-

Those with the resources to sort through compliance thickets may be better positioned to take advantage of some long-awaited changes.

March 3 -

Analysts were permitted to adjust key stresses in the model used in determining commercial mortgage-backed securities ratings, according to the regulator.

February 17 -

The department says it is working “to determine how we might improve” the regulation.

February 12 -

Regulators and Washington policy makers are sure to up scrutiny once the dust settles on the market turmoil that has buffeted GameStop and others.

February 2 -

Letters sent to reps ask for extensive information on why they applied for a loan, how funds were received and used, and all compensation under the federal program.

January 22 -

Jacob Glick is accused of breach of fiduciary duty and misappropriating client funds, among other alleged misconduct.

January 22 -

“We look forward to our day in court and will not be bullied by the regulatory thugs at the SEC," the firm's co-founder says.

December 23 -

The revelation is buried in an SEC enforcement action that accused Robinhood of hiding for years how it made the bulk of its revenue.

December 18 -

The regulation permits more exemptions from fiduciary duties, but may itself be replaced by the incoming Biden administration.

December 16 -

With a new administration, the regulator has an opportunity to renew its focus on a key pillar of its mission.

November 10 PIABA

PIABA -

Unclear — or no — disclosures were among a number of concerns regulatory officials expressed about initial examinations.

October 29 -

The former J.W. Cole advisor’s practice allegedly sold more than $40 million worth of unsuitable and unregistered promissory notes.

October 22 -

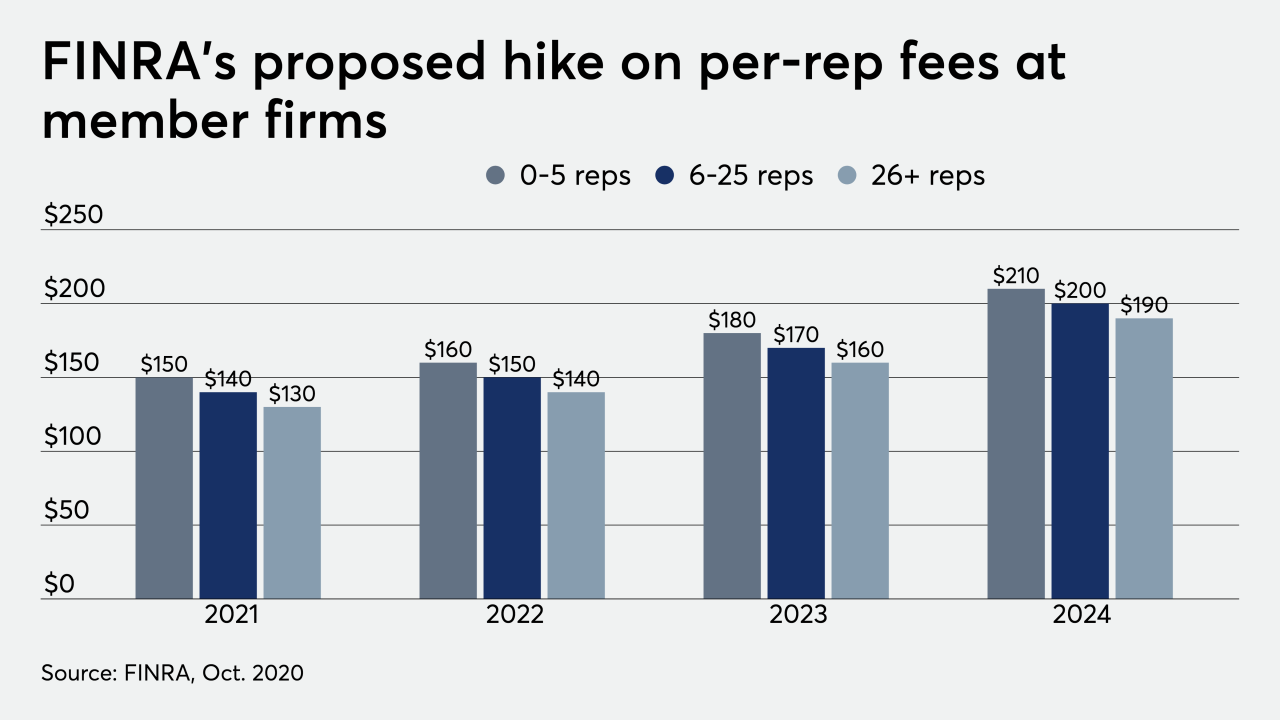

The regulator would generate an additional $225 million per year from the fee increases.

October 9 -

Insiders see a Democratic administration backing tightened investor protections as industry advocates look to tax legislation.

October 8 -

The Justice Department filed two counts of wire fraud against the firm but agreed to defer prosecution under a three-year deal that requires the bank to report its remediation and compliance efforts to the government.

September 29 -

The Labor Department’s short comment period is one reason to get up to speed, fast.

July 8 -

The board is “decisively moving away” from allowing advisors to self-disclose, CEO Kevin Keller says.

June 25 -

It’s the regulator’s largest restitution order this year.

June 4 -

The change is one of several made to the board’s disciplinary reporting process following a report by an independent task force that found “systemic, long-standing, governance-level weaknesses.”

May 29 -

Given that I must disclose on my Form ADV that we accepted the aid, I had to ask myself difficult questions about possibly over-zealous regulatory scrutiny as well as my firm's reputation, this advisor writes.

May 15 Segment Wealth Management

Segment Wealth Management