The provider of alternative mutuals funds said it would, among other items, change the benchmark index for its commodity fund to the

The Auspice measure is arules-based commodity index designed to provide investors with the opportunity to take advantage of rising prices on certain commodities, while simultaneously assuming a cash position in commodities whose prices are declining.

The index has the ability to adjust positions intra-month, a monthly rebalance process that assesses volatility levels as a means to control risk, and a focus on shorter term trends to be more responsive. The also incorporates a smart contract roll process that takes into account

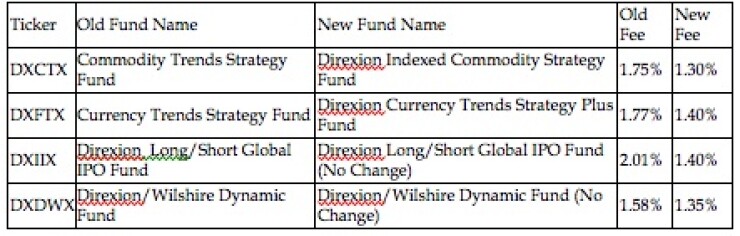

To reflect the change, the commodity fund has been renamed the Direxion Indexed Commodity Strategy Fund. Also effective February 1, 2012, the Fund’s annual incurred expenses will decrease.

“We believe that the strategy modifications and fee reductions will make our commodity fund more attractive to shareholders,” said Ed Egilinsky, Managing Director, Head of Alternative Investments at Direxion.

Also effective February 1st, a number of other modifications will be made to Direxion’s lineup of alternative “buy and hold” mutual funds, including name changes, fee reductions and share class restructuring.

Tom Steinert-Threlkeld writes for