-community) property.

But what exactly is community property? Conceptually, for post-death basis planning purposes, you might think about community property as property that is simultaneously owned 100% by both spouses, regardless of whose name(s) is/are actually on the account. Thus, community property of spouses will generally receive a full step-up/down in basis on the entire value of the property, at both deaths… automatically.

Example #3: Recall Max and Tricia, the married couple from Example #2. Suppose that, instead of living in Virginia, a separate property state, they instead chose to marry and live in a community property state.

Further recall Max and Tricia have three taxable brokerage accounts: one that is titled only in Max’s name; one that is titled only in Tricia’s name; and one that is titled as a joint account. Now imagine each of the accounts again contains CPR stock that was purchased for $200,000 (each) with income the couple earned while married (i.e., community property funds). Thus, although all three accounts have different registrations, they are all considered to be community property.

On Tricia’s date of death, the CPR stock in each of the three brokerage accounts noted above was worth $50,000. Thus, the couple had a total of $150,000 of CPR stock as of Tricia’s passing. Oddly – at least to the majority of people who are more familiar with common-law-state rules — since each of the accounts was considered community property, Max will be subject to a full step-down in basis on all three accounts (i.e., the basis of the stock will decrease to $50,000 in each account, for a total basis of $150,000)… even the account that was only in Max’s name to begin with.

Compared to Example #2, in which all the facts were the same except for the fact that Max and Tricia’s assets were considered separate property in a common-law state, there is an additional step down of $225,000 (on top of the $125,000 that was already lost in Example #2) because of the community property rules!

Minimizing Step-Down-In Basis Reductions Clearly, the result in each of the three examples above is wholly unsatisfying (albeit some even worse than others). Investment losses are certainly not desirable, but once they exist, they do have real economic value in the form of a tax deduction for the loss. Thus, if a loss is, well… lost upon death, so is the economic value associated with it. Planning to minimize such outcomes is an important and valuable part of estate planning, especially when federal estate tax planning has been so greatly diminished in recent years due to the increases in the federal estate tax exemption.Notably, when planning to minimize the impact of a step-down in basis for an investment with an unrealized capital loss, it’s important to determine to whom the loss-laden assets are intended to be bequeathed upon the death of the owner, as there are key differences that apply when the intended recipient of assets is a spouse as opposed to a non-spouse.

More specifically, while the same strategy — gifting — can be used in both cases, the ultimate outcome of the strategy will be different depending upon whether the recipient of the asset is a spouse or non-spouse.

Mitigating the impact for married couples

When evaluating near-death basis-planning strategies, it’s important to maximize any potential unrealized losses that a soon-to-be-deceased spouse may own. As noted earlier, the basis of the assets that spouse transfers to heirs steps to the value at the date of their death. That happens regardless of whether that value is a step higher or a step lower than their own pre-death basis, and the unrealized capital loss, along with its economic value, is generally lost via a step-down in basis.When it comes to mitigating the potential impact, the easiest, and often the best approach is to simply gift the loss assets to the intended beneficiary prior to death.

This pre-death gifting strategy works well in a variety of situations but is particularly effective in scenarios where the goal for the surviving spouse in a separate property state is to retain assets upon the death of the first-to-die spouse.

As notably,

In the case of any property acquired by gift in a transfer described in section 1041(a), the basis of such property in the hands of the transferee shall be determined under section 1041(b)(2) and not this section.

And

The basis of the transferee in the property shall be the adjusted basis of the transferor.

Thus, if one spouse transfers an asset with an unrealized loss to the other spouse, the receiving spouse has only one basis — the original spouse’s basis — and the full unrealized capital loss can be preserved.

Example #4: Earnest, who has chronic health problems, is married to Ida, who is in excellent health. The couple has lived in a separate property state throughout their marriage.

Earnest has an individual brokerage account, and the couple has a joint brokerage account as well. Each account holds a number of different investments, some of which have unrealized gains, and some of which have unrealized losses. The unrealized losses in Earnest’s individual account equal $70,000, while the unrealized losses in the joint account equal $100,000.

If Earnest dies without taking any action, the $70,000 unrealized capital loss in his individual account will disappear as the assets receive a step-down in basis. Similarly, half ($50,000) of the $100,000 unrealized loss in the couple’s joint account would be eliminated via a step-down in basis.

Accordingly, it’s likely advisable for Earnest to consider a more proactive approach. One straight-forward, yet highly effective strategy, is for Earnest to transfer (gift) the positions in the accounts (both his individual account and the joint account) with the unrealized losses to an account in Ida’s own name, while he’s still alive.

In doing so, Ida (the transferee spouse) will retain Earnest’s (the transferor spouse) basis in the investments. Thus, by making such a gift, Earnest can avoid the step-down in basis (i.e., the loss) of $70,000 + $50,000 = $120,000 of unrealized capital losses upon his death, allowing Ida to ‘hang on’ to them for future use by avoiding that step-down in basis.

Notably, it’s important to examine investment accounts granularly to identify potential assets to gift to preserve losses from a step-down in basis. Thanks to the historic bull market run following the financial crisis of 2008, cumulative built-in capital gains are more common than capital losses. However, it’s not the cumulative total of these amounts that matters. It’s the individual positions in the investment accounts.

Any position with an unrealized loss in the taxable account of a terminally ill spouse living in a separate property state should be earmarked for possible transfer to the healthy spouse in order to preserve the potential loss for that position! And despite the market’s good fortune of the past dozen years, most diversified portfolios are likely to have at least some positions at a loss (not to mention losses incurred during the ongoing COVID-19 crisis).

Finally, it should be noted that by moving loss-laden assets into the healthy spouse’s name, the ill spouse gives up control over those assets. Once the assets are transferred, there may be nothing to prevent the receiving spouse from later transferring those assets (via gift or by bequest upon death) to someone or some entity of which the ill-spouse would not have approved (e.g., a future/second spouse, children from a future marriage, etc.). Thus, when choosing to implement such a strategy, trust is a critical component.

Mitigating impact for married couples: Community property states

Generally speaking, assets tend to appreciate over time. That makes the community property rules — where a full step-up in basis is received on any community property, regardless of titling – preferential to the separate property rules as a default for post-death basis treatment. But for proactive individuals who wish to try and preserve the full unrealized capital loss of an investment, the community property rules can actually work against them (by forcing a full step-down in basis upon the death of either spouse). Accordingly, when it comes to trying to avoid losing the unrealized loss of a community property asset, additional steps may need to be considered. For instance, it may be beneficial to convert the community property to separate property by mutual agreement of the spouses (and under whatever additional procedures are required to do so under state law) should one spouse become seriously ill.

Once such a conversion has taken place, the planning can proceed as if it had been separate property to begin with. Of course, by doing so, the ill spouse would again be relinquishing control over their portion of the community assets, which needs to be considered.

Mitigating the impact for a non-spouse

Some individuals never get married. Others are married and are later divorced or widowed. And in some cases, married individuals may simply wish to give assets-with-an-unrealized-loss away to persons other than their spouse (e.g., their children, grandchildren, or other heirs).

In such situations, the good news is that there is still a benefit to giving away loss-laden assets (to non-spouse persons) prior to death. The bad news is that the benefits are not as great as when a spouse is the recipient of the same gift.

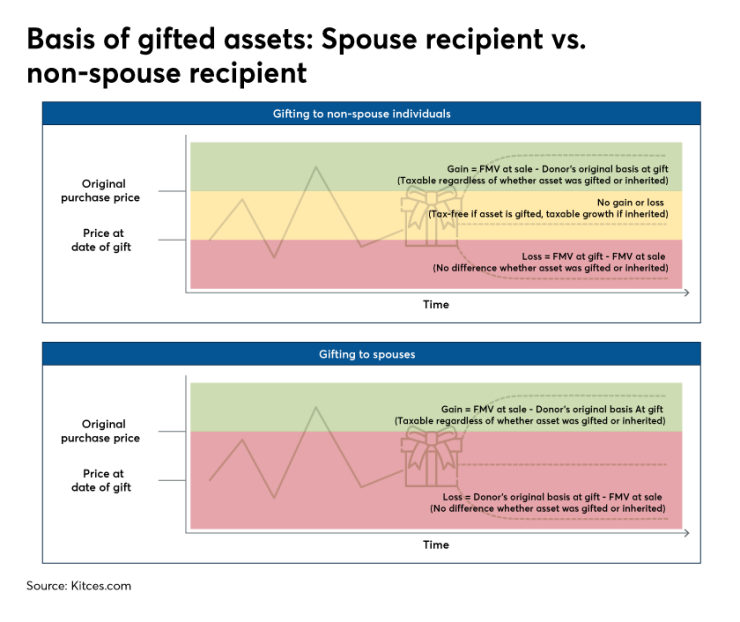

When an asset is gifted, the recipient of the gift takes the previous owner’s basis as their own (i.e., basis is carried over from the donor to the recipient). This is the case when an asset with an unrealized gain is given to another individual, regardless of whether the recipient is a spouse or a non-spouse person. In addition, as discussed above, basis is also carried over from one spouse to another when an asset with an unrealized loss is gifted between spouses as separate property.

There is, however, an exception to the general carryover basis rule, when an individual transfers property that has a fair market value below its adjusted cost basis (i.e., an unrealized loss) to a non-spouse.

In such situations,

Under these “double basis” or “split basis” rules, the recipient of the property uses the value on the date of the gift as the basis amount to determine a potential capital loss. By contrast, for purposes of determining a potential capital gain, the recipient of the property uses the donor’s higher original (carried-over) basis.

The ultimate result of these double basis rules is that there are actually three potential tax outcomes for the recipient of property gifted with an unrealized loss when (if) they eventually sell the gifted investment. It all depends upon the value of the gifted asset at the time of the sale.

The three potential consequences for the recipient of the gift can be summarized as follows:

- Scenario # 1: Sale price of gifted assets less that the fair market value on the date of the gift — The recipient of the gift is entitled to claim a capital loss equal to the difference between the fair market value on the date of the gift and the sale price (but not the loss from the owner’s original basis).

- Scenario # 2: Sale price of gifted asset is more than the original owner's basis on the date of the gift (carryover basis) — The recipient of the gift will have a capital gain equal to the difference between the sales price of the asset and the original owner’s carried over basis.

- Scenario # 3: Sales price of gifted asset is between the fair market value on date of the gift and the original owner’s basis — The recipient of the gift will not owe any capital gains tax (because the value is not higher than owner’s original basis), nor will the recipient be able to claim a capital loss (because the value is not lower than the fair market value on the date of the gift).

As the graphic below shows, the treatment afforded to non-spouse individuals gifted investments with a capital loss is not nearly as strong as the treatment when the same asset is gifted as separate property to a spouse. More specifically, for purposes of claiming a future capital loss, it makes no difference to a non-spouse individual whether they receive an asset with an unrealized loss as a gift or as a bequest upon the death of the owner. In either case, they will only be able to claim a capital loss for additional losses incurred after their receipt of the asset.

But on the capital gains side of things, it’s a different story. In essence, by gifting an asset with an unrealized loss to a non-spouse individual, the recipient is able to earn back the original owner’s unrealized loss tax-free (because for capital gains purposes, the recipient’s basis remains the owner’s initial basis). By contrast, if the same individual were to die and leave the same asset to the same non-spouse individual, the asset would be stepped down in basis, and all future gain would be subject to capital gains tax.

Example #5: Rhonda is 70 years old and is terminally ill. As part of her ongoing tax planning, Rhonda transfers $100,000 of HereUGo stock to her son, Max. Rhonda had purchased HereUGo stock several years ago for $180,000, and consequently that was still her basis in the stock at the time of its transfer to Max.

If HereUGo stock continues to decline in value and Max sells it when it is worth “only” $80,000, Max will be entitled to a $20,000 capital loss; the difference between the $100,000 value of the stock on the date of transfer and its ultimate sale price. This is precisely the same outcome had Max inherited the same shares at the same $100,000 fair market value.

If, however, HereUGo has a mild recovery, and Max sells it for $150,000, he can walk away with the full amount. There is no capital gain owed because the sales price is less than the $180,000 Rhonda initially paid for the investment (Max cannot, however, claim any capital loss, because the sales price is more than the $100,000 value of the HereUGo stock on the date of its transfer).

Consider, now, what would have happened if Max had inherited the same shares at the same $100,000 fair market value. Instead of a ‘wash’ of no gain/no loss, the basis would have been stepped-down to the $100,000 fair market value, and Max would have incurred a capital gain of $50,000.

Finally, if HereUGo stock has a tremendous recovery, and Max sold it when it had increased in value to $200,000, he would owe capital gains tax on $30,000 of gain; the difference between the sales price of $210,000 and Rhonda’s original, carried over basis of $180,000.

By contrast, if the shares had been inherited, the basis would have been stepped-down to the $100,000 fair market value, and Max would have incurred a capital gain of $110,000 (as opposed to the $30,000 of gain he’d have by receiving the same shares via gift). Thus, by gifting the asset to Max instead of dying and leaving it to him, Rhonda allows Max to earn up to her $80,000 unrealized capital loss on HereUGo stock back, tax-free!

No one likes to see their investments go down in value, but if an individual has a diversified portfolio and rebalances with any sort of regularity, they are almost guaranteed to have positions with a loss at most, if not all, times. When such positions are held within retirement accounts, such losses are of no concern (at least from a tax-planning point-of-view), as the tax-deferred nature of retirement accounts eliminates any tax benefit that would otherwise be associated with the loss.

A lesson from the Red Hot Chili Peppers

But if the same loss-burdened position is held in a taxable account, it becomes a different story. All of a sudden, that loss has real economic value, which should be preserved to the extent possible. There are a variety of ways in which planners may choose to do so, but one of the simplest and most effective solutions is to engage in a little

It’s that simple. By giving it away now, instead of dying with an asset with an unrealized capital loss, some economic value related to the loss can be preserved.

In the case of one spouse gifting separate property to the other spouse, gifting the asset allows maximum economic value to be retained as the recipient-spouse picks up the donor-spouse’s basis for purposes of calculating future gains and losses (upon the sale of the asset).

And while the treatment for non-spouse recipients of similar gifts isn’t as strong, the double-basis rules still allow such individuals to earn back the donor’s capital loss on the position tax-free.

Ultimately, even though the federal estate tax is no longer an issue for most individuals, income taxes, including taxes on capital gains, remain a real problem. Accordingly, planning to mitigate such taxes is an important part of any estate plan. Doing so not only requires trying to maximize the step-up in basis for assets of an individual that have an unrealized gain, but also minimizing the step-down in basis of assets of the same individual by preserving the economic value of such losses to the extent possible under the law.

Jeffrey Levine, CPA/PFS, CFP, MSA, a Financial Planning contributing writer, is the lead financial planning nerd at