As interest in M&A intensifies, more lending options are opening up for RIAs looking for capital to do deals.

The deal flow over the last six months is the highest in the history of the industry, exceeding the previous record by more than 20%, according to DeVoe and Co. And last month’s groundbreaking

Expect more RIAs to seek more capital for growth, says industry consultant John Furey, principal of Advisor Growth Strategies. “RIAs need more capital to structure next generation equity, succession plans and M&A,” Furey says.

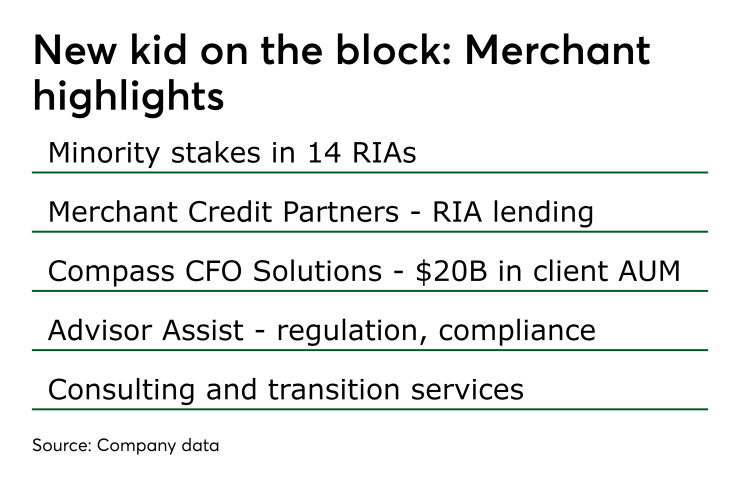

Merchant Investment Management, which calls itself “a non-controlling and collaborative growth” partner to wealth management firms, is the latest lender to enter the market, via a strategic alliance with Fidelity Investments.

RIAs who custody with Fidelity will receive a discounted fee on loan origination documents from Merchant, according to David Canter, head of Fidelity Clearing & Custody Solutions RIA division. Fidelity won’t receive any remuneration for lending deals its clients do with Merchant, Canter says.

The Fidelity connection has also put a new spotlight on Merchant, an emerging force in the RIA world that has flown under the radar until now.

In addition to supplying capital and taking minority interests in RIAs, Merchant controls related companies which offer outsourcing services such as compliance, accounting and finance as well as transition services for brokers and advisors.

The heightened interest in lending services and capital needs reflects "the professionalization of our space,” says Ed Swenson, Dynasty’s chief operating officer.

Merchant has under 20% stakes in 14 RIAs, including San Francisco-based Perigon and Summit Financial in Parsippany, New Jersey, according to Marc Spilker, Merchant’s executive chairman. Spilker, a former Goldman Sachs partner, co-founded Merchant in 2017 as an outgrowth of GPS Investment Partners, a private investment partnership he and two other former Goldman partners launched in 2015.

The rapid growth of the RIA business and corresponding interest in M&A, inorganic growth and succession planning prompted Merchant to begin offering lending services to advisory firms. “The amount of capital available to this industry is small relative to the size of the need,” Spilker says.

RIAs that Merchant takes a stake in won’t be required to buy from the companies it controls, including Advisor Assist (compliance services) and Compass (outsourced CFO and accounting services), according to Spilker.

Merchant will be competing for RIA business with a host of established lenders, including Dynasty Financial Partners, Live Oak Bank, Oak Street Funding, PPC Loan and community banks.

Dynasty began lending to its partners six years ago, offering loans to advisory firms up to half of their annual revenue. The heightened interest in lending services and capital needs is a reflection of both the M&A boom and "the professionalization of our space,” says Ed Swenson, Dynasty’s chief operating officer.

Spilker says Merchant isn’t competing with Dynasty, but the firm’s advisor transition business directly intersects with one of Dynasty’s main business lines. And Merchant’s executive team includes two Dynasty alumni, Tim Bello and Amit Grover, the platform provider’s former CFO.

-

The platform outsourcer is now appealing to a new market.

October 1 -

The market is expected to remain heated in the months ahead.

April 9 -

The RIA will be combined with Sontag Advisory to create an $11 billion wealth management powerhouse.

March 26

Borrowing money can make more sense for advisory firms who need capital for tuck-ins or outright M&A, says Canter. “You can obtain funding from cash flow or equity and cash flow,” he explains, “but loans can be less expensive because you don’t have to give up equity. And right now equity is at a premium for RIAs.”

Echoing remarks made by Pershing’s

“Capital is the fuel to get the deals accomplished,” Canter notes. “But firms have to consider the objective of the deal, the financials, integration and the resulting culture.”

The Merchant deal was driven by making sure Fidelity’s clients and prospects have access to loans, according to Canter. “We want to provide solutions to advisors,” he says. “That’s what attracted us.”