Sen. Elizabeth Warren is asking some pointed questions about FINRA's evolving protocols for deleting customer dispute information from brokers' records, amplifying a theme of business accountability that is a central element of her presidential campaign.

In a

"[T]he study suggests that FINRA's current method of assessing expungement requests — which approves the vast majority of expungements — is failing to safeguard information needed for investor protection," Warren writes.

"Given FINRA's crucial role in promoting safe markets and regulating the securities industry, it is of utmost importance that the organization consider the impact of broker expungement on the future misconduct of industry brokers," she says.

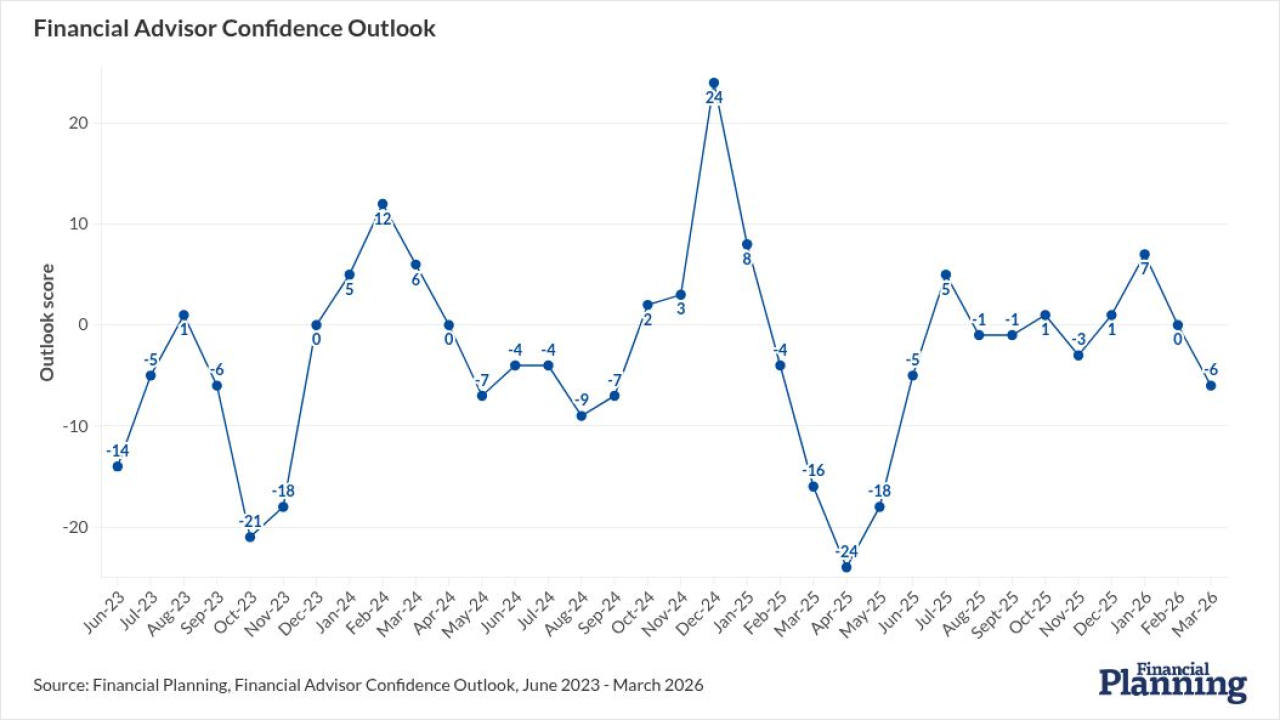

After an optimistic start to the year, financial advisors' confidence in the economy and other key indicators fell sharply in March as the United States escalated its bombing campaign in Iran.

Analysts warn AI agents could automatically move clients' uninvested cash into money markets and other high-yielding investments, depriving brokerages of one of their most lucrative revenue sources.

Warren's letter comes as FINRA contemplates major reforms to its system for handling requests to expunge disputes from broker records in the Central Registration Depository. The regulator has proposed requiring unanimous approval from an arbitration panel to delete a dispute record, and is suggesting capping the eligibility for a making an expungement request at one year from the time the complaint was filed or resolved in arbitration.

In December, FINRA's board of governors approved proposals to improve training for the arbitrators who commonly decide expungement requests, and to bar non-attorney representatives from those proceedings.

However, FINRA has yet to submit any of those proposed changes to the SEC, a necessary procedural step to finalize a rulemaking.

In her letter, Warren asks when FINRA plans to send along its proposals to the SEC, and presses Cook on whether he envisions further reforms to the expungement system, asking, among other things, why the approval rate on expungement requests is so high.

A spokeswoman for FINRA declined to comment on the substance of Warren's letter, saying in an emailed statement: "We have received the senator's letter and are working to respond accordingly."

Warren is no stranger to FINRA's proceedings, having previously signed her name to letters asking the regulator about how it is addressing

She is also making accountability for Wall Street and

"Wall Street is always a popular election-time pinata, and nobody is better at whacking Wall Street than Warren," says Andrew Stoltmann, the immediate past president of the Public Investors Arbitration Bar Association.

Richard Pacelle, chairman of the political science department at the University of Tennessee, doesn't see Warren as reflexively hostile to Wall Street, though he notes that she has made her name calling out the excesses of the industry as she has made the case for tougher regulation.

"She uses Wall Street as a symbol, and she attacks that," Pacelle says. "It's a very convenient target, and I think Democrats are going to use that during the campaign."

But the often arcane regulation of the wealth management sector doesn't typically bear on national politics — recall the 2016 election, when the debate over the Labor Department's fiduciary rule was roiling the industry, but essentially a non-issue on the campaign trail.

Though not entirely. Duane Thompson, senior policy analyst at the fiduciary consultancy Fi360, recalls that Trump campaign advisor (and short-lived White House official) Anthony Scaramucci promised to repeal the Labor Department’s rule, though Trump himself does not seem to have mentioned it.

And Hillary Clinton did

"The precedent has already been set," Thompson says. "I would be more surprised if Senator Warren or other Democratic candidates did not mention the fiduciary standard."

But Warren's focus on how FINRA handles customer disputes is of a piece with her larger message of corporate accountability and the importance of strong, fair-minded regulators to protect consumers and curb the excesses of business.

"Would expungement be the centerpiece of her anti-Wall Street message? Of course not, but it's just one of multiple different attack planks that she has," Stoltmann says. "The expungement issue itself isn't all that sexy, from a political perspective, but what is is the unsuspecting mom and pop investor who get defrauded by a bad broker with a clean CRD."

That focus on individual consumers will probably be a more compelling argument for voters than calls for more stringent regulations, which Republicans reliably counter by arguing that regulations curb job growth, Pacelle says.

"Stuff like consumer protection I think is a reasonable one, but the regulation one is a tougher one to sell," Pacelle says. "They have to figure out a way to make this seem like it's for the average person."