-

The ballot initiative was proposed by a California union as a way to fund health care.

January 20 -

New OBBBA restrictions mean wealthy donors lose deductions on smaller, routine gifts. Here is how to use DAFs and donation grouping to preserve tax benefits.

January 19 -

Rhode Island Governor Dan McKee proposed a higher tax on millionaires to help fill a hole in the state's budget.

January 16 -

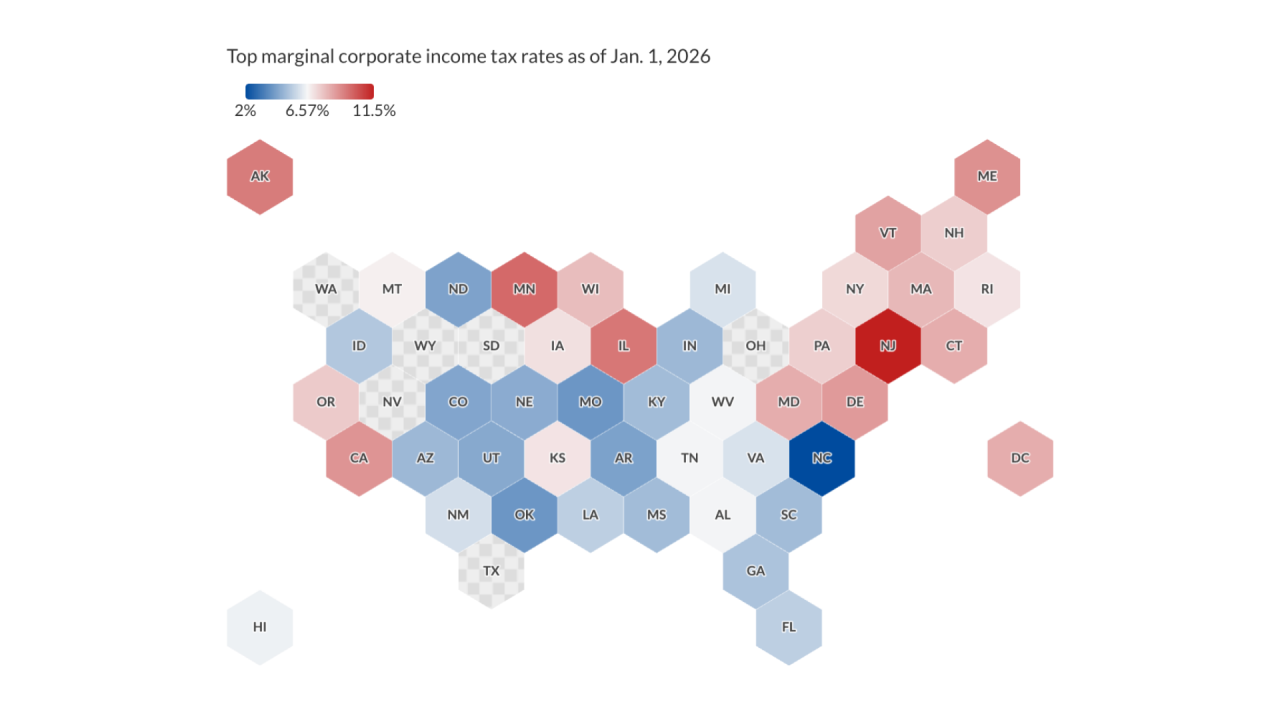

Corporate tax rates vary widely by state, affecting client business decisions around relocation, expansion and growth planning. Here's how the landscape is changing in 2026.

January 13 -

How charitably inclined taxpayers can use donor-advised funds and other tax strategies to get ahead of the OBBBA's revised rules on charitable deductions.

October 23 Natixis Investment Managers Solutions

Natixis Investment Managers Solutions -

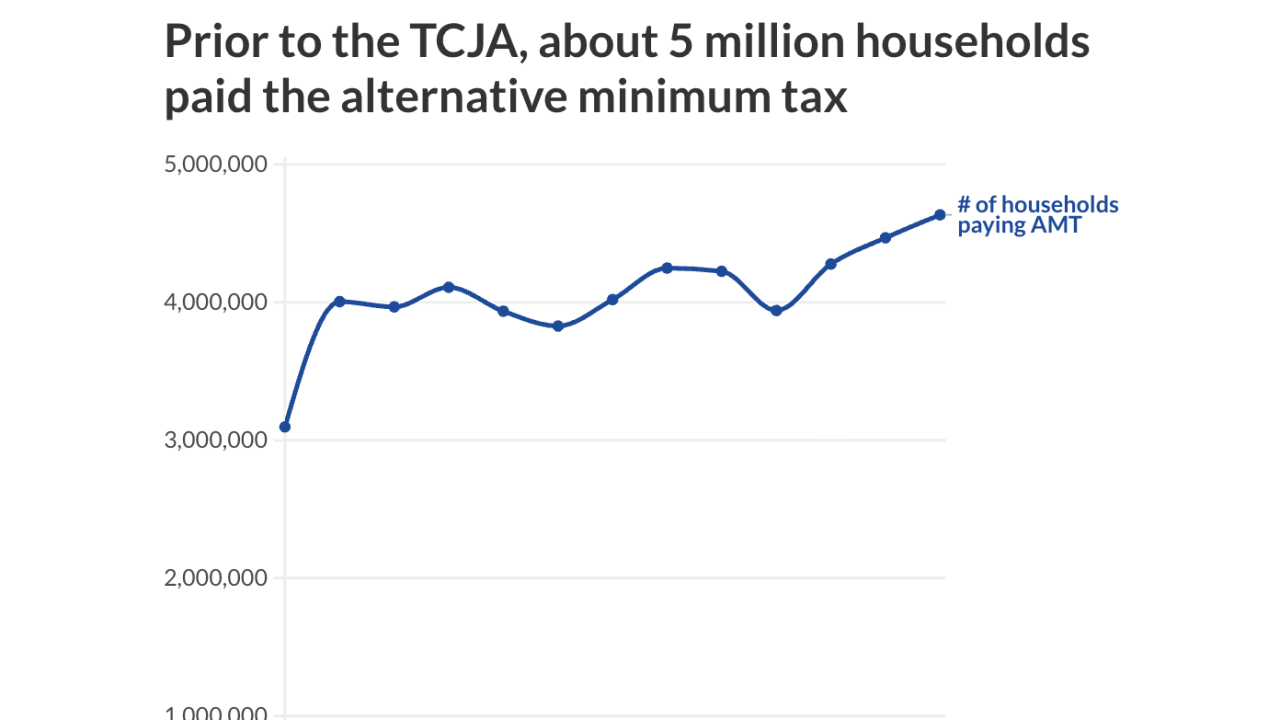

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

Tax returns released by his campaign show he made over $4.2 million in capital gains and took a $4.8 million deduction, paying taxes on $5.9 million in income.

October 17 -

It's time to revisit the $10,000 cap considering a new $40,000 limitation under the OBBBA.

September 30 University of Colorado Boulder

University of Colorado Boulder -

Senate and House Democrats proposed a bill to ensure billionaires pay a "fair share" of taxes, without actually raising their tax rate under current law, while Republicans advanced legislation pertaining to the IRS and the U.S. Tax Court.

September 18 -

The sprawling new tax law includes a number of provisions that present opportunities for accountants and tax professionals to discuss estate and gift planning.

August 14 -

A new study predicts the One Big Beautiful Bill Act will reduce federal taxes on average for individual taxpayers in every state, but the impact will differ.

August 13 -

Republicans will be planning a victory lap and Democrats will be thinking about their election strategy. But financial advisors and tax pros will be preparing their clients.

July 3 -

The prospect of prolonged talks with holdouts threatens Senate Majority Leader John Thune's goal of passing President Trump's tax-cut legislation by July 4.

June 17 -

Daffy's campaign toolkit upgrade aims to boost donations via social functions: "People are inspired to give when they see others step up," said CEO Adam Nash.

June 16 -

It would extend Trump's first-term tax cuts due to expire Dec. 31, along with new tax relief including raising the limit on deducting state and local taxes.

May 22 -

The Internal Revenue Service is projected to lose more than $313 billion over a decade as undocumented workers are poised to pay fewer taxes.

April 11 -

Donor-advised funds are continuing to grow while enjoying substantial tax deductions -- even as many contributions go to other DAFs.

April 7 -

A sizable increase to the current $10,000 limit on SALT write-offs would represent a major victory for a crucial group of swing-district House Republicans.

April 2 -

A change to Social Security will impact millions of beneficiaries. Here's what financial advisors need to know.

March 4 -

The move can help boost income, but financial advisors say it can also bring unintended Social Security consequences.

March 3