A financial advisor who admitted to defrauding his own parents, a cognitively disabled client and two dozen other victims received a sentence of more than five years in prison.

The prison term of 63 months for Ex-Mutual of Omaha Investor Services representative Edward E. Matthes at his May 20

“I don’t know if the word ‘devastating’ describes the frantic overwhelming terror of waking up one day and finding out that all you have worked for, your retirement income is gone, and your own flesh and blood, your son, swindled you out of it,” Matthes’ father said in a victim statement.

Although he espoused Christian values and recruited clients from his church, the YMCA and business organizations, he spent the mostly older investors’ money on Ponzi-like payments, luxury items, car and home bills like most fraudsters, investigators say. He “held himself out publicly as an advocate for the very values he privately ignored,” the government memo says.

Without it taking

The barred former Milwaukee-area advisor surrendered life insurance policies of $22,000 and paid his parents $15,000 “prior to police involvement” and “wishes to continue to work to pay back his restitution obligation” to other victims, according to the defense’s sentencing memo. Matthes believes the sentence imposed by U.S. District Judge Brett Ludwig “was fair and he is prepared to serve his punishment,” his attorney, Jonathan LaVoy said in a statement.

“Edward Matthes accepted full responsibility for his actions,” LaVoy said. “He plans to spend the rest of his life making up for his bad decisions and wishes to become a productive member of society.”

Matthes lives in Pewaukee and had a one-person branch in Oconomowoc while with Mutual of Omaha between April 2012 and March 2019. In discharging him, the firm cited allegations he created fake account statements and diverted client funds, FINRA BrokerCheck shows. He spent the prior six years with Thrivent Investment Management. Mutual of Omaha has paid $2.2 million in 12 arbitration settlements with clients since 2019, according to BrokerCheck.

Representatives for the Nebraska-based firm didn’t respond to requests for comment, though one speaking at the sentencing hearing last month “explained how Matthes’ actions caused the company to expend considerable resources to investigate the matter and to reimburse most of the victims for their losses,”

Minneapolis-based Thrivent paid a settlement of $75,000 in April 2012 to a client of Matthes who alleged he made an unsuitable transfer to a variable annuity from an income agreement, BrokerCheck shows. In an email, Thrivent spokeswoman Callie Briese noted that the conduct for which Matthes was sentenced occurred while Matthes was no longer affiliated with Thrivent.

“We trust the legal process resulted in the appropriate outcome,” Briese said.

A client prompted an investigation of Matthes by alerting FINRA in March 2019 to an account statement that looked fake,

In the scheme between 2013 and 2019, Matthes concocted a fake investment that he guaranteed would yield at least 4% per year and made unauthorized sales and withdrawals from variable annuities clients held in accounts with him, SEC investigators say. He gave them fictitious account statements to conceal the theft, according to investigators.

Matthes resorted to fraud when he had more difficulty gaining clients than he expected upon joining Mutual of Omaha, federal prosecutors say. Besides the financial losses and IRS tax penalties relating to the unauthorized withdrawals, clients have suffered from sleepless nights, depression and feelings of betrayal, according to the government’s sentencing memo.

“I cannot explain in words how panicked, scared, frustrated and angry we were to find out how an upstanding businessman, religious, family man in a small community associated with a large organization [like] Mutual of Omaha could possibly carry out this crime for years,” one victim said.

Another said: “I know that I am not the same person I once was, my trusting mechanism is broken, and I don’t think I have enough time in my life to heal from it.”

In handing down the sentence, Judge Ludwig said that Matthes had “cultivated trust” from the clients through a “veneer of friendship” while diverting their retirement savings. The length of time of the conduct, the amount of losses and the betrayal dictate a sentence that punishes Matthes and deters future misconduct, the judge said.

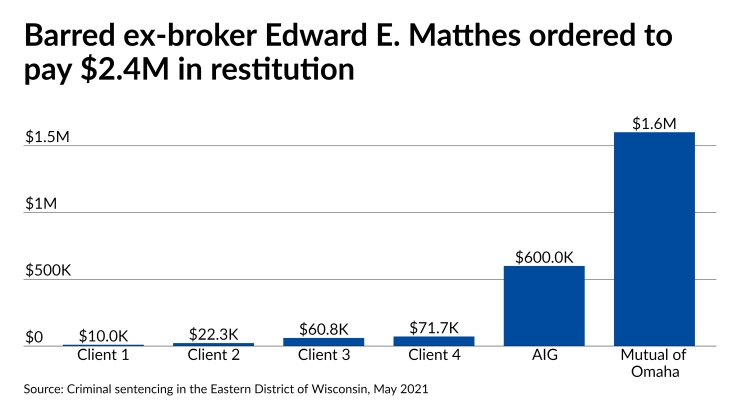

Besides the five years in prison, Ludwig ordered the restitution and three years of supervised release following the term. Matthes had agreed to the restitution and all other injunctive relief sought by the SEC in settling the regulator’s case in January 2020. In the criminal case, he later pleaded guilty to three counts of wire fraud. The Federal Bureau of Prisons will notify him soon about when and where he’ll begin the sentence, Matthes’ attorney says.

“Once his behavior came to light, he fully cooperated with the FBI and the U.S. Attorney’s Office,” LaVoy said. “He resolved the matter with a plea agreement and voluntarily surrendered all licenses related to the financial services industry. He expressed sincere remorse to the victims including his parents.”